Five years ago, air cargo in Chicagoland was the near-exclusive province of O’Hare International Airport. Now four airports ringing the southwestern shore of Lake Michigan are all investing to support anticipated demand from companies that rely on air transport to move goods faster.

The latest installation spreading its cargo wings is Gary/Chicago International Airport (GCIA), an underutilized facility in Gary, Indiana, 25 miles south of downtown Chicago, that mostly functions as a destination for corporate jets and weekend aviators.

Chicago O’Hare is expected in May to open a $56 million terminal addition for cargo, Chicago Rockford International Airport to the west is attracting new express and international freighter services and Milwaukee Mitchell airport is drawing up plans for a large air logistics facility.

The Gary Chicago Airport Authority recently received $6 million in funding from the Federal Aviation Administration to support upgrades to its air cargo facility. Two-thirds of the money is earmarked for construction of a concrete parking pad for up to 18 cargo aircraft and the balance to install a sanitary sewer line for the existing deicing pad. Having a segregated drainage system prevents untreated chemicals from draining into local water supplies.

UPS (NYSE: UPS) is the only cargo tenant at GCIA and will gain elbow room with the extra parking positions. Officials are taking advantage of the project mobilization to build more space than needed in anticipation of eventually attracting other customers interested in establishing an air logistics center. The airport hasn’t had any passenger service since Allegiant left in 2013.

“As the airport continues to mature its cargo service offerings, additional tenants will operate out of the airport and the future logistics center expansion is planned with future growth in mind,” the airport said in a statement to FreightWaves.

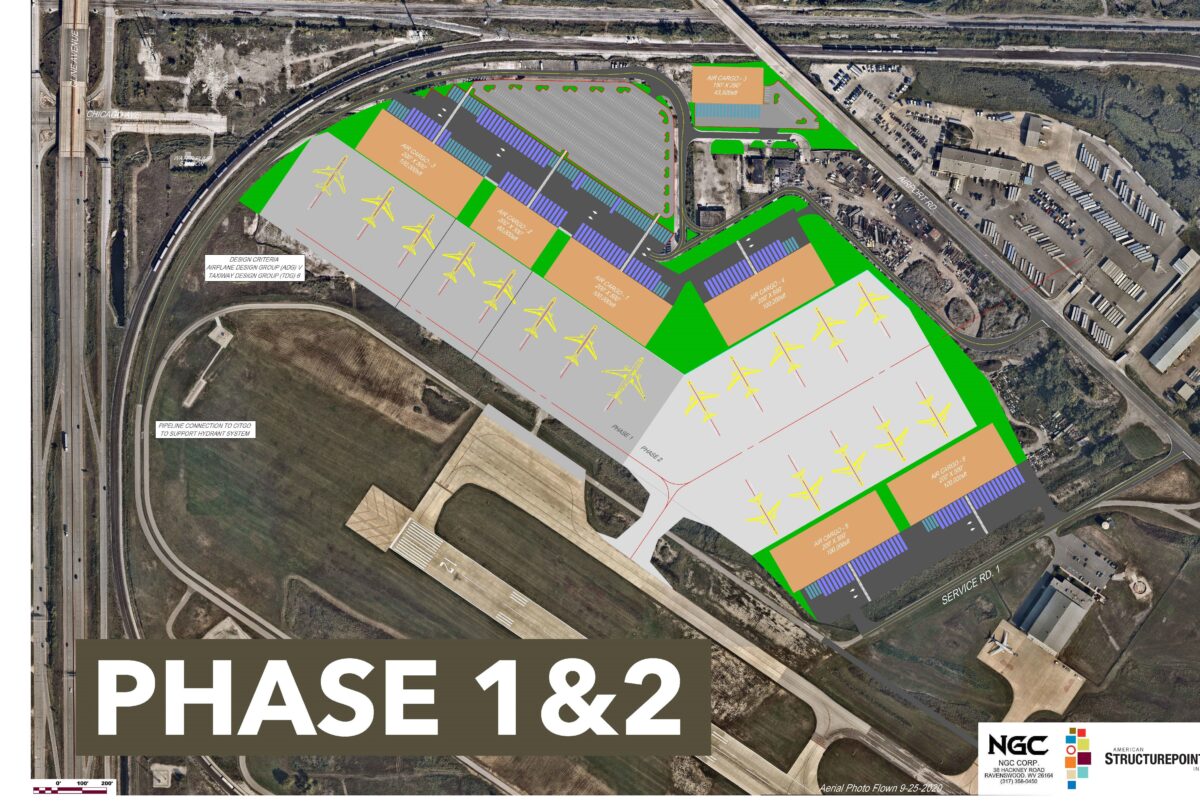

Construction for the first phase of the apron project, which will accommodate eight large cargo jets, is scheduled to start in the fourth quarter. The second phase is planned for 10 additional freighters. The apron will include an in-pavement hydrant system connected to a BP pipeline so aircraft can refuel without bringing in trucks, which will reduce diesel emissions and allow for quicker turns, said Dan Vicari, GCIA’s executive director.

The airport authority isn’t building the new apron specifically for UPS, but the integrated parcel carrier will be able to make use of it.

UPS added Gary/Chicago to its express network in November 2020, with staff working out of a 14,000-square-foot office in the vacant passenger terminal and using a modular distribution center to sort packages. The mini crossdock is a small metal building on a concrete foundation with truck doors and a conveyor belt inside for directing packages to ground vehicles.

GCIA gives UPS additional capacity in the Chicago area, in the same way it uses multiple airports around New York and Los Angeles. It currently operates two flights every weeknight from GCIA to the Worldport in Louisville and a regional hub in Philadelphia, said spokesman Jim Mayer. Activity has increased from a single flight when the facility opened. The aircraft are usually Boeing 757s or Airbus A300s, according to Vicari.

The new apron will be located on the west end of the runway, far from the space UPS currently occupies and where the master plan calls for a cargo terminal.

The alternate site will include a small building for UPS with bathrooms, break rooms, storage for parts and office space, as well as the modular distribution center.

“What we’re doing is providing the accommodations so that it could be developed in the future, but right now plans don’t include warehouses,” Vicari said in an interview. “The demand is certainly there from importers, exporters, forwarders and airlines. Everybody is looking for space.”

GCIA officials say they want to capitalize on the economic development opportunities an increased cargo presence will give northern Indiana.

Nearby airports

North of Gary, O’Hare airport is wrapping up the third, and final, phase of a multi-year cargo development with 130,000 square feet of cargo space, offices and a large apron that can accommodate two extra-large (747-8) cargo jets. The project includes an extension of an existing taxi lane and access road.

Chicago Rockford airport has invested more than $200 million in new cargo facilities over eight years to support a large UPS hub, Amazon Air and several global freight forwarders. A new 50,000-square-foot cargo transfer building is set to open in June.

Like GCIA, Milwaukee is a third-tier airport when it comes to cargo, with a limited amount of FedEx and UPS traffic. Regional officials have an ambitious vision for growth. The airport recently partnered with Crow Holdings to finance, build and operate a 288,000-square-foot logistics hub, with ramp space for up to five 747 jumbo jet freighters.

Click here for more FreightWaves and American Shipper articles by Eric Kulisch.

Twitter: @ericreports; LinkedIn: Eric Kulisch; ekulisch@freightwaves.com

RELATED STORIES:

Rockford airport prepares next cargo expansion as Menzies moves in