Smart labels are one of those buzzy technology terms that have a lot of meanings. The ones logistics giant Kuehne+Nagel are rolling out with Chorus — one of Alphabet’s X moonshot factory entities — address questions some might not even think to ask.

More than RFID

It’s one thing to know through a radio frequency ID tag – wireless communication incorporating electromagnetic or electrostatic coupling – where a particular parcel is located and maybe even some details about its condition. But Swiss transport giant Kuehne+Nagel is taking it to the next level with what it calls Max Visibility. Machine learning predicts what might befall a package. Bluetooth connectivity – think Apple AirTags – collects sensor data and stores it via on-demand Cloud computing.

“The label is fully embedded into the day-to-day logistic operation,” Alireza Nemati, K+N global head of road innovation, told me.

Tracking applies at the pallet or carton level or – if critical enough – an individual item. Everyday commodities don’t need smart labels. An automotive prototype qualifies as a sensitive shipment. So does an elevator for a construction site where continuing work on a building depends on vertical movement.

“It’s only for critical shipments,” Nemati said. “I don’t think someone will use this technology for shipping toilet paper unless there is another Covid [pandemic] and there’s a shortage.”

Reading is fundamental

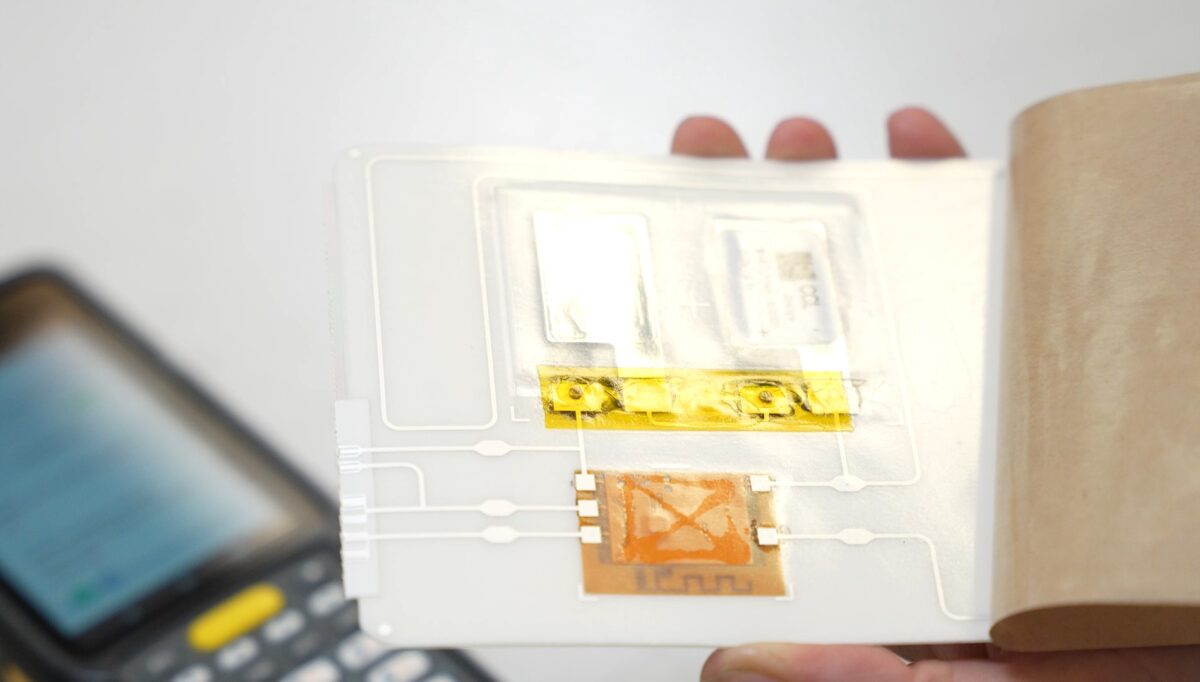

K+N and Chorus started with a suite of sensors that resembles an iPhone without a screen. The label looks normal enough but contains a battery, temperature sensors and location/GPS sensors.

Next, K+N and Chorus approached access points like Cisco and Extreme Networks to open their Bluetooth interfaces. They have started to connect handheld devices like scanners and Android mobile devices and plan to add Windows-based personal computers.

“Once you consolidate all that together, you have a very good footprint on the reader network,” Nemati said. “And if all that doesn’t work, we have a dedicated device that we can attach to a pallet that can become sort of the reader of all these labels.”

Winning shippers to Max Visibility took work. Many blanched at the capital and operational expense of adding three seconds of scanning time to every parcel. The agnostic labels addressed that.

Winning shippers to Max Visibility took work. Many blanched at the capital and operational expense of adding three seconds of scanning time to every parcel. The agnostic labels addressed that. K+N is trying to grow its roster of more than 30 cargo airlines that accept the labels.

No more guessing on delivery times

The labels essentially are a notification engine that informs the right people at the right time. For example, retail employees no longer have to accept a two-or-four-hour window for deliveries. K+N demonstrated this for shoe store deliveries in Europe, pointing to downstream financial savings.

“Based on their preferences, we can say if a shipment is 30 minutes out, we send a notification to the employee that it’s about to arrive,” Nemati said. “That’s the exact timestamp of arrival, and the operations and the employee can be ready for the shipment.”

Cargo theft

Other savings are possible. An insurer typically pays for the value of a hijacked shipment, but not for missed Black Friday sales or other revenue-generating add-ons.

Cutting or tampering with a smart label prompts an emergency signal. Knowing of a breech isn’t all that helpful by itself. K+N and Chorus work with third-parties like supply chain risk management company Overhaul to recover stolen goods.

“We want to make sure the entire journey is safe,” Nemati said. “If a driver parks in an unsecured parking lot we will send a notification out before he even approaches it. With the label we can exactly say where the goods are if someone is tampering with them. If a breach happens, we send that information to a third party and that third party helps recover the goods.”

Crossing borders

K+N has conducted multiple successful tests of Max Vsibility in Europe and North America.

Mexico is a focus because of the rise in nearshoring, which uses employees from a neighboring country to complete services such as cross docking – consolidating shipments from various consignees on a single dock before shipping. A cross-docked box with a smart label needs no further scanning on its journey.

K+N already offers Advanced Visibility, a step below Max Visibility that relies on vehicle-based telematics instead of the smart labels.

“That becomes extremely complex because you don’t know who the next driver is and what telematics they’re using,” Nemati said. Transport management systems typically don’t talk to each other, especially at the border where a Mexican tractor is required to be swapped for a U.S. tractor to enter the country.

“The second you hand it over to the other side, it’s a [communications] black hole,” Nemati said. “They don’t know what happened before.”

Workhorse wins EV contracts, but cash dips to $3.2M

Workhorse Group has made some significant positive moves, delivering 15 battery-powered Class 5 electric step vans to FedEx and being added to the catalog of General Services Administration-approved electric trucks.

But the financially struggling company is cutting every cost it can – including half its 105-member work force in Union City, Indiana – to fulfill the orders it has booked.

It costs more to make a W56 step van than Workhorse can charge for one. Company shares, despite a 1:20 reverse split in June to artificially prop up the price, hover dangerously close to Nasdaq delisting territory. The exchange requires a $1 minimum bid price. Workhorse (NASDAQ: WKHS) closed at 96 cents a share Thursday.

Uncertainty surrounding federal support for electric vehicles is another headwind, though incentives in California, New York and a few other states are probably safe for the near term. They are critical to reducing the acquisition cost, helping make the step vans financially competitive with gasoline and diesel models.

Workhorse had just $3.2 million in cash and was owed $3.7 million at the end of the third quarter. It has access to $100 million in high-priced loans.

Briefly noted …

YMX Logistics will deploy 20 Orange EV electric yard tractors at distribution and manufacturing sites across North America.

Daimler Truck North America will tap into Plug and Play’s network of startups and emerging technologies to help its truck and financial businesses.

Nikola has recalled 72 battery-electric trucks that it recently returned to customers from an earlier recall following a few battery fires. The truck’s instrument cluster display goes black and must be replaced.

That’s it for this week. Thanks for reading. Click here to subscribe and get Truck Tech delivered to your email on Fridays. And catch the latest episodes of the Truck Tech podcast and video shorts on the FreightWaves YouTube channel. Send your feedback on Truck Tech to Alan Adler at aadler@firecrown.com.