LAKE BUENA VISTA, Fla. — Much has been written and dissected about what is happening in the freight markets. On Tuesday, FreightWaves founder and CEO Craig Fuller put some data behind the words in a market outlook presentation at the Gartner Supply Chain Symposium/XPO 2022 conference at Walt Disney World’s Dolphin Resort.

“The last couple of months and the last couple of years have been transformative,” Fuller told the audience, before diving deeper into the discussion. “We’ve never seen the levels of disruption that we’ve seen.”

Fuller applauded the industry for its ability to seamlessly manage the supply chain through the years, and noted it was only after the major disruptions of COVID and the ensuing global crises that seemed to pile one on top of the other of late that the general public became aware of the supply chain.

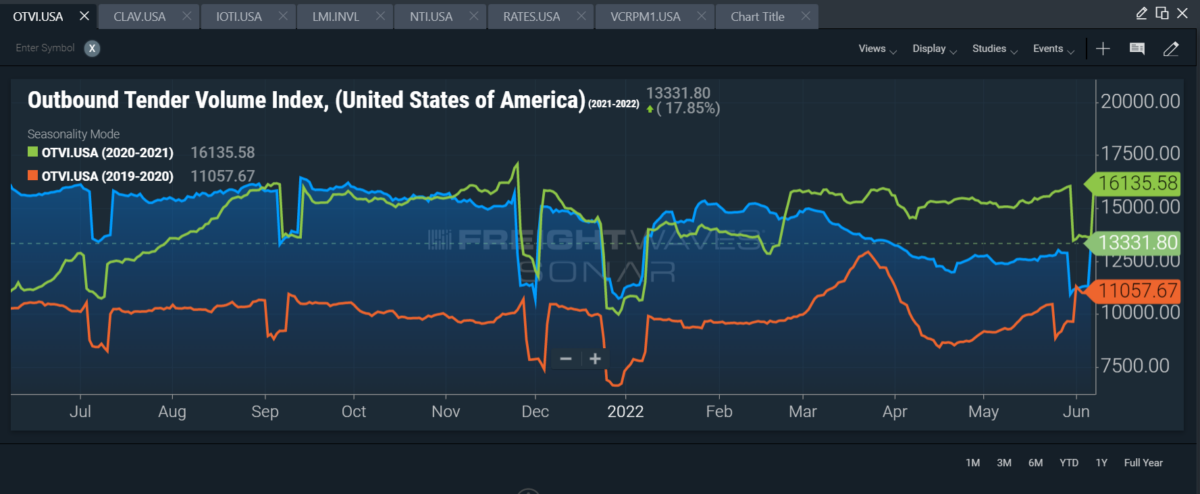

The CEO then turned to some of the specific FreightWaves SONAR data points he has been using to make his market predictions, including the Outbound Tender Volume Index (OTVI.USA). Based on electronic data interchange requested transactions, OTVI saw a massive surge in 2020, Fuller said, followed by a “substantial crash.”

“Then we saw this really significant ramp-up in volume,” he noted. Then February and March of this year arrived and “we saw a significant chance in how the market was operating.”

That led Fuller to write an article published on March 31 detailing why he thought a freight recession was on the horizon.

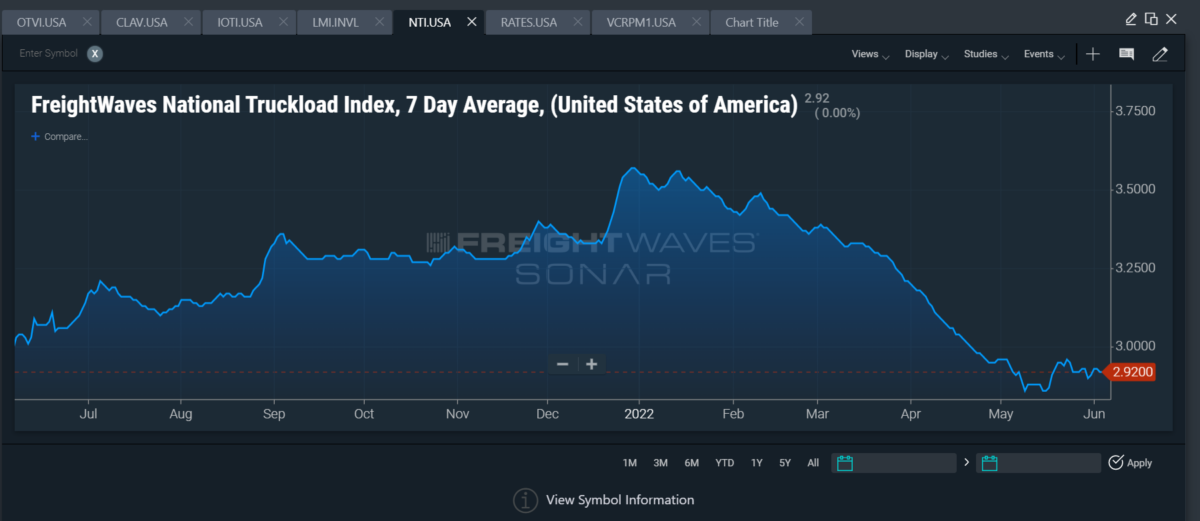

On Tuesday, Fuller went into some detail, explaining that the volume of contract transactions being requested in OTVI dropped, as did spot rates. He added that he thinks the spot rate relief will “persist” and that he didn’t think freight rates would rise again in the near future.

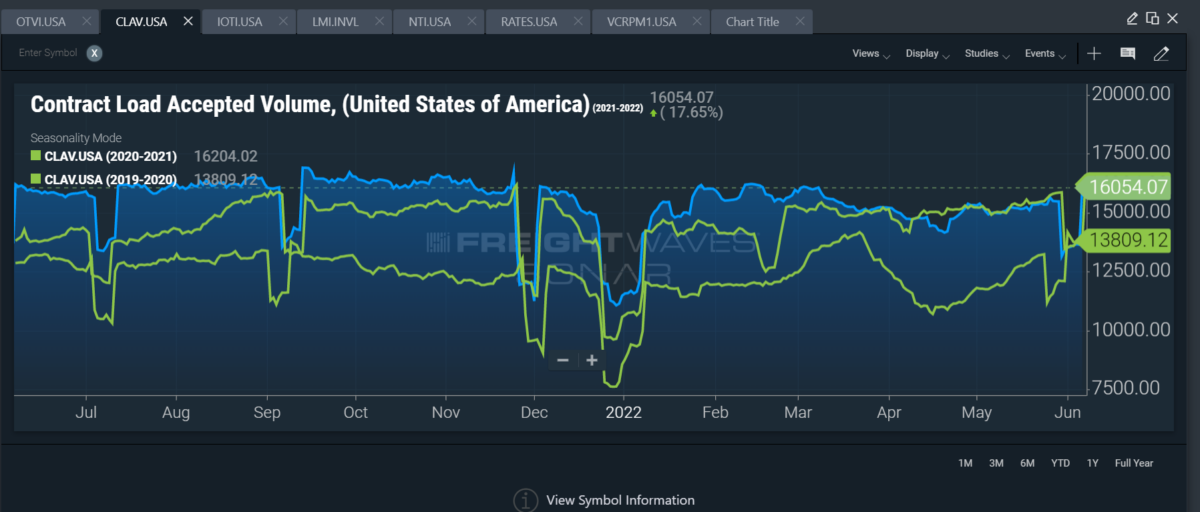

Contracted loads accepted have also dropped, and that is showing “less contract loads tendered in the market than we have seen in the last 12 months,” Fuller said.

A positive sign, though, is that the freight market seems to have stabilized since the Memorial Day weekend, Fuller noted, but “that doesn’t help the spot market carriers.”

Those carriers, he said, are facing significant headwinds as rates have dropped and fuel has risen to record levels of $5.70 a gallon nationally as of Monday.

“If you’re a small trucking company that has seen your rate deteriorate by $1 per mile and your fuel prices [rise], you are probably feeling a significant amount of pain,” Fuller said.

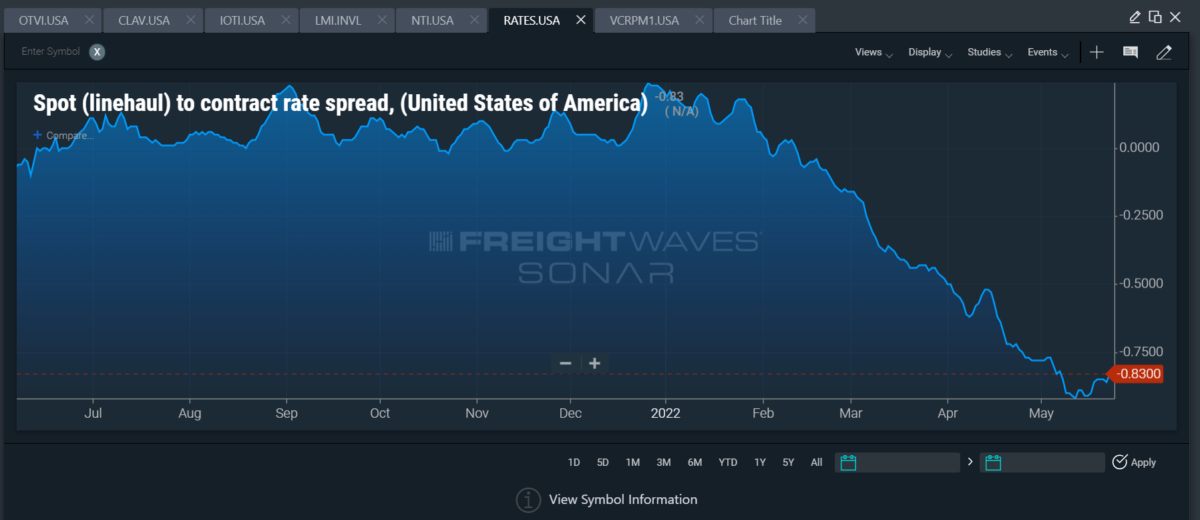

Brokers, on the other hand, are seeing an expansion of margin, with the spread between spot and contract rates now at 83 cents per mile. For comparison, Fuller said the spread in 2019 was about 45 cents. In addition, Fuller said he is seeing no “level of contract rate deterioration” at this point.

Fuller added that he thinks contract prices will start moving downward, in part because shippers may have held off on rebidding contracts, hoping for better market conditions.

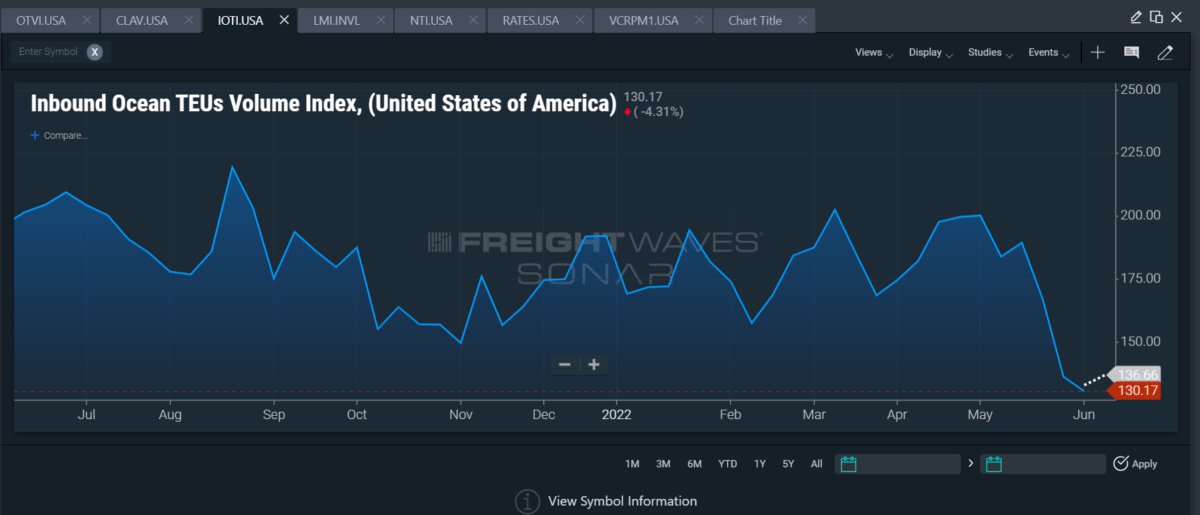

The second half of the year is still a bit uncertain, and Fuller said the trucking industry could see a “second wind” of issues. Part of his reasoning is inventory concerns — there is just too much of it — and indications that inbound container shipments are falling off dramatically.

Back in December, the Logistics Management Index suggested retailers had too much inventory. That exact scenario has played out, with Target on Tuesday morning saying it was canceling ocean containers and would work to drastically reduce its inventory, which is 43% above the year-ago period.

In a Tuesday morning article, FreightWaves ocean expert Henry Byers noted that “consumer buying patterns are rapidly normalizing to pre-COVID levels, and U.S. retailers are stuck with too much inventory.”

“Container imports bound for the U.S. have dropped over 36% since May 24. This is a troubling sign for domestic U.S. freight markets that have been benefiting from an unprecedented surge of containerized import volumes over the last 18 months. Since ocean transit times for these inbound container volumes have recently been averaging between 30 and 35 days, we will begin seeing the softer volumes show up at U.S. ports in the first couple of weeks of July,” Byers wrote.

“The supply chain has plenty of inventory,” Fuller said in his presentation, noting that as China has eased recent lockdowns, container volume increases have not followed as some predicted. Walmart is No. 1 in container shipments from China and Target is second, Fuller said, so if the retailers have too much inventory now and slow inbound shipments, there will likely be a significant impact on trucking.

Seventeen percent of U.S. truckload volumes are tied to imports, Fuller said.

“The second half of the year is far more exposed,” he noted.

Click for more articles by Brian Straight.

You may also like:

Drones are flying into weather data deserts. Can they be stopped?

Navigating COVID-19 shipping chaos: Finding capacity and servicing the customer