Another ocean carrier financial report, another awe-inspiring bottom line. Germany’s Hapag-Lloyd posted its best quarter ever on Friday, and CEO Rolf Habben Jansen provided his take on spot rates, California congestion and all those new container ships that were ordered.

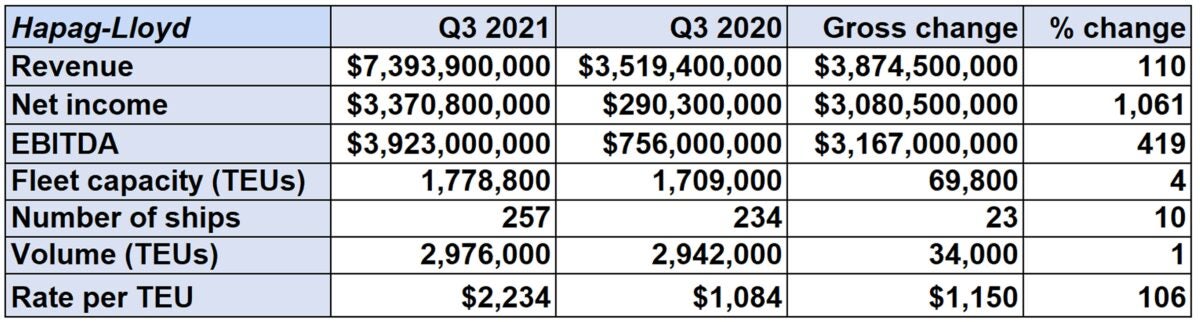

The world’s fifth-largest ocean carrier reported earnings before interest taxes, depreciation and amortization of $3.92 billion in Q3 2021, up 419% from $756 million in Q3 2020.

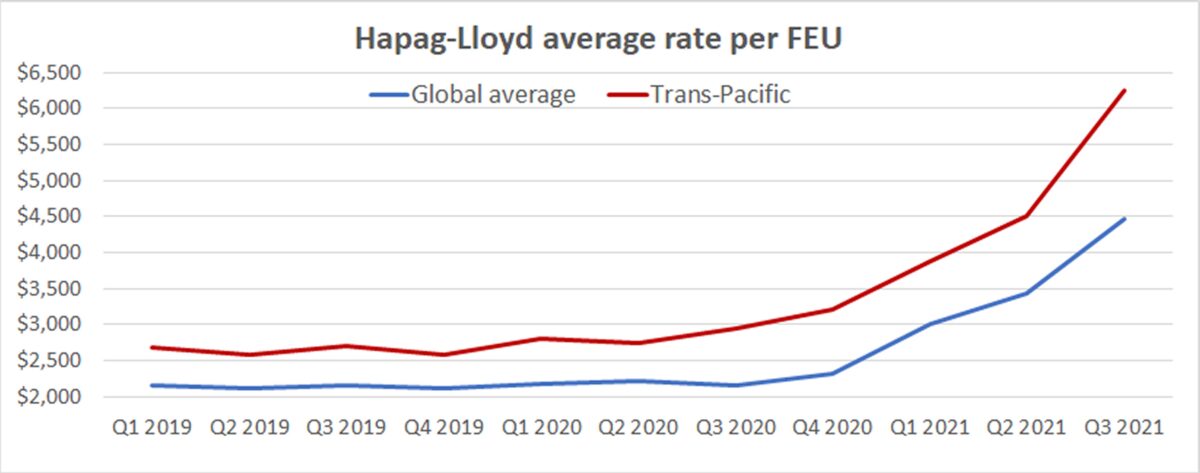

As with Maersk and other carriers, surging freight rates were the key profit driver. Hapag-Lloyd earned an average of $4,468 per forty-foot equivalent unit in the third quarter, up 106%, year on year. Rates in the trans-Pacific averaged $6,244 per FEU, up 112% year on year.

Hapag-Lloyd reiterated its full-year guidance for EBITDA of $11.56 billion-$12.48 billion, implying Q4 2021 EBITDA of $3.4 billion-$4.32 billion. In other words, if it’s not another record quarter, it’ll be a close second. As for Q1 2022, Habben Jansen signaled more of the same. “We would not expect to see a dramatic change,” he affirmed on Friday’s conference call.

Rates still ‘very high’

Fourth-quarter spot rates have been a major focus of investors, given pullbacks in several indexes, particularly the Frieghtos Baltic Daily Index (FBX), which includes premium surcharges in its trans-Pacific rate assessments. The FBX Asia-West Coast assessments dropped in early October, then rebounded, then fell sharply again this week.

But the Hapag-Lloyd CEO is not seeing any big drop. “I think the decline we see right now is probably less than you would normally see at this time of year. And, of course, we are also coming down from a very high level.

“Spot rates are still very high today. Going into 2022, I think it would be better for everybody if we saw a little bit more normalization. We don’t see a lot of that just yet, to be honest.” He added that volumes moving at premium rates — the pricing that’s causing FBX volatility — are not significant for Hapag-Lloyd. The premium-cargo share of the carrier’s trans-Pacific volumes was only in the single digits, he said.

Tackling California congestion

The CEO offered his perspective on the controversial plan of the ports of Los Angeles and Long Beach to charge a fee on containers that dwell too long at the terminals. Those charges, which will be levied on carriers and then passed along to shippers, are set to begin Monday.

“On one hand, I think it’s good to have an incentive to peel out those boxes earlier,” said Habben Jansen. “But it could become a double-edged sword. If there’s cargo in those boxes that is not very valuable, you may end up with a lot of abandoned cargo that is going to stay at the terminal for much, much longer. It’s a bit of a balancing act. I hope it works.”

Asked how he would unclog the logjam in Southern California, he replied: “I think the focus has to be on improving efficiency. If you look at the waiting times trucks have in places like LA, but not just there, they could move a lot more boxes if they could just go in and out of the terminal faster and pick up the boxes and deliver the empty ones.

“There’s a lot that can still be done in terms of efficiency, not only at the ports but at the warehouses, where they only accept boxes during certain times of the day and certainly not at night. If we all think a bit more 24/7, we would actually create an enormous amount of additional capacity.”

Vessel supply outlook

He believes port congestion will be alleviated at some point next year. When that happens, a large chunk of vessel supply will be freed up, which should bring spot rates down but allow carriers to move more volume.

According to Habben Jansen, 5%-10% of Hapag-Lloyd’s capacity is currently tied up in port congestion.

“That will never go down to zero, but can that give a boost to available capacity [when it clears]? Yes, definitively. We are anticipating that next year and will be able to move more cargo because of that.”

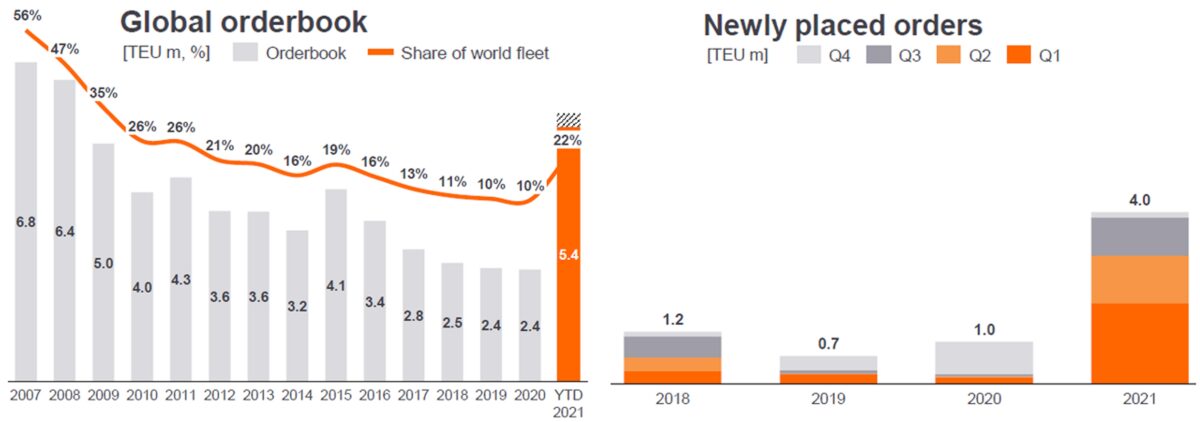

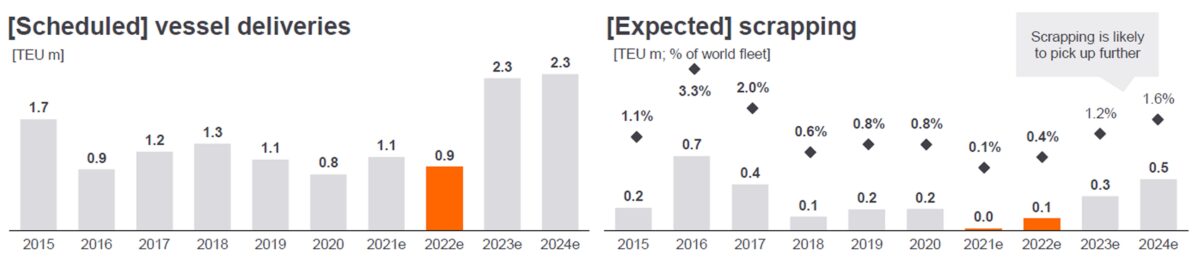

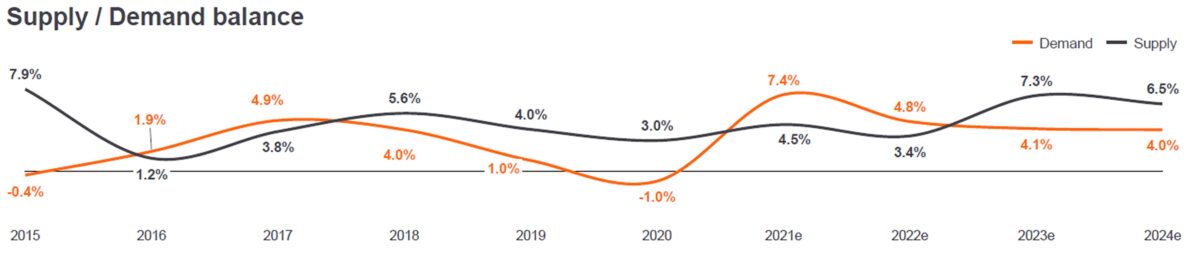

The bigger vessel-capacity issue arises in 2023-2024, when ships ordered in Q4 2020-Q4 2021 are delivered. New orders appear to be slowing and were much lower in the third quarter than in the first. The orderbook capacity has reached 22% of on-the-water capacity, the highest level since 2011, but nowhere near the peak ratio of 61% hit in 2007.

Habben Jansen does not foresee significant overcapacity in 2023-2024, despite the larger orderbook.

“A lot of people have been pushing back scrapping of older ships and drydockings for regular maintenance, and there are new environmental rules that kick in starting in 2023,” he explained. “We see demand growth will probably outpace supply in 2022. And then in 2023 and 2024, it might be a little bit the other way around. But I personally still think that because of scrapping and the additional drydockings as people catch up on maintenance, the gap [between supply and demand] will be smaller — and the big wildcard will be the environmental rules.”

Hapag-Lloyd cited projections that demand would outpace supply by 3.2% in 2023 and 2.5% in 2024. But Habben Jansen predicted that the gap will close. “I would be surprised if it’s more than 2%,” he said.

Click for more articles by Greg Miller

Related articles:

- Clock ticks closer to midnight for overwhelmed California ports

- Shippers fear ‘catastrophic’ fallout from ‘crazy’ California port fees

- Shipping giant Maersk continues buying spree after best quarter ever

- Container shipping’s ‘hockey stick’: Liner profits just keep on climbing

- No relief from ‘ridiculously expensive’ container shipping rates