Seven months ago, Maersk CEO Soren Skou touted Q4 2020 as “the best quarter ever.” Announcing the initial outlook for this year on Feb. 10, he said the best-case scenario “would basically mean for us to do four times what we did in the fourth quarter.”

That outlook has long since been left in the dust. On Thursday, Maersk revised its numbers skyward yet again.

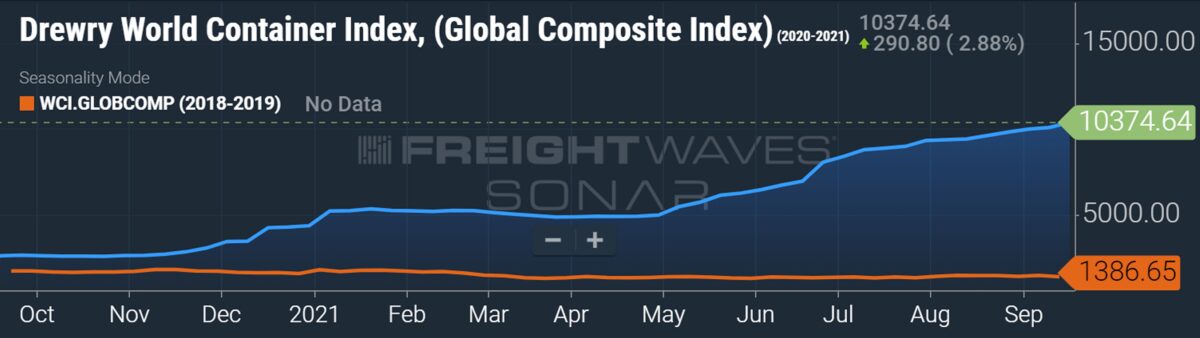

The second half is now looking even more profitable for ocean carriers — and more ominous for cargo shippers — than the first. But the second half may not be the peak: A new forecast from Deutsche Bank argues that container shipping has entered a “super cycle” and ocean carriers will actually rake in more money in 2022 than they will this year.

According to Stifel analyst Ben Nolan, “Container craziness should abate, although we expect not until sometime later next year or perhaps even in 2023.”

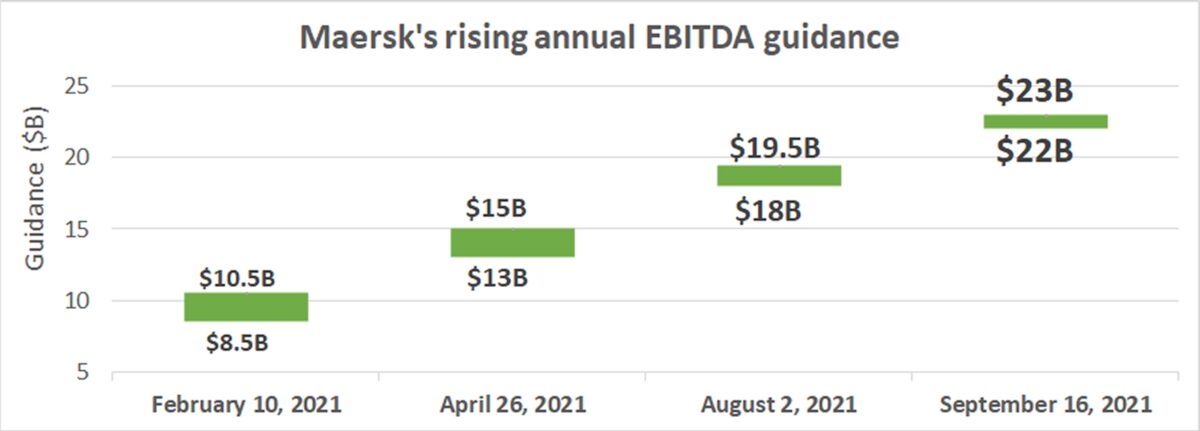

Maersk upgrades guidance — again

In February, Maersk announced full-year guidance for earnings before interest, taxes, depreciation and amortization of $8.5 billion-$10.5 billion. The high end of the range was roughly quadruple Q4 2020 EBITDA of $2.7 billion.

After the first quarter came in better than the fourth, Maersk upgraded its 2021 guidance to $13 billion-$15 billion. By early August, it was clear that the third quarter would be better than the second, thus another upgrade, to $18 billion-$19.5 billion.

Maersk said Thursday that it expects 2021 EBITDA of $22 billion-$23 billion. The new midpoint is 137% higher than the February midpoint.

Maersk’s first-half EBITDA was $9.1 billion. It now predicts substantially higher earnings in the second half: $12.9 billion-$13.9 billion.

Clarksons Platou Securities analyst Frode Mørkedal pointed out that Maersk is expecting $7 billion in EBITDA in the third quarter and close to that — up to $6.9 billion — in the fourth. “In other words, Maersk now signals that there could be no normalization in rates this year,” he said.

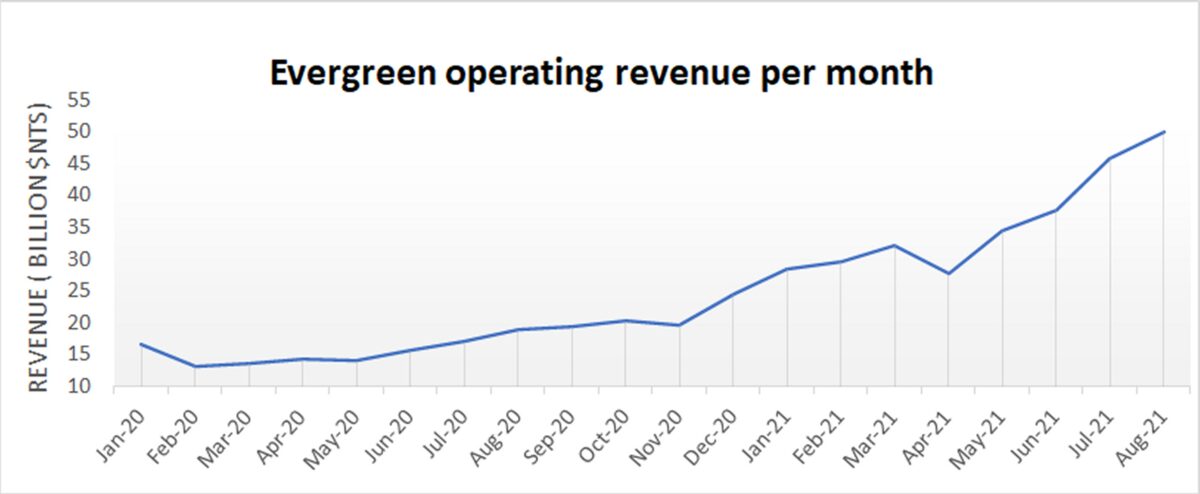

Record monthly revenues for Evergreen

Another signal on second-half strength comes from Taiwan-based ocean carrier Evergreen, which publicly reports monthly operating revenues.

Evergreen’s operating revenues hit all-time highs during the past two months: 45.88 billion New Taiwan dollars (NT$), the equivalent of $1.65 billion, in July, and NT$50.02 billion last month ($1.8 billion).

Evergreen took in almost as much in the first two months of the third quarter as it did in the entire second quarter.

Deutsche Bank makes ‘super cycle’ call

On Monday, Deutsche Bank analyst Andy Chu published an exceptionally bullish report on container shipping.

“We are moving to the view that earnings will peak in 2022, not this year,” wrote Chu. “We feel that there is a material positive surprise to 2022 and 2023 forecasts [for carriers] that is yet to be factored into consensus forecasts.”

In May, Chu had expected that “supply chain disruption and port disruption trends would begin to improve … which would drive down spot rates.”

“However, since that time, what has become apparent to us is that not only do we now see container demand being stronger for a longer period of time, but the supply chain issues and port congestion issues are deteriorating and not improving,” said Chu. “Given the high amount of port congestion and lingering nature of COVID-19, we think that these issues will not be quickly resolved.”

Deutsche Bank hiked its 2021 EBITDA outlook for Maersk to $22.18 billion (prior to the carrier’s latest upward revision) and now believes Maersk will make even more money next year: $23.77 billion.

Deutsche Bank sees the same pattern of rising profits for Germany’s Hapag-Lloyd, which has an internal outlook (as of late July) for 2021 EBITDA of $9.2 billion-$11.2 billion. It forecasts Hapag-Lloyd will earn $11.54 billion this year and even more — $11.88 billion — next year.

Click for more articles by Greg Miller

Related articles:

- Record shattered: 61 container ships stuck waiting off California

- Supply chain ‘anarchy’ is gold mine for ocean carriers like ZIM

- Inside container shipping’s COVID-era money-printing machine

- Shipping lines come out swinging in high-profile profiteering case

- Global demand isn’t booming. So why are shipping rates this high?

- Maersk posts blockbuster Q2 results — and Q3 looks even better