Supply chain professionals responsible for transportation procurement at Fortune 500 companies focus on three things – budget forecast accuracy, service scores and primary tender acceptance.

“At Freightwaves, we see the uncertainty and pressure shippers are under, especially in volatile markets, and we believe the best way to improve overall performance is to empower them with near-real-time freight data,” said Craig Fuller, FreightWaves founder and CEO.

“That’s why we created SONAR Supply Chain Intelligence (SCI) for shippers that represents the most comprehensive freight data on the planet. And that’s not marketing speak,” Fuller pointed out.

Key advantages for shippers

SCI aggregates $20 billion in annual shipper-to-carrier settled contract rate transactions from hundreds of shippers and thousands of carriers. Those transactions include millions of unique shipments, billions of miles of transit and trillions of pounds of freight. Instead of giving a general market overview, data is broken down by industry, accounting for the distinctive rates and demand in each vertical.

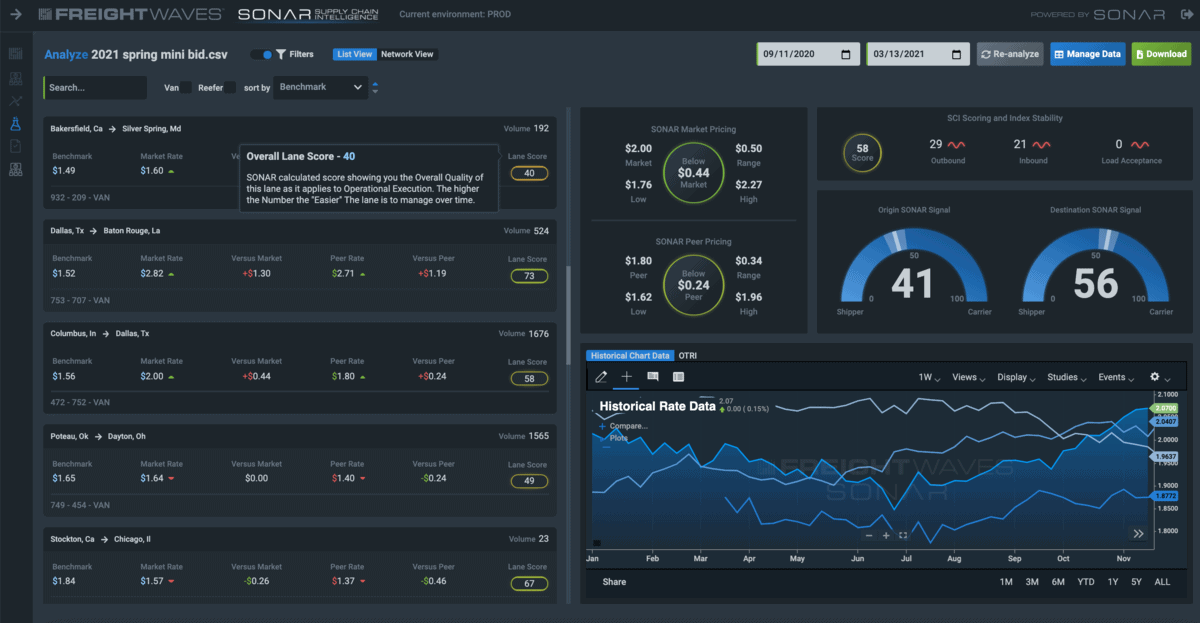

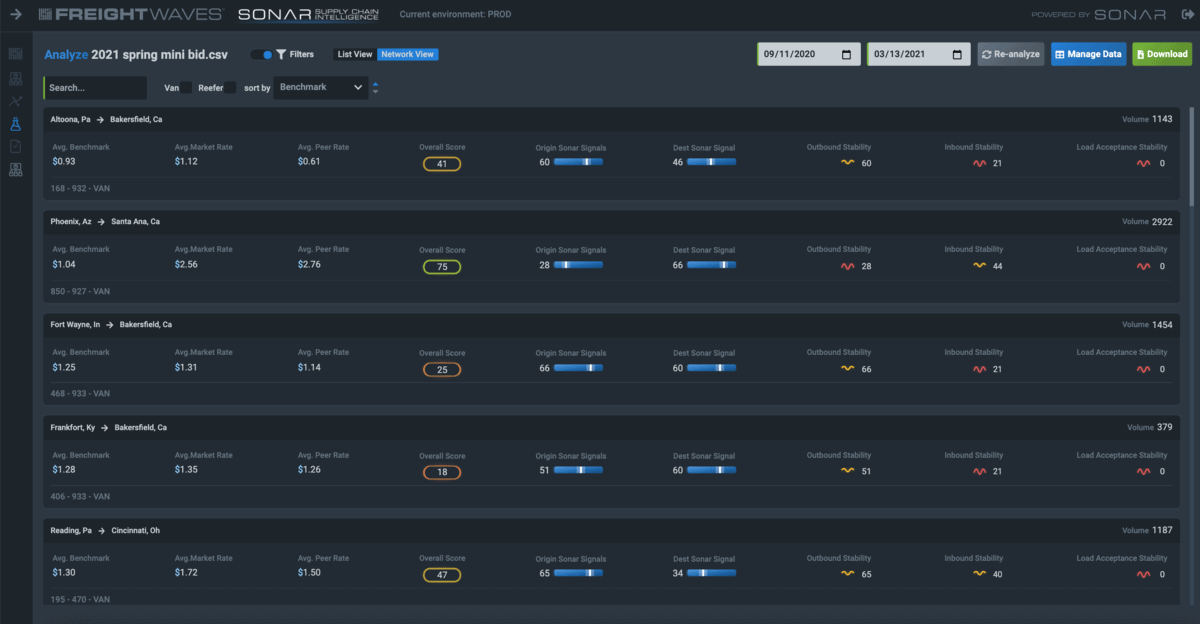

“FreightWaves is now introducing SONAR SCI Lane Acuity, which is a volatility index that provides lane-level insight into market stability and freight management,” Fuller added. “Lane Acuity provides SONAR SCI subscribers insights into market stability by lane, helping participants identify rate and capacity risk. The higher the score, the more consistent tender acceptance, capacity and rates are on a given lane. The lower the score, the more likely a given lane will experience market instability and rate volatility.”

Lane Acuity determines lane stability/volatility by using freight tender activity and historical contract rate transactions movements over time. This information comes from a pool of $80 billion in actual paid contract rate invoices. This data has been collected over a four-year period, broken down into shipper industry cohorts.

“When paid contract rate data is combined with tender activity on a given lane, FreightWaves SONAR SCI can accurately predict when and where incidences of stability or instability are likely to occur,” explained FreightWaves Chief Product Officer Travis Rhyan. “The bottom line is SONAR SCI provides shippers information on their shipping lanes never before available. It also lets them benchmark their performance against industry peers, the entire market, and their own historical data.”

Lane Acuity

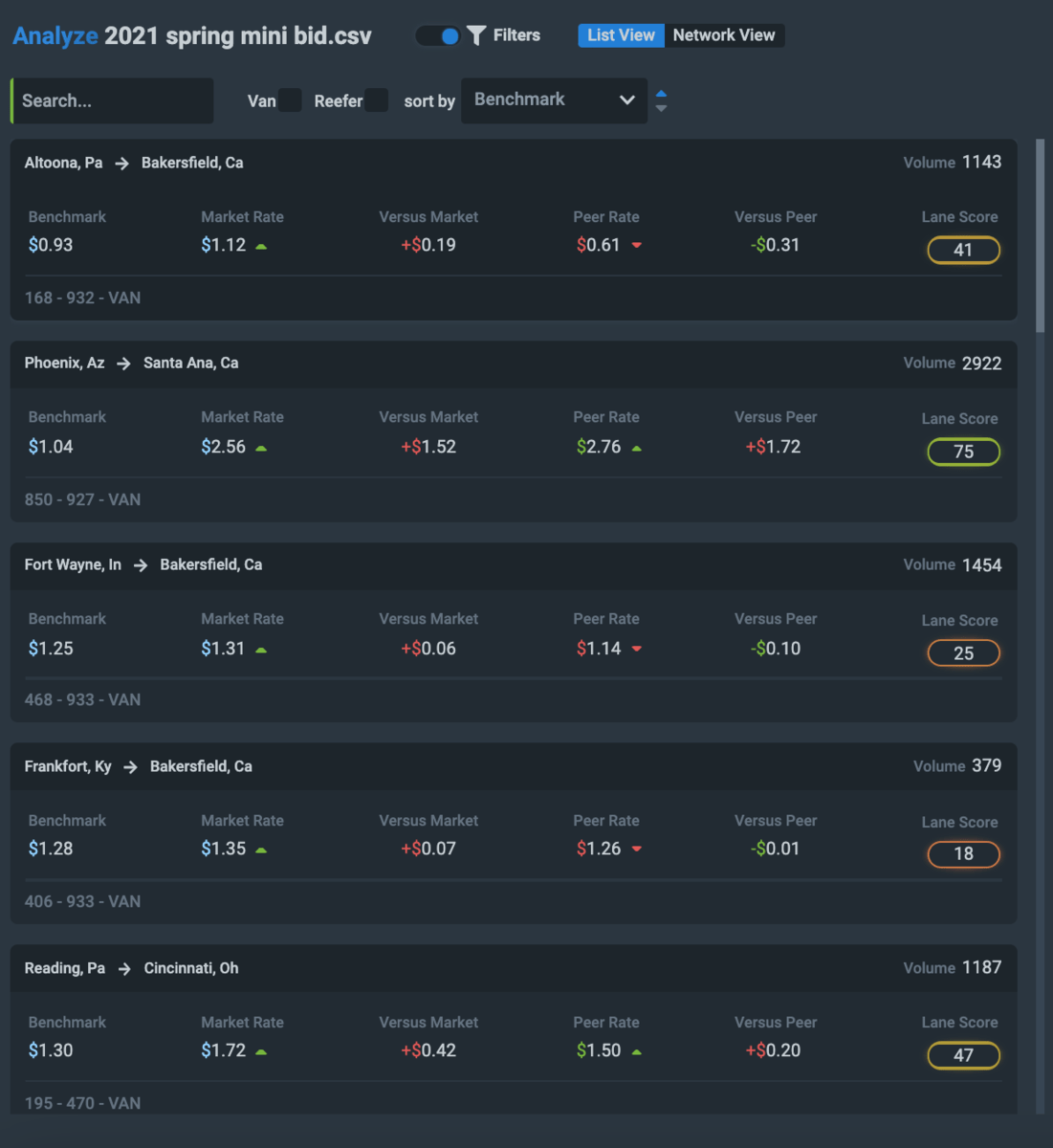

Lane Acuity is a key feature of SONAR SCI. It provides users deeper insights into a lane; they can score, measure and benchmark existing transportation procurement, as well as lane execution inside of a supply chain. Lane Acuity looks at a lane by mode inside a transportation sector. It can also show how a user’s targeted benchmark rate compares to the industry, the overall market, peers and at a pricing level.

With SONAR SCI’s advanced analytics, Lane Acuity scores a lane by pricing, competition and mode. A lower SCI score, such as 30, indicates how difficult it will be to get a lane covered at the user’s desired benchmark rate, whereas a higher SCI score, such as 70, indicates the user is more likely to get that lane covered at the desired benchmark rate target.

SONAR SCI

The SONAR SCI data and analytics platform has all of SONAR’s features – and more. “SONAR SCI benefits brokers and carriers; it will particularly benefit shippers in specific industries like automotive, CPG, retail, manufacturing and more,” Fuller said.

“SONAR SCI helps users benchmark, analyze, monitor and forecast their freight spend. It is particularly useful when conducting freight contract negotiations for longer-term freight RFPs.” Fuller stated, “SONAR SCI is a unique method for shippers to gain visibility into transportation spend and can change how shippers view operations and make decisions. In addition, while SONAR SCI contains massive amounts of data, it is presented in an easy-to-use, easy-to-understand dashboard.”

Fuller concluded, stating, “SONAR SCI is sophisticated but simple; it provides actionable, near-time data, insights and intelligence at a speed currently unavailable in the industry. SONAR SCI empowers users with a new set of critical performance management tools.”

SONAR SCI is also available as a stand-alone product with an included SONAR Starter platform that includes the predictive rating power of SONAR Lane Signal, pre-built Global Pages and the Critical Events tool.

Rhyan added, “Intelligence is more than data or knowledge. Intelligence guides SONAR SCI subscribers with added context about where the market is going. In addition, SONAR SCI’s datasets are focused more on the contract freight market rather than the spot freight market.”

“FreightWaves SONAR and SONAR SCI are mission-critical platforms for participants in the North American freight market. We are investing significant resources to increase the speed of the platforms and make them more intuitive for users,” explained Rhyan.

He also said, “Over the past year, the number of clients using SONAR to manage their transportation pricing and market analytics has tripled. In the next few months, we will be making significant upgrades to the user experience and look forward to introducing them to SONAR subscribers and prospective subscribers.”

SONAR and the SONAR SCI platforms have proprietary data that comes from actual load tenders, electronic logging devices and transportation management systems, along with dozens of third-party global freight and logistics-related index providers like TCA Benchmarking, Freightos, ACT, Drewry and DTN. In addition, confidential and proprietary data from industry peers is a key component of SONAR SCI. This data is not available anywhere else.