As Brad Jacobs prepares to exit the CEO helm at XPO Logistics, he touted two particular numbers on the company’s earnings call with analysts Friday.

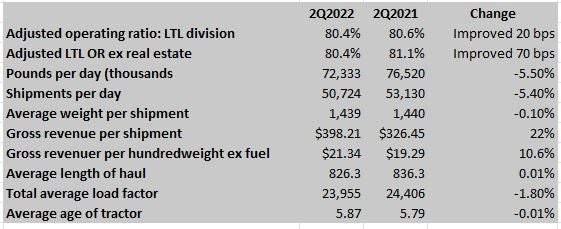

The less-than-truckload business, which is the core of XPO (NYSE: XPO) after selling off multiple divisions as it looks to become a pure-play company, posted an adjusted operating ratio–the ratio of revenues to expenses– of 80.4% That was only 20 basis points better than the LTL’s division a year ago, but when real estate transactions are taken out of the equation, the LTL OR was up 70 bps, improving from 81.1% a year ago.

In the earnings call with analysts, Jacobs said the 80.4% OR is an XPO record for any quarter. It also is a significant improvement from the adjusted OR of 85.7% the LTL group posted for the first quarter. And he reiterated that XPO expects OR to improve by 100 bps year over year by the end of 2022.

The second number at the top of Jacobs’ list was the performance of the company’s brokerage division, which measured in revenue is significantly larger than the LTL group. It posted gross profit of 20.8%, which Jacobs said was a quarterly record and up 610 basis points from a year earlier.

LTL revenue was $948 million — up 3.4% — excluding a fuel surcharge of $291 million. Brokerage, by contrast, saw revenue of just over $2 billion, but that was down 4.3% on the year.

“And it’s not just a price play,” Jacobs said of the group’s performance in addressing the market conditions of falling spot rates that helped make Q2 a strong three months for all brokerage companies.

Volume was up 16%, Jacobs said. But the breakout of the company’s financials do show how much of that performance was tied to the type of conditions so favorable for brokerage operations: Revenue was down 4.3% to $2 billion, while the cost of transportation and services declined 7.2% to $1.54 billion. With other cost centers lower, the end result is operating income at the XPO brokerage division was $93 million, 38.8% more than the $67 million of 2021’s second quarter.

However, it was down from the $100 million in operating income in the first quarter. But the EBITDA margin in the first quarter for the brokerage division was 6.7%. In the second quarter, it was 7.4%, which was an improvement from 6% in the corresponding second quarter a year earlier.

Wall Street reaction to the XPO earnings was mixed. On a day when overall indices changed little, XPO stock at the day’s close was down 2.27% to $59.86. XPO stock is down roughly 34% from its 52-week high, set almost one year ago to the day. But it’s up approximately 24.7% in the last month and 9.2% in the last three months.

But analyst reaction was more positive, spurred in part by XPO’s raising of its guidance for the rest of the year. Todd Fowler at KeyBanc, in maintaining its Overweight rating, said he was “encouraged with ongoing improvement with respect to (LTL) operations as well as a favorable fundamental brokerage backdrop coupled with notable volume growth.” Momentum in both segments will “persist, given favorable less than truckload yields and positive brokerage spreads.” He added that the increased guidance by XPO may end up being “somewhat conservative.”

At Cowen & Co., Jason Seidl said the XPO earnings per share of $1.81 “handily beat our estimate of $1.50 and the consensus forecast of $1.52.”

“Efficiency metrics in the LTL segment are now approaching peers and deleveraging efforts continue,” Seidl wrote, an apparent reference to several mentions on the earnings call of improved “fluidity” in the LTL operations. Cowen’s rating on the stock, similar to KeyBanc, is “outperform.”

Even as the company’s LTL division was hauling less freight, its yield numbers were improved. Pounds per day in the quarter were down 5.5% and shipments per day were down 5.4%. Chief Strategy Officer Matt Fassler said on the call that year-over-year (y/y) growth in tonnage became stronger through the quarter.

But gross revenue per hundredweight including fuel was up 22.1%, and gross revenue per hundredweight excluding fuel, which is the more significant yield number, was up 10.6% to $21.34.

The improvement in yield, according to Fassler, was tied to a “solid pricing backdrop” and the “benefit of our proprietary pricing tools” the company uses to set rates. “Pricing is a major focus of our technology development in LTL,” he said, adding that pricing on contract renewals was up y/y by 12%.

Mario Harik, head of the LTL division who was tapped Thursday as Jacobs’ successor, said new contract renewals through July continued to be in double digits, though he did not offer further specifics. Harik said the LTL division’s cost per mile for line haul was up 33% in the first quarter and 14% in Q2, with new rates that went into effect in May holding that number down.

Looming over any LTL provider is the performance of Old Dominion Freight Lines (NASDAQ: ODFL), with its sub-70 OR. AThat standard was raised by Tom Wadewitz, the chief transportation analyst at UBS Securities.

“I think if you look at Old Dominion, they have this remarkable culture of service and focus on getting employees focused on service,” Wadewitz said on the call according to a transcript. “Is that something [where] there’s opportunity to improve or need to improve as well as having the strong technology?”

Harik, whose job will be to chase that standard as CEO, said Wadewitz was “spot on.”

Harik said XPO has a culture of “continuous improvement (with) focus on the customer and keep improving service.” There are a number of initiatives at XPO working on that, he added, citing sales team efforts on best practices, including a “feedback loop” where XPO hauls trailers owned by their customers. Changes in incentive plans for “our people in the field” also have been introduced, he said.

More articles by John Kingston

Truck transportation job growth slows in July

U.S. Xpress shows no marked improvement at Variant

Off a small base, Uber Freight profits more than double in Q2