Supply chain software provider Descartes said demand from its customer base of logistics service providers improved as its fiscal first quarter progressed.

The Canada-based company said international ocean container shipments are strengthening and benefiting from higher pricing due to disruptions in the Red Sea and Panama Canal. It expects the higher ocean shipments to eventually bleed through and result in higher domestic truck volumes.

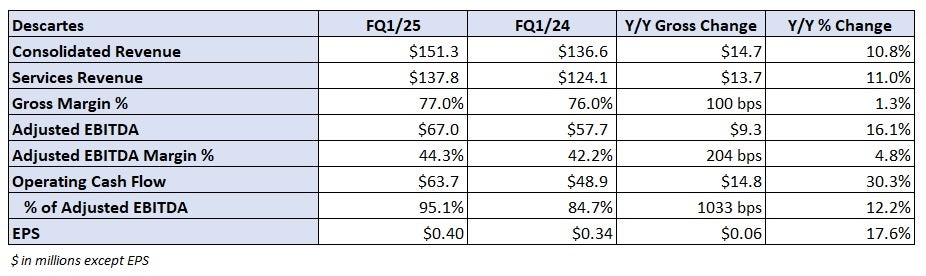

Descartes (NASDAQ: DSGX) reported earnings per share of 40 cents for the fiscal quarter ended April 30. That was 6 cents higher year over year (y/y).

Consolidated revenue of $151 million was 11% higher y/y. Services revenue was up by a similar percentage at $138 million. Excluding the impact of acquisitions and changes in foreign exchange rates, services revenue was up by more than 8% in the period.

“Supply chains and logistics operations continue to be impacted by a myriad of factors, including military conflicts, disruptions to trade routes, government sanctions, and material changes to taxes and tariffs,” said CEO Ed Ryan. “Our technology solutions are designed to help shippers, carriers and logistics services providers manage this dynamic complexity.”

Adjusted earnings before interest, taxes, depreciation and amortization of $67 million was 16% higher y/y. The company reiterated an annual EBITDA growth rate of 10% to 15%.

For the fiscal second quarter ending July 31, management forecast baseline revenue of $136 million with adjusted EBITDA of $52 million.

The company made two acquisitions totaling $150 million in the quarter. It acquired trade compliance provider OCR Services in March and customs and regulatory compliance company Aerospace Software Developments in April.

Management said there are several potential targets available for sale in the market currently.

Descartes generated $63.7 million in cash flow from operations in the quarter, a 30% y/y increase. It ended the quarter with $239 million in cash, a 26% decline from the prior period. However, the change was largely tied to the use of cash to fund the acquisitions.

It ended the period with an untapped $350 million line of credit.