Procurement and supply chain management platform GoExpedi announced Wednesday it has closed on $33 million in additional funding from new investors Tiger Global, Labyrinth Capital Partners, Cortes Capital (Love’s private equity group), I2BF and FJ Labs to continue growing its technology for heavy industry.

GoExpedi last raised $25 million in September 2020. The company has raised a total of $108 million from past investors, including Top Tier Capital Partners, Crosslink Capital, Bowery Capital, Blue Bear Capital, CSL Capital Management and Hack VC, who continued their support in this round.

The company was launched in 2017 by co-founders Tim Neal, chief executive officer, and Jonathan Hamiltion, chief operating officer, who met while holding management positions at global industrial and energy equipment provider TSC Group Holdings.

“Through building operations of drilling rigs and seeing manufacturing operations, we identified a market opportunity in the heavy industrial sector to supply their critical need items,” said Neal.

“If I order a shirt and it arrives late, it doesn’t really impact my life in a negative way. However, if you need a piston and that doesn’t arrive on time, it becomes a critical issue and it jeopardizes the uptime of your asset.”

Neal explained that while downtime can be costly to the industry and energy sectors, the process of procuring, shipping and receiving these parts is still outdated, consisting of phone calls and numerous emails to solidify one transaction of parts.

| Funding details | GoExpedi |

|---|---|

| Funding amount | $33 million |

| Investors | Tiger Global, Labyrinth Capital Partners, Cortes Capital (Love’s PE), I2BF, FJ Labs, Top Tier Capital Partners, Crosslink Capital, Bowery Capital, Blue Bear Capital, CSL Capital Management and Hack VC |

| Business goals for the round | Grow sales to add new industrial sectors, improve platform capabilities |

| Total funding | $108 million |

In its first year, both co-founders would find these critical parts and deliver them in their own trucks, bootstrapping GoExpedi directly, driving up to 3,000 miles a week.

After its initial seed round in April 2018, GoExpedi began to execute its platform solution to provide procurement and shipping services to its heavy industry customers.

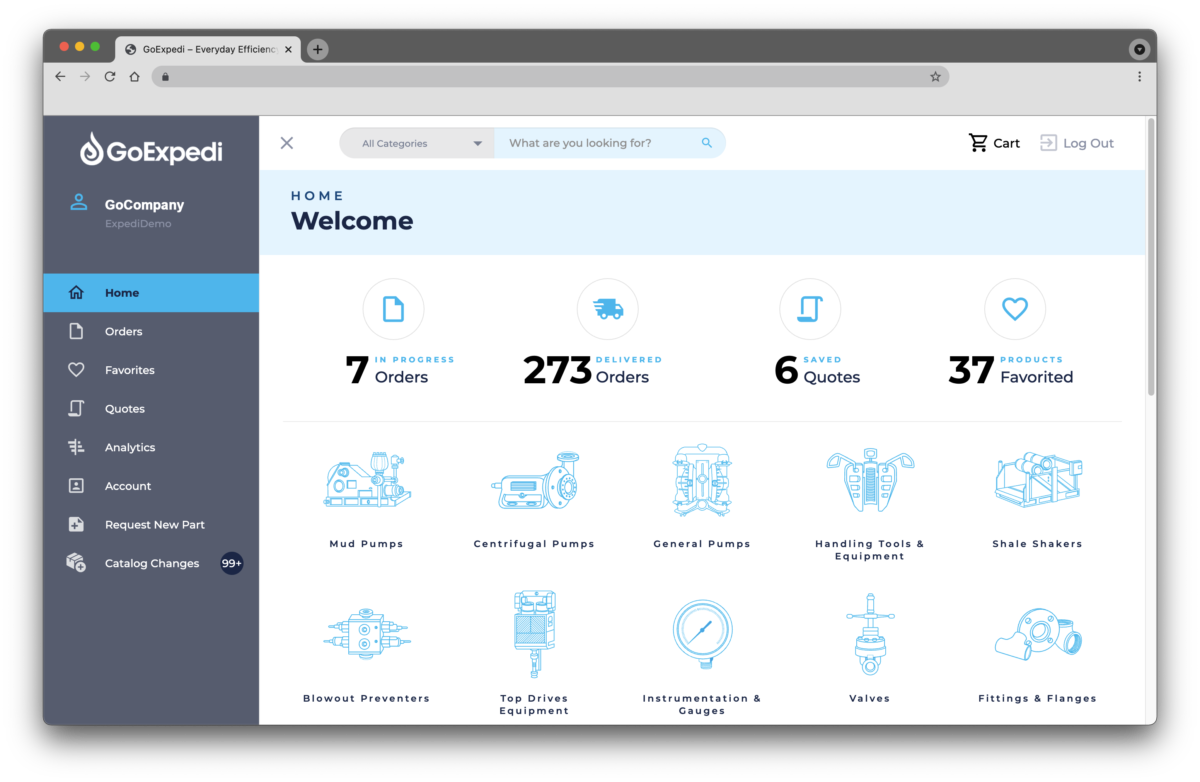

“We built custom catalogs with customer logos to make it feel like an internal purchasing tool made just for them. For their management teams, we have live analytics dashboards that show real-time visibility on their expenditure. … That is how we have built the stickiness of our solution and we have had phenomenal growth,” said Neal.

“We started working with the top five drilling contractors and we really grew into the remote industry sector in 2021. We are working a lot more in the construction space and one of the largest electric vehicle auto manufacturers. The utility sector, including solar power, and maritime are becoming fast growing for us,” he continued.

That growth has led GoExpedi to deliver over 2 million items to more than 3,000 manufacturers within an average of 2.5 days with 99% order accuracy, according to the company.

With the new capital in hand, Neal is looking forward to adding to GoExpedi’s solutions within the company’s platform so customers can continue to “get ahead of their supply chain.” He also looks forward to leveraging investor partnerships to enter new industry sectors.

“The procurement of industrial products and spare parts is at a critical crossroads as the global supply chain is faced with unprecedented headwinds,” said Chris Lawrence, managing partner at Labyrinth Capital Partners. “GoExpedi’s strong growth is a testament to its state-of-the-art digital solutions, which provide blue-chip customers with a competitive advantage in a world of antiquated options.”

Watch now: Heavy goods logistics and delivery solutions for 2021

Read more

Greenscreens.ai raises $5M to help logistics providers ‘win more opportunities’

Hwy Haul raises $10M to build produce book to keep reefer drivers busy

MyCarrier, Estes Express partner to transition customers from KuebixTMS