GXO Logistics Inc. sees an upward trend in the global freight market in 2025, encouraged by its growing customer base and organic sales growth in the third quarter.

“We definitely are feeling that we’re out of the trough that we’ve been in for the last 12 months, and we’re getting back to a more normal kind of growth type of metric,” CEO Malcolm Wilson said during a call with analysts Tuesday. “We’re definitely building for a much stronger 2025.”

Greenwich, Connecticut-based GXO Logistics (NYSE: GXO) is one of the largest pure-play contract logistics providers in the world. It has more than 970 facilities totaling approximately 200 million square feet, with a global workforce of more than 130,000 people.

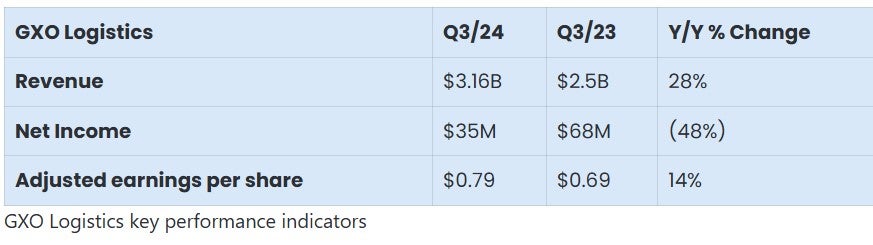

The company reported Monday that quarterly revenue surged 28% year over year to $3.16 billion.

Adjusted third-quarter earnings per share was 79 cents, compared with 69 cents for the third quarter in 2023.

The results exceeded Wall Street expectations for the quarter, which had estimated revenue of $3.03 billion and adjusted EPS at 78 cents per share.

GXO saw third-quarter organic revenue growth of 3%, which has accelerated sequentially throughout the year, said CFO Baris Oran.

Adjusted earnings before interest, taxes, depreciation and amortization was $223 million, a 12% year-over-year increase compared with $200 million for the third quarter of 2023.

“The improving trajectory reflects the growing contribution of new facility startups each quarter, and we expect it to continue as we move into 2025,” Oran said. “We have also seen sequential margin expansion throughout the year, and we expect this trend to continue as we see a margin uplift due to a better space utilization in our multitenant network.”

For full-year 2024, GXO’s guidance expects organic revenue growth of 2% to 5%, adjusted EPS of $2.73 to $2.93 and adjusted EBITDA of $805 million to $835 million.

Related: GXO Logistics sees upward trend in global freight market

While revenue and earnings per share increased during the quarter, GXO’s net income fell 48% year over year to $35 million. The company also has $2.8 billion in outstanding debt and $2.2 billion in net debt.

GXO’s customers include Gymshark, LG Corp., L’Oreal and Zalando. The company recently expanded its partnership with Zalando and opened the largest outsourced e-commerce warehouse in France, Wilson said.

“Our sales pipeline has grown 30% year over year and now stands at over $2.4 billion of high-quality opportunities, its highest level in more than two years,” Wilson said.

The e-commerce marketplace drove significant third-quarter revenue gains, GXO officials said.

“There has been a return of a lot of e-fulfillment projects. I think that’s very pleasing for us to see,” Wilson said. “It was always one of the big engines of this company’s high-single-digit, double-digit organic growth. It’s great to see them starting to return now.”

GXO signed $226 million in new business contracts during the third quarter, bringing its year-to-date total to about $750 million. The company’s sales pipeline stands at its highest level in more than two years, officials said.

Kristine Kubacki, GXO’s chief strategy officer, said 60% of the company’s new sales in the third quarter originated from e-commerce fulfillment and companies looking to outsource their logistics operations.

“At an industry level, about a quarter of all retail sales today come from e-commerce, and this proportion is expected to grow by more than 10 percentage points over the next decade,” Kubacki said. “As supply chains become increasingly complex, customers are relying more and more on scaled tech-forward logistics experts like GXO. This has been driving an acceleration of outsourcing for fulfillment activities.”