Fourth Quarter Results

Goodyear Tire and Rubber (NASDAQ: GT) missed consensus revenue expectations of $4.05 billion. The company’s sales decreased 5 percent year-over-year (Y/Y) from around $4.1 billion to $3.88 billion. According to Seeking Alpha, Goodyear missed revenue consensus estimates by $170 million, or about 4 percent.

Goodyear also missed consensus expectations of fourth quarter earnings per share (EPS) of $0.67 by nearly 24 percent. Quarterly EPS were $0.51, according to Seeking Alpha. Also, the company’s earnings release said adjusted net income decreased by 51 percent Y/Y from $245 million in the fourth quarter of 2017 to $125 million in the fourth quarter of 2018.

According to the earnings release, tire unit volume was 40.7 million for the quarter, a decrease of 3 percent Y/Y. Growth in Europe was offset by weakness in Brazil and lower automotive production in China and India. The company missed its guidance for flat volume in the fourth quarter.

The earnings release attributed decreased income to a reflection of higher raw material costs compared to the first three quarters of 2018, weaker results from other tire-related businesses, lower volume and an unfavorable impact of foreign currency translation. These challenges were partially offset by improved price/mix, net cost savings and improved overhead absorption.

During the company’s earnings call Goodyear Chairman, Chief Executive Officer and President Richard Kramer said, “I’m not satisfied with our overall performance in 2018. While higher raw materials, a strong U.S. dollar and industry volatility in China negatively impacted our results, our operational execution was below my expectations for our team and of our capability as demonstrated by past performance.The realities of today’s challenging macro backdrop mean that we need to intensify our focus on factors that we can control including our expenses and cash flow.”

Business Segments Results

Americas

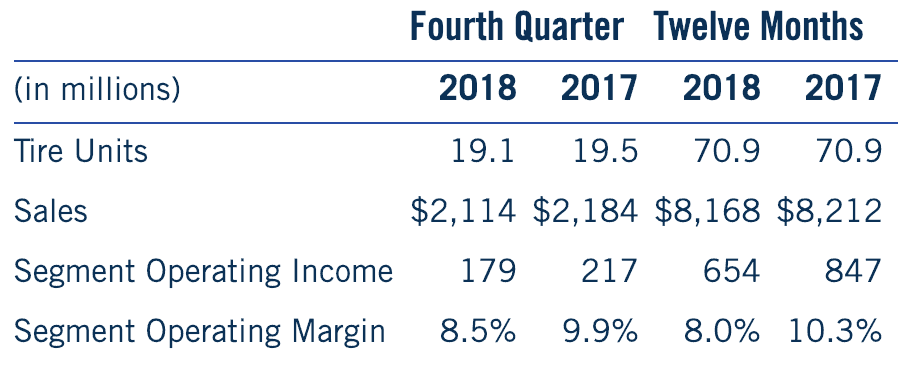

Fourth quarter 2018 segment operating income of $179 million was down 18 percent Y/Y. U.S. consumer replacement volume was flat while original equipment volume was down 4 percent.

Africa, Europe, Middle East

Fourth quarter 2018 segment operating income of $74 million was down 23 percent Y/Y. Replacement tire shipments were up 1 percent while original equipment volume was down 5 percent.

Asia Pacific

Fourth quarter 2018 segment operating income of $54 million was down 54 percent Y/Y. Replacement tire shipments were down 2 percent while original unit volume was down 22 percent, reflecting weak vehicle production in China.

Shares

According to the earnings release, as part of its previously announced $2.1 billion share repurchase program, the company repurchased 897,000 shares of its common stock for $20 million during the fourth quarter. For the full year, the company repurchased 8.9 million shares for $220 million.