If you operate a regional-haul trucking fleet in California or the Northeast, it’s time to start considering electric trucks. That is a high-level takeaway from a new report released on Monday by the North American Council on Freight Efficiency (NACFE) and its project partner, the Rocky Mountain Institute (RMI).

The Guidance Report, “High-Potential Regions for Electric Truck Deployments,” was co-written by RMI Freight and Transport Associate Jessie Lund and NACFE Executive Director Mike Roeth. It focuses on a three-part framework that it said industry can use when considering regional-haul electric vehicle deployment. That framework includes technology, need and support.

“In considering where to deploy electric trucks, there’s a lot to think about – everything from charging infrastructure to which climates the technology operates the best in to where the most funding and incentives are available. This framework helps not just fleets, but utilities, OEMs, policymakers, and others think through the many considerations to ensure that wherever they deploy electric trucks, they’re a success,” Patrick Browne, director of global sustainability at UPS, states in the report.

“In evaluating each of these criteria, fleets should consider not only which regions are best suited for electric trucks, but also which represent the strongest competitive advantage over diesel trucks,” the report stated.

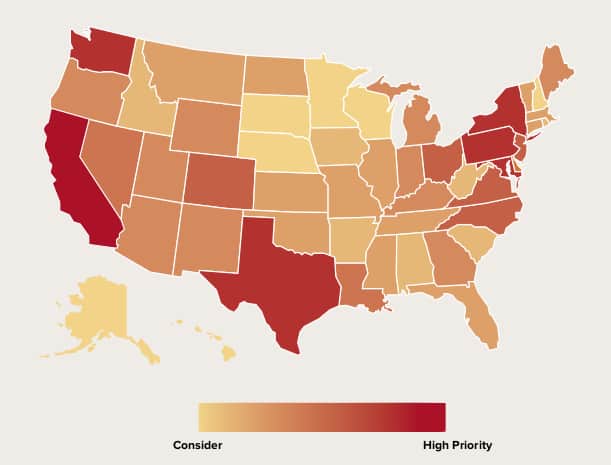

The regions with the highest potential for electric truck success include both Northern and Southern California, the Texas Triangle, the Cascadia region, the Front Range of the Southern Rocky Mountains, and the Northeast. The report advises fleets that run regional-haul routes of 230 miles or less per day in these areas to start immediately planning for electric truck deployments, at least on a pilot scale.

“We see depot charging as the near-term, and even medium-term [option] for these trucks,” Roeth said during a Zoom press conference discussing the findings. “Now is the time to work on depot charging.”

The joint effort by RMI and NACFE is part of a continuing series exploring electrification in trucking. This Guidance Report is the fifth in the series. Previous reports have focused on long-haul trucks, regional-haul trucks and infrastructure.

RMI is a nonprofit founded in 1982 and based in Boulder, Colorado. It focuses on ways to transform global energy use for a cleaner future. NACFE studies the development and adoption of technologies in the trucking space and is known for its Confidence Reports, which assess which technologies fleets are most confident in using, and Guidance Reports, which analyze emerging technologies for their potential fit within the trucking space.

The entire report along with a spreadsheet with the underlying data and state-by-state evaluations can be downloaded here.

NACFE created this heatmap to indicate the regions of the country based on their readiness to deploy electric, regional-haul tractor-trailers. (Photo: NACFE)

“If deployments are done strategically, they are more likely to be successful, which not only benefits first movers, but also catalyzes further deployments, thereby benefiting the industry as a whole and speeding adoption of this technology,” the report noted.

The report identifies each of the supporting characteristics that define its three-pronged approach, such as range, electricity pricing and regenerative braking under the technology prong. Need includes air quality considerations, equity and environmental justice, and freight flows. Support considers state and city policies and incentives, utility programs and rates, and training programs. The intersection of these three prongs is where the highest potential for electric truck deployment success occurs, the groups said.

Lund said the team producing the report focused on regions rather than corridors, as is typically done with automotive electric vehicle reports.

“We know fleets don’t keep vehicles in just one state, and that is why we looked at it on a regional level,” she said. Roeth added that future work will dig deeper in local markets, and Lund noted that the initial research will change moving forward. “We do expect a lot of these regions will become more and more favorable,” she said.

California is the focal point right now, and the Advanced Clean Truck (ACT) rule will further speed the deployment. That rule sets sales targets based on vehicle class. By 2035, 75% of Class 8 tractors sold in the state must be electric. More states are looking into similar mandates, and a group of 15 states and the District of Columbia recently announced a memorandum of understanding to study ways to move forward with zero-emission vehicles.

NACFE and RMI also believe the decision to transition to electric trucks will be driven in part by market forces. “As the technology proves a positive return on investment, demand among fleets will rise,” the report said, noting that in many cases, electric trucks already make financial sense. “Between ‘hard costs’ such as purchase price, maintenance expenses, and electricity prices, and ‘soft costs’ such as driver attraction and retention and environmental branding, total cost of ownership of electric trucks can be on par or even cheaper than diesel vehicles.”

Roeth said NACFE is committed to working with early adopters to gain insight and apply that knowledge to help deployment throughout the country.

The report focuses on battery-electric trucks, not fuel cell, as the groups believe battery-electric will be what early adopter regional fleets gravitate to given the nature of short-haul, return-to-base operations that ease dependence on infrastructure development.

NACFE estimates that battery-electric sales will grow to 13% of heavy-duty vehicle sales within a decade.

Even as California has served as ground zero for the testing and deployment of electric vehicles, other regions of the country are well suited for zero-emission vehicles, the report found.

Where does electric technology work?

Range was set at 229 miles for the purposes of the study, but geography plays a role, the groups said. High elevation or steep grades deplete batteries faster, so a round-trip route that extends out to 114 miles would require a fairly flat grade, the report said. How much braking is required on the route is also an important consideration as long highway stretches offer few opportunities for regenerative braking to add charge in the battery. Conversely, fleets operating in areas of congestion, such as New York City or along Interstate 5 in California, would see more benefit from regenerative braking.

The report said that fleets need to consider all the costs when contemplating electric trucks, including the cost of electricity.

“While fleets with geographically diverse operations may be tempted to prioritize electric truck deployments in regions with the lowest electricity prices, the metric that should truly be used for evaluation is which locations have the biggest savings potential compared to diesel fuel,” the report noted.

Lund told FreightWaves that part of the consideration regarding the electricity question was whether a utility had “make ready” infrastructure, meaning could it scale as demand grew. The regions in the report that ranked highly have this capability.

Where is the electric need?

Environmental considerations play a critical role in deployment of electric trucks. California has been pushing initiatives to clean up the air, and with 70% of smog-causing pollution and 80% of particulate matter coming from diesel trucks, the opportunity is great there.

The report noted the environmental justice component of electric truck deployments.

“Historically disadvantaged communities are more likely to be located near truck-traffic corridors and therefore more likely to breathe toxic vehicle emissions. Thus, they are disproportionately impacted by air and carbon pollution and more likely to experience higher rates of asthma, lung and heart disease, and chronic bronchitis,” the report stated.

Freight flows are another important consideration, but the report noted an advantage early-adopter fleets will have.

“Fleets may also want to prioritize regions with high levels of freight activity since long term, these regions may be most likely to require expensive grid upgrades to meet the increasing electricity demand from increasing deployments of electric trucks. Therefore, fleets that invest in deployments in these regions early are less likely to experience costly infrastructure upgrades or backlogs in the future,” it said.

Where is the electric support?

The final piece of the puzzle NACFE and RMI considered was support. Regions where mandates for zero-emission vehicles are in place also ranked highly. Also ranking highly were areas that offered state and/or city incentives, vouchers for deployment of vehicles or infrastructure development, and those areas that offered utility programs.

. Over $711 million in utility funds to offset electric-vehicle deployment costs have already been approved across the country among just 10 utilities. More will likely follow.

The report concluded that the above-mentioned regions represent the best near-term opportunities for electric-truck deployment programs, but fleets should prioritize regional-haul operations in doing so. It also advises policymakers to consider which parts of the framework can be changed (incentives, infrastructure and utility rate structures) to speed adoption.

Roeth said it just makes sense for regional-haul fleets to look into electrification.

“The regional-haul day cab is such a large, fertile ground for electric trucks and a big wave [potential],” he said. “Our first [instincts] go to the sleeper tractor — long haul — but we are [remaining] focused on regional haul. That’s where we think the focus should be to help scale.”

Click for more FreightWaves articles by Brian Straight.

You may also like:

Technology is changing the way freight brokerages operate

Answers to 7 critical questions on oversize/overweight permits

Trucking companies caught in Trump’s payroll tax deferment order