This story originally appeared on flyingmag.com.

The suburbs of Dallas are buzzing.

About 210,000 now live in Frisco, to the northwest of the fast-growing Dallas-Fort Worth metroplex. But that’s not the buzzing I’m referring to, because accompanying that influx of residents are the first flights of a new technology: drones.

I spent last week in Dallas covering UP.Summit, an annual, invite-only gathering of some of the biggest movers and shakers in the transportation world. Among the attendees were senior U.S. defense officials, state and federal lawmakers, former presidents and prime ministers, and executives from some of the top firms in the industry.

Adam Woodworth, CEO of Wing, fell into the latter group. At UP.Summit, Woodworth detailed the next phase of the company, which is owned by Google parent Alphabet. A large part of that road map relies on Dallas, where Wing last month launched drone delivery out of a Walmart Supercenter in Frisco. It plans to add a second store in the coming months.

A Wing spokesperson gave me an inside look at the company’s newest operation, complete with a simulated delivery to show how its drones take off, navigate, deliver and return to the Supercenter — all on their own. Read on to see exactly how Wing delivers, hear Woodworth’s vision for drone delivery and get an outlook on the service as it starts to hit the U.S. market.

The setup

After listening to Woodworth speak, I hopped in an Uber and headed to Frisco, where I met a Wing spokesperson in front of the Walmart Supercenter at 8555 Preston Road. I didn’t see the operation at first. But upon closer inspection, I came across a small, fenced-in area in the parking lot. It took up just two rows of parking spaces and was about the size of a tennis court.

The spokesperson emphasized Wing’s ability to fit into Walmart’s framework seamlessly. After all, the largest retailer in the world needs the parking space for customers, and its associates don’t necessarily have the bandwidth to run a drone delivery operation.

So, Wing keeps things compact and asset-light. Its store-to-door model, first launched in Australia’s Gold Coast region with grocer Coles, allows it to set up operations in the nooks and crannies of brick-and-mortar stores: in parking lots, on roofs or in unused space nearby. Meanwhile, all Walmart workers need to do is bring orders to the fenced-in service area.

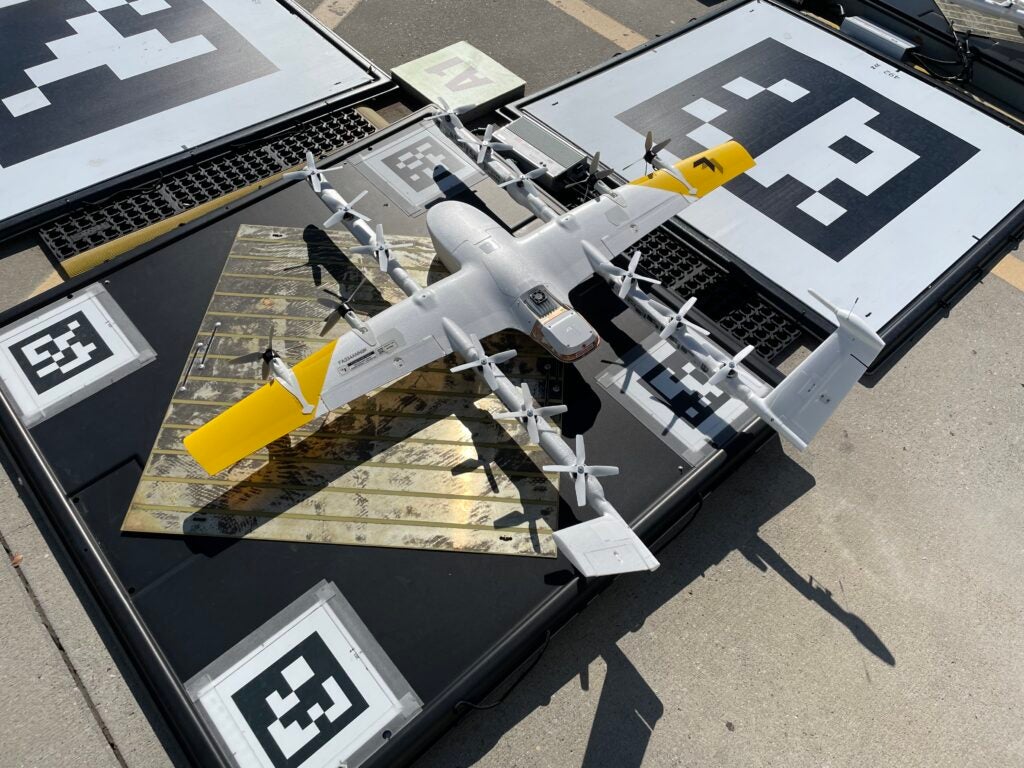

I arrived at the Frisco Supercenter just minutes before operations began at 10:30 a.m. CDT. A handful of employees were present. But they had little to do as 18 Wing drones charged on launchpads, performing routine maintenance checks on their own.

Even as orders started to come in, staffers — about five of whom were present at any given time — mostly just sat back and watched the drones do their thing.

An automated flight planning and uncrewed traffic management (UTM) system charted the path of each suitcase-sized aircraft, accounting for factors such as weather, time of day and the presence of other objects in the airspace. The system also flags issues as they arise and responds to them as needed (such as by grounding a drone assessed to be unfit for operations, for example).

Ground support operators were on-site, as is the case at other Wing locations. Their job is simple: When a drone encounters an issue, it tells them exactly what the problem is and where it’s located and the staffer makes what is usually an easy fix. For more complex repairs, drones are set aside to be shipped to a dedicated facility. But there were no hiccups when I was present.

While there was also a pilot at the Frisco site, he was only there for me. The flights I witnessed were actually overseen from a Remote Operations Center in another Dallas suburb, Coppell, about an hour’s drive away.

That facility and another near Wing’s Palo Alto, California, headquarters control the company’s operations nationwide, including its service in Christiansburg, Virginia. Pilots at these centers are akin to air traffic controllers, watching dots on a screen.

All of that automation and remote oversight left Walmart associates with a simple task: Bring orders out to the drones. From there, a Wing order loader attached the payload to the drone’s tether, using a tablet to match it to the right aircraft.

Soon, staffers will have even less to do. Wing recently introduced the AutoLoader, a new piece of tech that will allow workers to leave containers out for the drones to pick up themselves. The company demonstrated the concept at UP.Summit, likening it to curbside pickup.

How it’s delivered

The Wing spokesperson simulated a delivery so that I — and now you — could see the whole process in action.

The order (a water bottle) was sent to the order loader, who waited for the drone to rise and release its tether before attaching a small, Walmart-branded container. Then the aircraft ascended and zipped off to its destination, a nearby staging area.

Initially, the buzzing was pretty loud. But it quickly faded into the background as the drone reached cruising altitude, making it difficult to hear unless you were listening for it.

In the air, it cruised at 65 mph (56 knots) at roughly 200 feet, beyond the visual line of sight (BVLOS) of the ground crew. Because flights are preplanned, the drone accounted for how conditions such as wind would affect its battery. Still, onboard sensors kept an eye out for any unexpected changes, and the spokesperson said the drone could continue flying in moderate rain or even snow.

As we walked to the staging area, a countdown timer on the Wing app gave us an ETA. The spokesperson assured me this was exact, since the entire route was planned in advance. Sure enough, like clockwork, the drone emerged on the horizon on schedule, descending to about 25 feet before lowering the order to the ground with its tether. If pulled, the tether and payload would release and the aircraft would return to the parking lot.

Finally, water bottle in hand, I walked with the spokesperson back to the staging area, where the drone returned to the landing pad just six minutes after the order was initially placed. That’s far less time than a delivery driver would need to complete the trip. While the service is still relatively small, Wing envisions those same benefits for retailers nationwide.

Wing is not winging it

Some drone delivery companies have struggled to garner customers due to overly ambitious plans, premature launches, or some combination of the two. Wing, with its deliberate approach, is not one of them.

In the 30 or so minutes I spent at the Frisco Supercenter, I saw at least 10 organic orders come in from customers. Residents within 6 miles of the store can pick from over 1,000 items (the most popular being rotisserie chicken), including fragile items like eggs, since the container locks into place in the air to prevent swaying. Frozen foods such as ice cream are also on the menu, even in Texas, because delivery times can be as fast as three minutes.

The store — combined with another, unnamed Supercenter that will begin service later this year — is expected to serve about 60,000 households. And customers have been clamoring for Wing to add even more coverage in the region, according to the spokesperson.

But Dallas is just the tip of the iceberg. Wing so far has completed more than 350,000 deliveries, with the vast majority happening outside the U.S.

The company got its start in Canberra, Australia, in 2019, expanding to the suburb of Logan and adding service in Helsinki later that year. To date, Logan is the company’s largest service — on some days, it handles over 1,000 deliveries, or one every 25 seconds. Partnerships with restaurants such as KFC have given its Australia business a boost.

Recently, Wing expanded operations in Queensland with property development group Mirvac and on-demand delivery provider DoorDash, which has an integration with the company’s service. Instead of using the Wing app, Queensland customers simply place their orders on DoorDash and select the drone delivery option.

In the U.S., operations are less substantial. Wing began serving Christiansburg, Virginia, in 2019, where one couple has received more than 1,200 deliveries. Outside Christiansburg and Dallas, it’s largely been limited to testing and demonstrations: A delivery of Coors beer and peanuts to Coors Field in Denver, the drop-off of a ceremonial tee-off golf ball for the Sports Illustrated Invitational and some testing near its Palo Alto headquarters and Hillwood’s AllianceTexas.

Wing is also partnered with Walgreens to expand store-to-door service in the U.S. and is working with Hillwood to prepare a special delivery facility at Frisco Station, a mixed-use development not far from the Supercenter.

Speaking at UP.Summit, Woodworth was bullish on Wing’s domestic prospects. He emphasized a few tricks the company has up its sleeve, such as the Wing Delivery Network philosophy it revealed last year. The decentralized, automated system will share resources across each of the company’s service areas based on spikes and lulls in demand. That way, Wing can send capacity wherever it’s needed, allowing it to service larger, more populated areas.

Woodworth also highlighted Wing’s Aircraft Library team, which develops new drone configurations based on components the company already uses. The idea is to help meet the unique payload, range or other requirements of its customers. Then there’s the AutoLoader, which figures to make matters significantly easier for store associates.

Combined with a small ground footprint, high levels of automation and APIs (like the one for DoorDash) to integrate drone delivery directly into customers’ sales channels, Wing’s new tools should push it toward offering a service that’s fast, cheap and good — not just two of the three — as Woodworth put it.

Walmart will certainly hope that’s the case. The retailer is looking to jump-start its drone delivery business, which it said has completed just 10,000 deliveries over the past two years. That’s despite operating a total of 36 hubs across seven states in partnership with DroneUp, Flytrex and Zipline, the industry leader in terms of sheer volume with 700,000 deliveries and counting.

According to McKinsey, Zipline and Wing are not the only key players in the space. It said more than 10 drone operators made at least 5,000 commercial deliveries in 2022, delivering nearly 875,000 packages (an 80% increase over 2021). And with 500,000 deliveries completed through the end of June, the company forecasts over 1 million by year’s end.

The majority of these are health care deliveries centered in Africa and the Asia-Pacific region, largely owing to Zipline’s dominance. But per data from McKinsey, North American market share is on the rise this year, while the European market is fading.

The North American market would get a lift from more clarity on BVLOS operations. An FAA committee began developing regulations in 2021, but there is still no final rule in sight. That could change with the passage of the House FAA Reauthorization Act, which calls on the agency to produce a BVLOS Notice of Proposed Rulemaking within four months of its effective date.

As things stand, Wing operates BVLOS under a Part 135 certificate, becoming the first drone delivery firm to obtain one in 2019. But the process is often expensive and lengthy, with Zipline, Amazon, UPS Flight Forward and Flytrex partner Causey Aviation Unmanned holding the only other approvals.

The cheaper, shorter alternative is a waiver to section 91.113(b), which the FAA awards intermittently. Recently, Zipline, UPS and a few other firms successfully took this route.

But a final BVLOS rule would allow Wing and others to scale, expanding current service areas and adding new ones in places spread out, hard to reach or obstructed by obstacles (such as tall buildings). It could also reduce costs by allowing drone firms to assign a single pilot to multiple aircraft, as Wing does, and offer customers a simpler path to sustainable operations as executives focus increasingly on ESG initiatives.