If you take a direct hit from a Category 3 hurricane, the fallout is far more severe if the storm stalls over your house than if it quickly passes by. The same goes for supply chains. When demand is super-hot, port and transport infrastructure can deal with short spikes, but eventually, they buckle.

Backlogs in the U.S. are mounting in the face of surging imports. Container equipment in China is running out. When could the supply chain get some relief? Next month or next year?

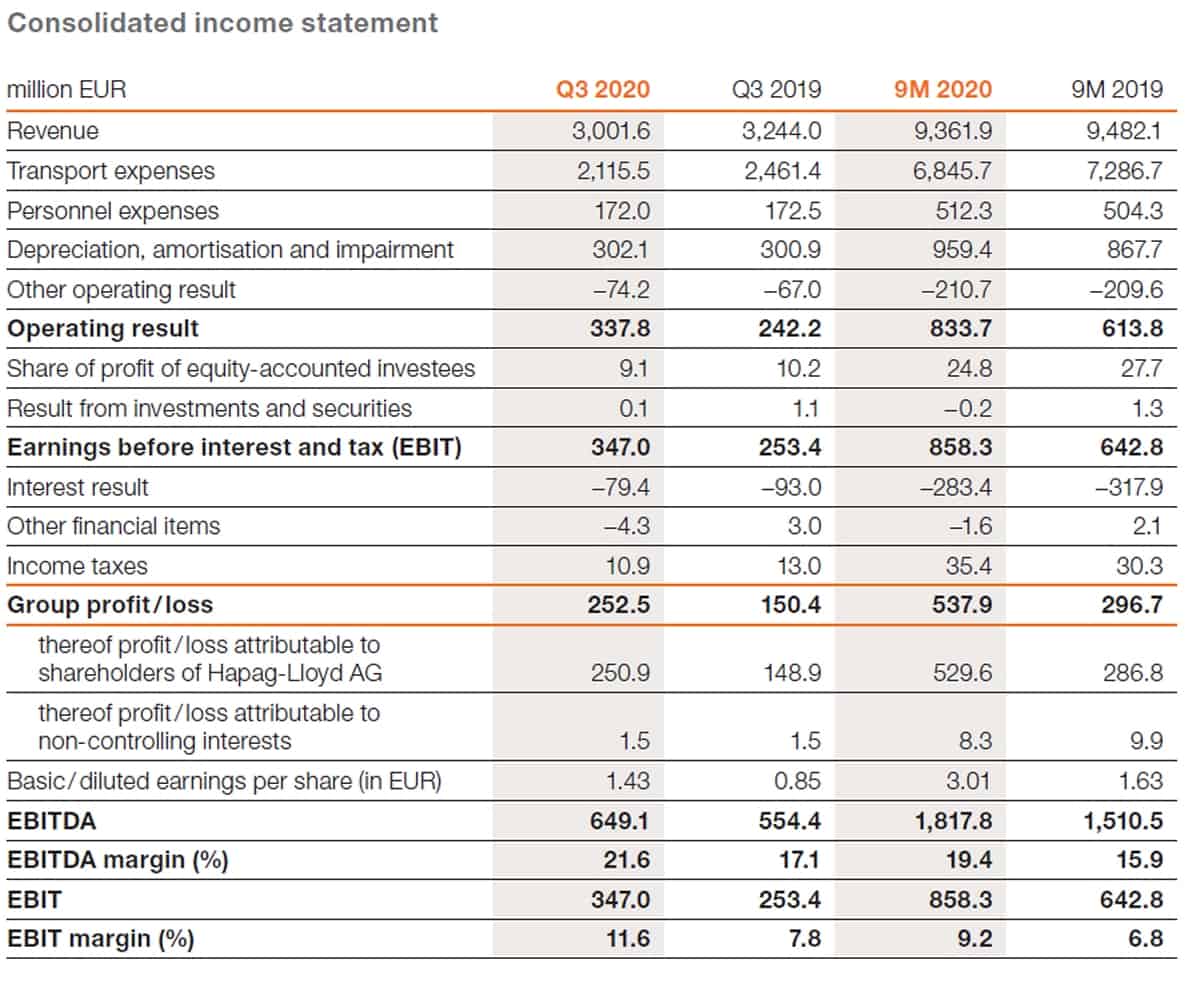

Hapag-Lloyd CEO Rolf Habben Jansen commented on timing on Friday’s quarterly conference call, after the German carrier reported net income of 252.5 million euros for Q3 2020, up 68% from 150.4 million euros in Q3 2019.

Habben Jansen’s short answer was: Strong volumes and equipment constraints will last through year-end if not longer.

The more nuanced answer from Habben Jansen — who struck a conservative tone — was that today’s cargo pace won’t last forever, there could always be a big fall around the corner, and equipment shortages will ease.

Demand high through Chinese New Year

“We have seen a very strong recovery — probably stronger than anyone anticipated,” said Habben Jansen. “If we look ahead, the market looks pretty strong at least until Chinese New Year [in mid-February],” he reported.

Asked whether he thought fresh consumer demand or inventory restocking is driving volumes, he replied, “Based on what we see right now, [the market] is indeed being driven by demand, not so much by restocking.

“I would expect there would be more restocking going into 2021. And on top of that, people may decide to have more safety stock in their supply chains. Those are certainly positive factors [for] what’s going to happen in the upcoming couple of quarters.”

Yet Habben Jansen also warned, “There is certainly a fair amount of uncertainty in the market if you look a little bit further ahead. More than usual.

“The market is very, very strong today … but it is not logical that it will just continue like this for the next couple of years.

“Unexpected things will come our way over the upcoming three, four, five quarters. We need to be prepared to move quickly,” he said.

Industry struggles with equipment shortfalls

Exceptionally strong cargo demand has pushed container equipment out of position, away from Asian loading sites. Simultaneously, liners like Hapag-Lloyd don’t have the ability to charter in more ships to handle extra loads.

“The idle fleet is pretty much zero,” said Habben Jansen. “Every ship that’s available today is sailing.”

Regarding container equipment, he said, “The entire market is struggling to get the boxes back to where they need to be. We have hired [leased] a record number of boxes this year, but we also face tightness.

“Because of the unexpected surge in demand, a lot of the infrastructure is just clogged up, which prevents us from moving containers back.

“We are working to incentivize people to use other types of boxes,” he continued, referring to equipment-imbalance surcharges. “They may be able to work with a 40-foot general container rather than a [40-foot] high cube. We also built a lot of new reefers we are trying to fill with [unrefrigerated] cargo at a discount, to release some of the pressure on equipment.

“I do think the situation is going to get a little bit better over the next six to 10 weeks, although today it is certainly a fairly big challenge,” he said.

On a positive note, Habben Jansen’s comment implies a light at the end of the tunnel. On a negative note, when you do the math, he’s referring to improvements in Q1 2021.

What if demand plunges again?

Given how high demand is today, it’s hard to imagine cargo volumes falling off a cliff.

But no one expected that to happen in April — and it did. European countries are now enforcing COVID lockdowns yet again. In the U.S., more states are now closing businesses back down.

Carriers “blanked” (canceled) an unprecedented number of sailings to cut costs and maintain rates during the lockdowns earlier this year. In a worst-case scenario, could this happen again?

According to Habben Jansen, “If demand all of a sudden breaks away, you have to cut costs. If you look at the month of April, all the sudden we saw demand come down 20%. In our case, that meant a sudden loss of $200 million of revenue per month.

“If we do not sail a ship, we can cut about 60% of the cost. If I miss $200 million in revenue and I can avoid $120 million in cost by adjusting my capacity to demand, I have to do that.

“That is the fully rational thing to do. I can only speak for Hapag-Lloyd. But for the last 10-12 years, this industry has not made any money. It has never earned its cost of capital. And at some stage, one would expect that people start to behave more rationally.

“You have to react,” he said, referring to sudden demand drops. “You cannot just continue. Because if you do, you will go bankrupt very, very quickly.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON THE TRANS-PACIFIC TRADE: Containers are the ‘new gold’ amid ‘black swan’ box squeeze: see story here. LA. box signal spikes and charter rates go ‘through the roof’: see story here. Holiday ‘shipageddon’ update: Container sector scrambling: see story here.

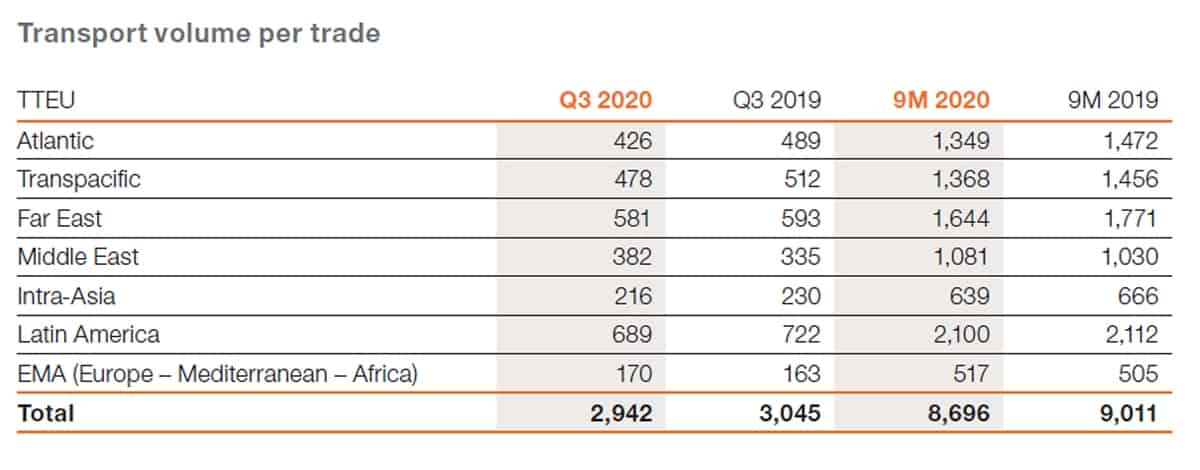

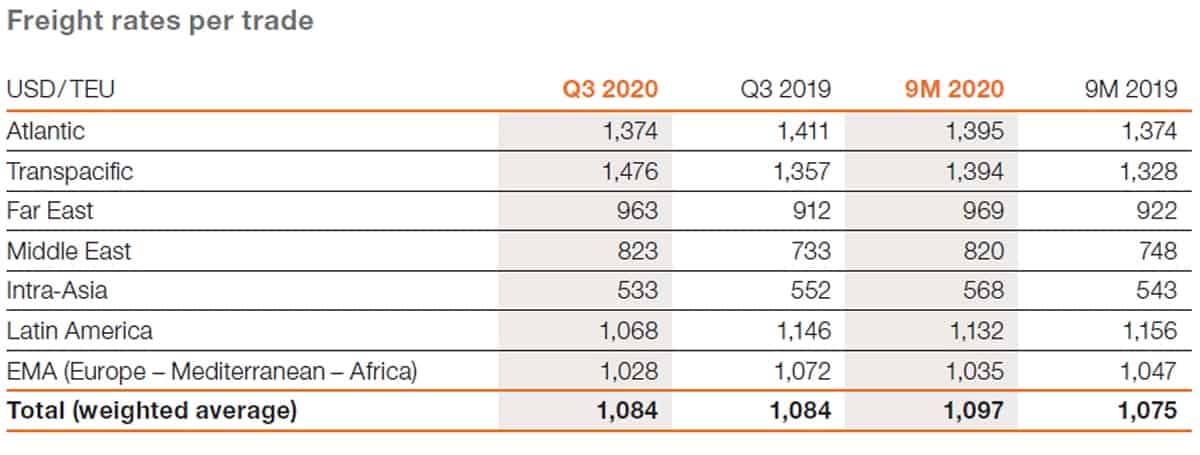

Hapag-Lloyd quarterly results: