While the federal government has deemed the majority of the nation’s truck drivers “essential” to delivering critical medical and food supplies amid the global coronavirus pandemic, some truckers say its a mixed bag when it comes to treatment at shippers and receivers.

However, some truck drivers say many shippers and receivers are stepping up and thanking them for their dedication to hauling the nation’s goods amid the coronavirus pandemic.

Long-time trucking veteran Ingrid Brown of Zionsville, North Carolina, says she’s yet to meet a shipper or receiver that hasn’t been “more than kind toward drivers” in the past few weeks.

“I‘ve really not had to wait,” Brown, who drives for Fleenor Brothers of Carthage, Missouri, told FreightWaves on Monday, April 13. “ I got to the Target Distribution Center in Lake City, Florida, on April 9, and I was the first truck in there, backed up to the door. I got out to take my paperwork in and by the time I came out they were already unloading my trailer.”

As she was leaving the check-in window at the Target facility, Brown said a woman there stopped her and asked if she wanted a breakfast or lunch snack and a bottle of water.

“I know truck drivers have a lot on their minds right now, but please don’t take it out on other people that have chosen not to file for unemployment and are standing there to help you succeed and get a paycheck,” Brown told FreightWaves. “The disrespect of some drivers toward these people that are showing us [truck drivers] kindness is unacceptable.”

Other truck drivers agree, saying their experiences at shippers and receivers have improved over the past two weeks.

“The last two weeks have been so much better than when all this [COVID-19] first started.” Wayne Cragg or “Trucker Wayne” as he is known on social media. “There’s been very little human interaction at shippers or receivers for the most part.”

This wasn’t the case two weeks ago when Cragg, an owner-operator from South Haven, Michigan, documented his wait time at a shipper for more than 14 hours to get loaded without being allowed to use the bathroom facilities before he decided to refuse the load and leave.

“I decided to cancel the load and take the weekend off, but as an owner-operator, I can do that because I am the only one losing out on the money, ” Cragg told FreightWaves in late March. “I don’t know how some company drivers are handling it out here because they don’t have the option to leave without risking getting fired.”

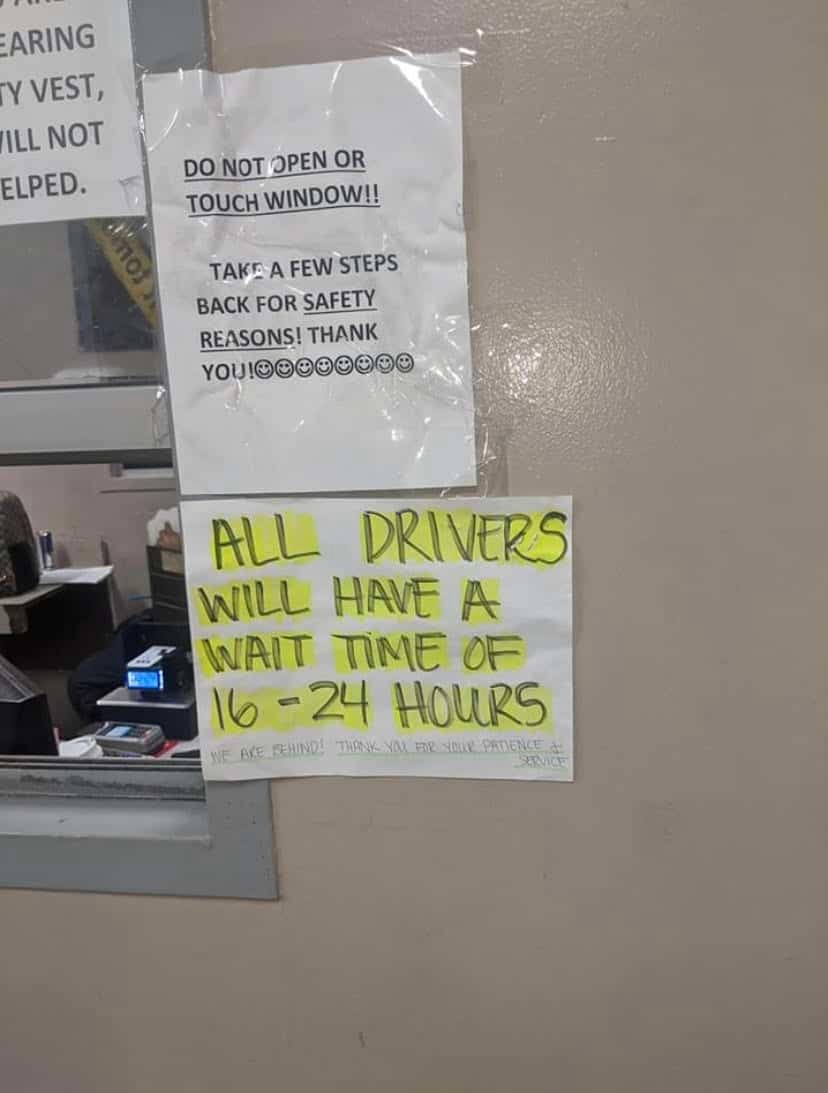

However, some truck drivers have reported wait times of up to 24 hours at some shippers and receivers as photographed by one truck driver, who was instructed not to “open or touch the window” and “take a few steps back for safety reasons.”

Good shippers and receivers will shine during this global pandemic, while poor ones will be exposed for not having a good plan in place prior to this challenging freight environment, Cragg said.

“The poor shippers and receivers that you hear these horror stories about were bad before the [coronavirus] pandemic, but they have gotten even worse now,” Cragg told FreightWaves.

“These poor facilities can’t just flip a switch and all of a sudden become good ones. I think it’s the exact opposite with the good shippers and receivers because they had a good plan in place before this happened and now they are shining.”

FreightWaves’ Research recently surveyed 130 motor carriers of all sizes about how truck drivers are being treated on the road as the number of confirmed coronavirus cases continues to rise in the U.S.

For the most part, most truck stops and rest areas are providing some access to parking and amenities, a huge concern for truck drivers delivering crucial medical and essential goods right now.

Percentage of drivers taken off the road after showing symptoms of COVID-19

While truck drivers have expressed concerns about being exposed to the coronavirus as they deliver critical freight across the country, nearly 69% of motor carriers say none of its drivers have tested positive for COVID-19. Another 31% of survey respondents have reported that one or more drivers have been taken off the road after showing symptoms of the highly contagious virus.

Fleet size

Of the carriers surveyed, around 31% of motor carriers reported fleet sizes of between 51 and 500 trucks, while 23% have 6-20 trucks and 21% have between 21 to 50 trucks. Of the carriers surveyed, 14% reported 500-plus trucks in their fleets, while 6% have 2-5 trucks and 5% are one-truck operators.

Average length of haul for loads

Of the motor carriers that responded to the survey, around 35% stated that the average length of haul for loads was between 501 to 1,000 miles, while 28% reported running 251 to 500 miles, on average per load. Approximately 18% reported running more than 1,000 miles on average per load, while 19% run 250 miles or less per load.

Are drivers still showing up for work?

Truck drivers hauling essential freight are in high demand right now as more hospitals are calling for more medical equipment and grocery stores are still reporting empty shelves as consumers stock up on or some “panic buy” necessities. However, more stores are restricting the number of essential items people can buy per visit now.

However, motor carriers are reporting that drivers are still reporting for duty. Approximately 48% of carriers surveyed report all of their company drivers showed up for work in the last two weeks. Around 44% reported that between 1% and 25% of their drivers did not show up and 3% say between 26% to 50% did not show up for work.

Motor carriers’ thoughts on the $2 trillion fiscal stimulus legislation passed by Congress recently?

Around 35% of carriers surveyed say they somewhat agree with the $2 trillion fiscal stimulus legislation passed by Congress recently, while nearly 25% reported that they strongly agree with the legislation.

Have you been asked personal questions by shippers or consignees not related to COVID-19 recently?

Nearly 50% reported that drivers have been asked if they have shown any symptoms of the coronavirus in the past few weeks, while nearly 30% have been asked about drivers’ prior travel history. Some drivers told trucking industry groups they were being asked personal questions not related to COVID-19, but that was not reflected in FreightWaves’ survey.

What best describes the survey responder’s role at their company?

Of the 130 survey respondents, more than 50% were executives of their companies, while nearly 20% were in operations and around 10% were dispatchers. Just shy of 10% of the motor carriers’ drivers participated in the survey.

At a time when truck drivers are on the road worrying about their own health, as well as their loved ones back home amid the pandemic, Brown said it’s important that truck drivers show professionalism.

“Instead of only focusing on the negative, let’s show everyone how important we are to keeping the economy moving,” Brown told FreightWaves. “This is our time to shine.”