Tender volumes are racing to the upside and are tracking positive year-over-year in May, albeit off a depressed 2019 comparison, and that is some positive news for carriers. As volumes have risen more than 15% since the trough on April 16, tender rejections are reacting slowly to the rising volumes, but rising nonetheless. Capacity remains very loose and spot rates remain depressed, but things are brighter now than they have been in many weeks.

The result is that after numerous weeks of decline, carriers reclaimed a small bit of pricing leverage this week in the weekly DHL Supply Chain Pricing Power Index. The Index’s reading of 15 is still weighted heavily toward shippers, but it rises 5 points after consecutive weeks of a reading at 10.

The DHL Supply Chain Pricing Power Index uses the analytics and data contained in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

Load volumes: absolute levels and momentum neutral

We had expected volumes to bounce off the bottom once parts of the economy reopened, but the rise over the past two weeks is surprising. The whiplash in freight volumes over the past two months has been like riding a prized steer in a Texas rodeo. Just one month ago, the Outbound Tender Volume Index (SONAR: OTVI) was down 16% y/y. On Thursday, OTVI was positive on a yearly basis. However, this needs to be taken with a grain of salt — May 2019 was a particularly slow point in the weak first half of 2019. Trade tensions and Trump tweets disrupted freight flows both domestically and internationally. So, the year-over-year comp for May does not glean many meaningful insights.

What is meaningful is the rate of acceleration to the upside currently happening in volumes. After a bit of a lull last week, volumes have resumed climbing rapidly, up 5.4% since this time last week.

Whether or not this increase can continue has yet to be seen. It is possible the freight moving is simply pent-up demand that has been stuck at shuttered shipping facilities. It is undeniable that the coronavirus pandemic has significantly damaged demand for most goods.

It may be some time before OTVI reaches pre-crisis levels, but parts of the economy reopening and produce season should be enough to keep the increase streak alive for a while.

Tender rejections: Absolute levels positive for shippers, momentum positive for carriers

The Outbound Tender Rejections Index has increased week-over-week for the second week in a row after tumbling for the six weeks since the OTRI (SONAR: OTRI.USA) peak of 19.25% on March 28. It seems the trough is now behind us, but at 3.05%, OTRI is still in a historically low range.

Rejection rates vary by trailer type. Currently, reefer rejections are more than double van and four times higher than flatbed. Reefer rejections have been rising steadily throughout May as produce harvests are loaded in California and Florida.

Lagging a few days behind volumes, rejections have also been on a wild ride the past three months. After spending the first two months of the year hovering around 5%, OTRI surged in lockstep with volumes all the way up to 19.25% on March 28. After the peak, OTRI plummeted more than 80% in a matter of weeks due to the lack of freight volumes, especially spot market freight.

Now that volumes have begun to return, OTRI is likely to rise modestly in the coming weeks as carriers regain confidence that they may have other options besides their contracted freight. However, this will likely be several months, if not quarters away. Carriers are still accepting nearly every contracted load they can get their hands on to keep utilization high and keep trucks rolling. Capacity will not tighten until freight volumes are restored in most markets around the country, and that has not happened yet.

Notwithstanding many drivers idling their trucks and removing capacity from the market, capacity remains extremely loose due to low volume throughput.

Spot rates: Absolute levels and momentum positive for shippers

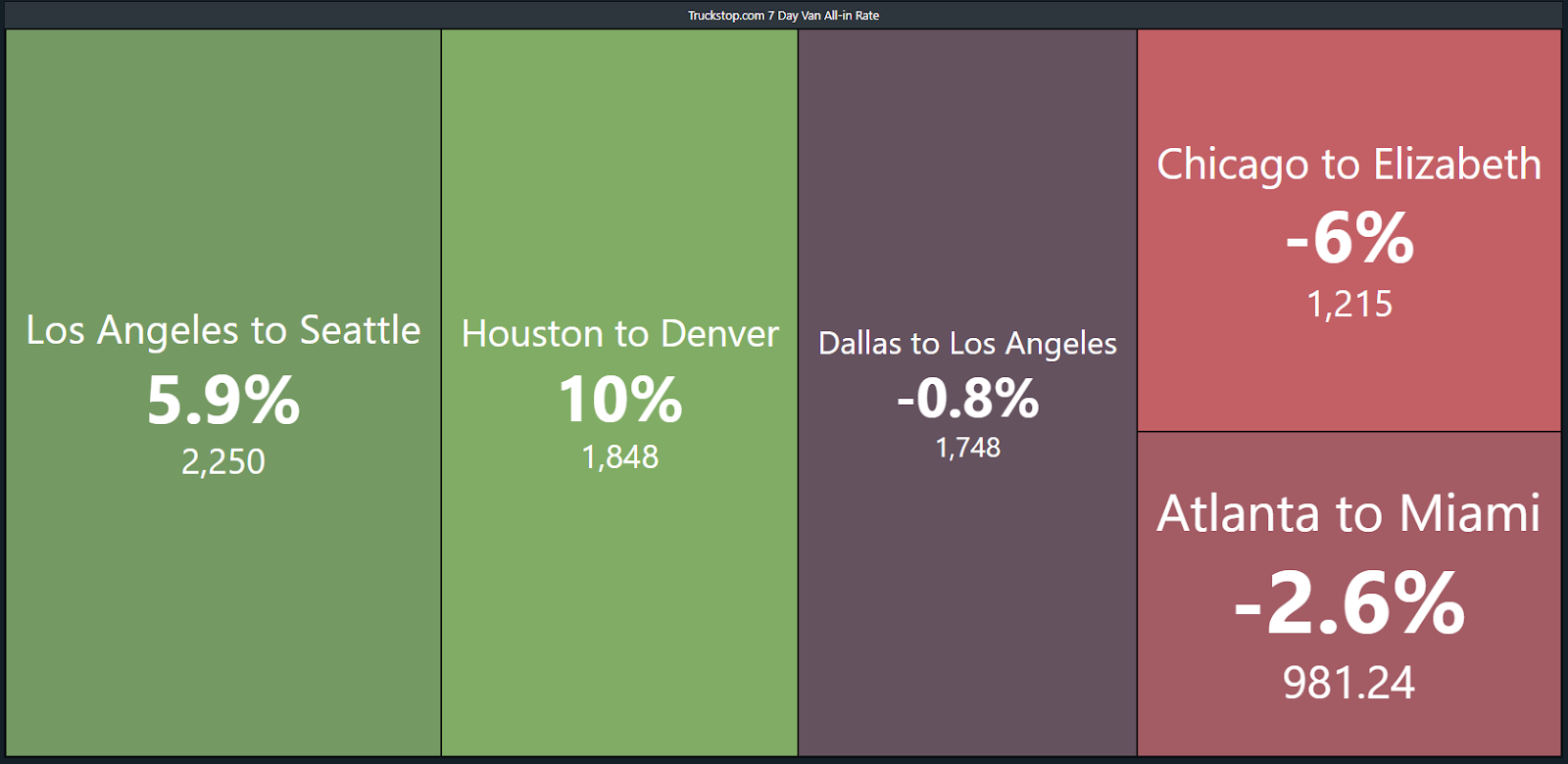

For the first time since volumes began plummeting in late March, spot rates from Truckstop.com (SONAR: TSTOPVR) are positive week-over-week in the majority of the 100 lanes available in SONAR.

Just three weeks ago, 97% of lanes in SONAR were negative. Spot rates are undoubtedly still well below what we would expect without a global pandemic, but it does seem we have found the bottom at least for the time being.

In general, spot rates have plunged over the past month. There have been small pockets of upward pressure on rates, but overall rates remain depressed due to the lack of spot market volume.

We have heard stories from drivers who confirmed our belief that spot rates would quickly encroach upon operational costs per mile during April. There will be expectations for grocery, consumer staples and medical supplies, but overall rates will be down considerably on a yearly and sequential basis in May as well. As FreightWaves CEO Craig Fuller noted Wednesday in a SONAR Freight Market Pulse, “Spot market activity won’t return until after the contract market does, so monitoring tender activity gives us a sense of market direction.”

And with tender volumes and rejections pointing downward, it will be some time before the contract market returns to normal.

Economic stats: momentum and absolute level neutral

Several significant economic releases this week are worth noting.

By far the most widely watched blockbuster economic data point this week was initial jobless claims, which came out Thursday. Given its frequency, this is one of the best real-time indicators we have.

Jobless claims for the first week of May were 3 million; this comes on the heels of 3.2 million initial jobless claims last week. This brings the eight-week total to 36.5 million Americans applying for unemployment benefits, which far more than wipes out all the job gains since 2009.

To put into context just how high that number is, 2% of the American workforce have lost their jobs in each of the past three weeks, and 3%-4% of Americans lost their jobs in each of the five weeks prior to that. Just in the past eight weeks, more than 22% of Americans have lost their jobs. Although initial jobless claims are trending downward, the 3 million initial claims are nearly five times the previous peak of 665,000 in the 2008-09 recession and the all-time record of 695,000 in October 1982. If there is any good news, initial jobless claims fell for the sixth straight week and marked the lowest weekly total since the coronavirus outbreak in March, indicating initial claims have peaked. The unofficial unemployment rate now sits at close to 26%, more than seven times the 50-year low of 3.5% from about eight weeks ago.

Taking a deeper look at more granular credit card data from Bank of America Merrill Lynch for the week ending May 2, several things stand out. The good news is that consumer spending appears to have convincingly bottomed and stabilized, albeit at a low level.

Overall credit card spending was down an average of 10% for the trailing five days, a huge improvement relative to the -18% last week and the trough of -36% during the last five days of March. Amazingly, retail sales excluding autos are actually running up 1% year-over-year for the trailing five days, driven by strength in the low-end consumer. If we are honest, we would never have imagined that consumer spending ex-autos would be up year-over-year in the midst of the worst recession since the Great Depression.

It remains to be seen how sustainable this boost in consumer spending that has been aided by stimulus checks, unemployment insurance and the reopening of several states will be, but it is certainly good news for now. Every category has distinctly bottomed, though airlines, lodging and entertainment continue to show 80%-90% declines in revenue. Restaurant spending is now down only about 35% over the past week, well off the lows of down 65%-75%. Online electronics and e-commerce continue to exhibit scorching growth of 129% and 85%, respectively, on average for the past week. Grocery and home improvement remain strong as they have been for weeks now.

The fabulous news is that every category has bottomed and is experiencing a strong recovery outside of airlines, lodging and entertainment. We had previously expected card spending to stall at the mid-teens decline rates of the past two weeks given 26% unemployment. There is a long way to go in many categories, however. Consumer spending will be important to watch to gauge when the economy and freight volumes will pick up; the card data indicates momentum in terms of improving volumes off of the bottom should continue.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.