Houston could soon become the largest U.S. city to enact a broad truck route plan to limit where tractor-trailers can travel as they move through town.

City officials have proposed a regulation that would limit commercial trucks to main roads, banning them on many smaller streets.

The aim of the measure is to improve roadway safety and the quality of life in Houston, according to Muxian Fang, a planner manager for the city of Houston’s Planning & Development Department.

“The Citywide Truck Route Plan (TRP) is an action item of the Vision Zero action plan to eliminate fatalities and serious injuries on our roadways,” Fang said in an email to FreightWaves. “We have received many complaints from our residents about how the cut through truck traffic has created traffic safety hazards, roadway damages, and [reduced] quality of life in their neighborhoods.”

Vision Zero is an initiative from the Federal Highway Administration adopted by cities across the country to eliminate all traffic fatalities and severe injuries, while increasing safety on roadways.

Houston’s TRP proposes dedicating a limited set of roads as truck routes for any commercial vehicle having a gross weight of more than 26,000 pounds, including the load carried. The routes would be designated into three categories:

- Through truck routes: primary routes for commercial vehicles traveling within and through the city, including interstates, state highways, toll roads, critical urban freight corridors and roadways that are functional and suitable for truck traffic.

- Local truck routes: major thoroughfares that provide direct access to local origins and destinations and can serve as alternate truck routes in case of through truck route closure for construction or emergencies.

- No-through-truck streets: road segments where through truck traffic is prohibited, which can only be used to access local origins and destinations.

The designation process to finalize truck routes is currently underway. The department will conduct a pilot test in the Settegast neighborhood in northeast Houston next spring before the truck plan is finalized.

If the plan moves forward, carriers violating it and traveling on no-through-truck streets could be fined up to $500.

Fang said Houston’s Planning & Development Department initiated a series of public engagement activities to involve all stakeholders in the TRP effort.

“We have been coordinating with the Texas Department of Transportation, Houston-Galveston Area Council, Port of Houston Authority, Harris County, [and] Houston Movers Association to develop the Citywide Truck Route Plan,” Fang said. “All of our stakeholders support this effort.”

John Esparza, CEO of the Texas Trucking Association, said that while he appreciates that Houston officials are approaching the issue of truck traffic through a planning process, he has concerns about a broad plan that doesn’t take into account the daily operations of local trucking companies.

“We maintain if there are particular problems with local schools or neighborhoods – let’s address those,” Esparza told FreightWaves. “In a city that’s not zoned, I can only hope that they’re taking into account every trucking company, that is, where the companies are located and their proximity to residential areas.”

The city does not have zoning laws, but development is governed by ordinance codes that address how property can be subdivided, according to the city’s website.

“Since Houston is not zoned, we’re talking about a trucking community of companies that can be right near residential areas, so how does the city determine what is a truck trying to egress and ingress out of their operations, and get to where they need to go and deliver the freight,” Esparza said. “I do hope that they’re listening to the companies in Houston, as they raise those specific concerns, over restrictions on where trucking companies can get in and out of their operations and where they deliver. Anytime you see these restrictions being proposed, it ultimately is going to come down to affecting the way that that motor carrier operates.”

Houston one of the fastest-growing US port cities

With a population of 2.3 million, Houston is the largest city in Texas and the fourth-largest in the U.S. The greater Houston metropolitan area is home to 7.3 million people and could grow to more than 8 million by 2028, according to a recent study by real estate consultant Site Selection Group.

Houston is also one of the busiest port cities in the country. The 52-mile Houston Ship Channel comprises more than 200 private and eight public terminals, collectively known as Port Houston.

The port and ship channel helps create about 1.5 million jobs throughout the state and generates about $439 billion in statewide economic impact annually, according to a study by Port Houston.

Port Houston ranked as the fifth-largest U.S. container port by total twenty-foot equivalent units in 2022, at 3.9 million TEUs. Total tonnage last year was up 22% year over year (y/y) compared to 2021, reaching 55 million short tons, a new record, according to the port.

Over the past several years, supply chain diversification across the U.S. has helped Port Houston increase its market share of container traffic, as well as imports and exports of products such as steel and resins.

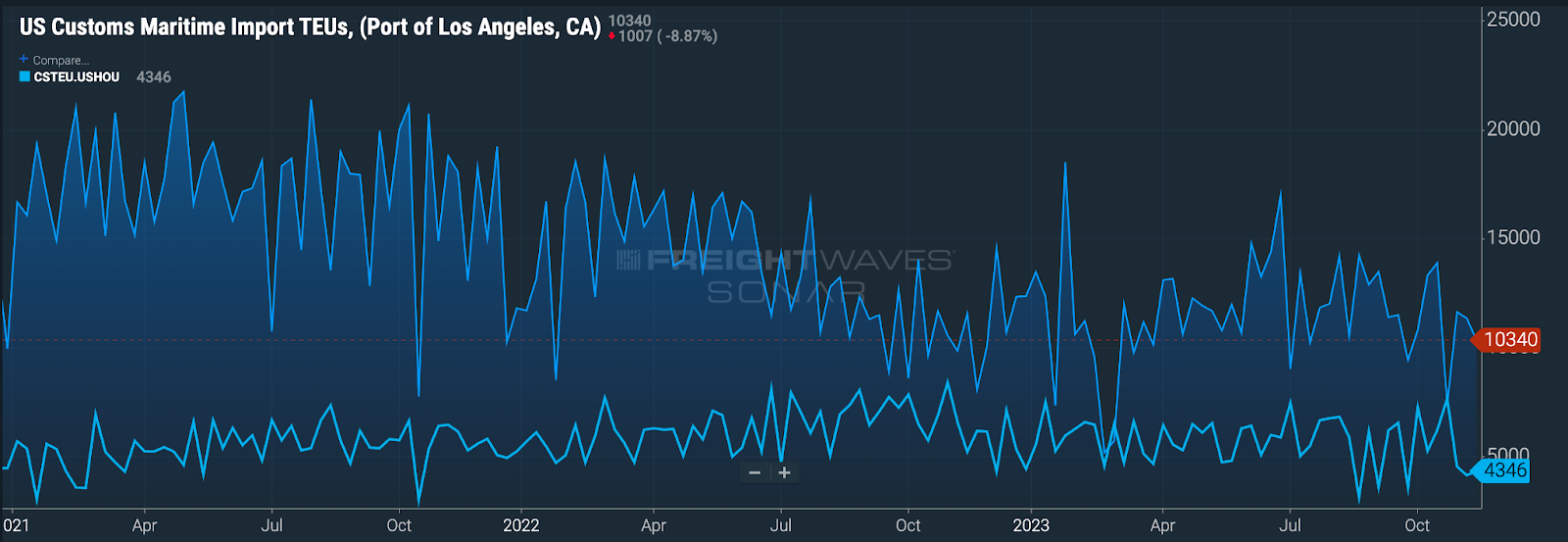

Customs data from FreightWaves’ SONAR platform shows that Port Houston’s inbound container volumes have increased steadily since 2019 but rose and declined sharply in September and October, falling 8% y/y in September to 325,588 TEUs. While freight traffic has remained steady for most of the year, it is down compared to the record results of 2022, Roger Guenther, the port’s executive director, said at a recent commission meeting.

Trucking company has concerns about route plan

Jefferson Walker, operations manager at Houston-based carrier J.H. Walker Trucking, expressed disappointment and concern about the proposed truck route plan.

“We as a carrier are frustrated by the idea of restricting our ability to move and operate around the city of Houston,” Walker told FreightWaves. “We do not feel it is necessary as it will only be used as a way to ticket us and impede our ability to operate and do business around the city.”

J.H. Walker Trucking has operated in Houston as an expedited oilfield transportation provider for over 30 years. The carrier utilizes everything from pickup trucks to cargo vans to 48-foot flatbed tractor-trailers to transport goods.

Walker said his company operates over 200 trucks, delivering 700 to 800 average loads per day. He worries how the plan could affect business.

“They presented their plan to us as a way to reduce both noise pollution and wear and tear on city streets for its residents by setting dedicated lanes aside for our trucks to use,” Walker said. “The problem is, we operate deliveries around the city in everything from the size of a small sedan all the way up to a large tractor hauling 100,000-plus pounds.”

Walker said Houston’s size and lack of zoning also create logistical challenges for any trucking company.

“Houston is a city that has sprawled in every direction to cover 640 square miles and with no zoning, we have customers in every part of the city,” Walker said. “The reality is, we are not choosing to take city streets just to add mileage to our trucks or because we believe them to be faster or more efficient. Streets are often much slower and more dangerous to maneuver in a large truck. The only reason that we are using the streets is because we are en route to or from a shipper/consignee for a load.”

Walker also said it’s unfair to restrict the movement of commercial vehicles throughout the city when trucking companies have to pay taxes that go toward road infrastructure.

“Our roads and infrastructure are primarily funded with revenue from the fuel tax, and a typical five-axle truck pays $4,454 in annual diesel and heavy vehicle use taxes alone, which is almost 50 times more than what an average car pays,” Walker said. “We are more than happy to pay this usage tax as a consumer because we are paying to maintain and improve the streets that we rely on to operate. However, when you still collect this money but then no longer allow us to use these roads, we feel we are now being unfairly taxed.”

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

10 Roads Express lays off 66 workers in Texas

T law

How about all trucks stay away from Houston and then the people starve, you need us whether you like us or not, personally I hate going there, my 1st trip there was in ’83, and they are still working on the same highways

Mark

In an unzoned city like Houston, trucks need access to many off-the-beaten-path roads.

In theory and dreamland this would work. But in reality……try again.

Edward Roberts

Could they please mail a map of the truck routes to ALL truck drivers in this country and every single other country that sends Bodies to drive trucks? Laminated. Also, could they please put the “no truck” signs up before the turn and not a half mile after you make the turn? That would be great.

Oh, if you could get them to read these comments that would be great. (sarcasm). But seriously. This is a great plan and should be easily implemented. Maybe even by the first of the year.

RedElephant

I live in H town…. While i do not support this i can say that if they wanted this then they should of had planned new warehouses where a milion new class B trucks would pick up the load and redistribute it thru the houston. It can be done

Southpaw

I chuckle as I read this. I feel for the businesses in Houston, because there will a price to pay for this nonsense, and I have to call it nonsense, because this is the typical thought process of an overeducated ideologist. As Stephen W said, this utopian theology has been tried before, and not just north of the boarder.

Perhaps our esteemed institutions of higher indoctrination should consider a course on Unintended Consequences. SMH

T. Johnston

I can easily see this driving up costs not only for the carriers but also small (and some not so small) businesses that may be located on the more minor streets and residential fringe areas that would have to come up with other ways of getting their goods delivered.

Stephen webster

If Houston is going to restrict truck it needs to build 3000 large semi truck parking spots plus 700 dropped trailer spots that have access to 24 hr public transit and medical clinic in the middle of this truck parking area with non profit housing and a co op hotel and short term housing otherwise this will result in more truck drivers getting other jobs like in ont Canada when Toronto and Hamilton tried to restrict truck drivers