COVID-driven cargo demand has dramatically altered the trans-Pacific shipping landscape. New data from Alphaliner highlights just how much the Asia-U.S. trade lane has changed over the past two years.

There’s now far more container shipping capacity in the trade than pre-pandemic. Capacity keeps rising, with more new shipping services focusing on the Asia-East Coast lane than Asia-West Coast.

Carrier competition is up, with more players overall and a lower share controlled by the three giant global alliances. The trans-Pacific liner leaderboard is different as COVID-era demand trends spur new deployment strategies.

New trans-Pacific liner leaderboard

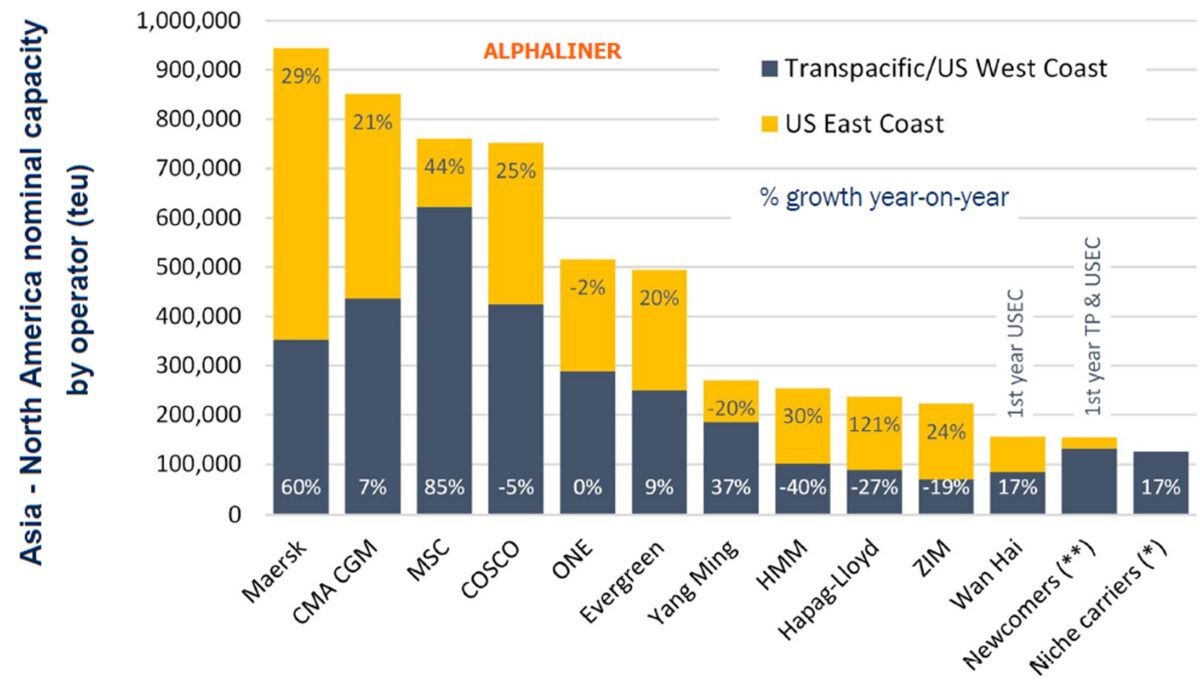

The trans-Pacific’s top five liners by capacity are Maersk, CMA CGM, MSC, Cosco and ONE, according to Alphaliner.

Back in mid-2020, as the U.S. was coming out of initial COVID lockdowns, Cosco was the trans-Pacific leader by far. Maersk was a distant fourth at that time, with almost 30% less capacity than Cosco. MSC, the No. 3 carrier in the trans-Pacific today, was No. 6 two years ago.

“MSC and Maersk were by far the fastest-growing carriers in the trade,” said Alphaliner.

It calculated that overall trans-Pacific capacity is up 24% year on year, now comprising 702 container ships with a total capacity of 5.75 million twenty-foot equivalent units. That annual growth rate mirrors a 24.7% increase between April 2020 and April 2021.

Alphaliner’s data confirms the coastal switch reported by others. Asia-East Coast capacity is up 28.1% compared to last April, outpacing Asia-West Coast growth of 20.5%.

Alliances’ trans-Pacific market share falls

There’s heightened political focus this year on container shipping antitrust protections in general and the role of alliances in particular (even though individual carrier members of alliances price their freight separately).

Alphaliner’s data shows that the alliances’ share of the trans-Pacific total is actually falling — a trend that should play well for ocean carriers in congressional hearings.

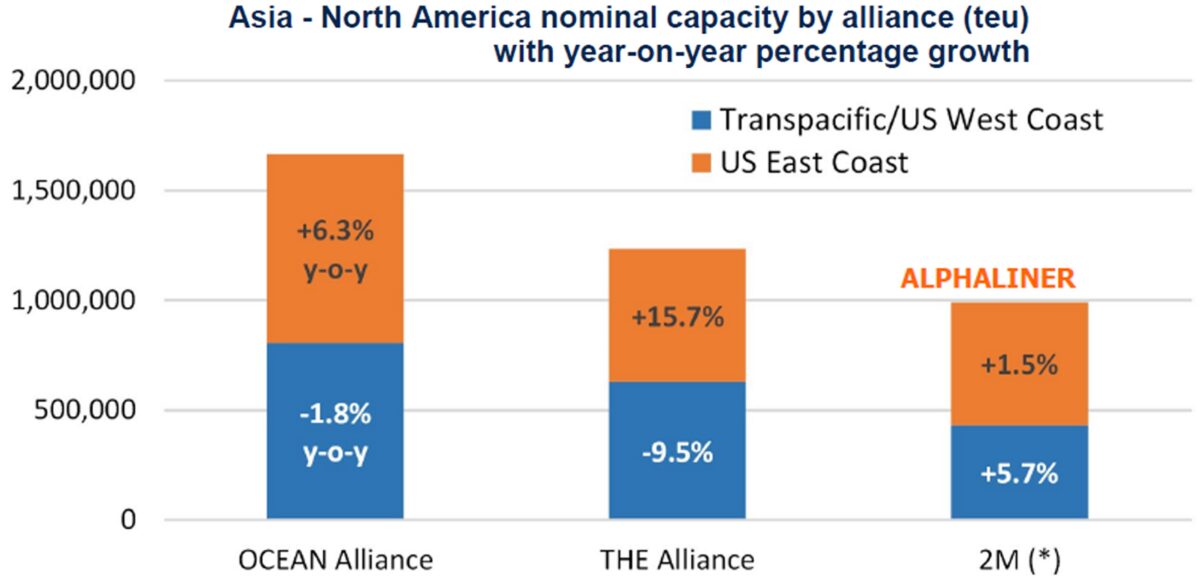

In mid-2020, the three alliances — 2M (Maersk, MSC), Ocean Alliance (Cosco, CMA CGM, Evergreen, OOCL) and THE Alliance (Hapag-Lloyd, ONE, Yang Ming, HMM) — controlled 89% of trans-Pacific capacity. The Ocean Alliance had 39%, THE Alliance 30%, 2M 20%.

At this time last year, the alliances’ share had edged down to 82.2%, according to Alphaliner. Since then, their share has sunk to 67.7%.

Alliances are still growing trans-Pacific capacity on a nominal basis but at a more moderate pace than the overall market, causing their share to decline.

Maersk and MSC are focusing on growing trans-Pacific capacity that’s not covered under their 2M alliance structure, “launching numerous standalone loops which remain outside the scope of their 2M agreement,” said Alphaliner.

Meanwhile, non-alliance carriers are growing their market shares, including Wan Hai, which entered the Asia-East Coast trade, and Asia-West Coast newcomers such as CU Lines, BAL and Transfar.

2022 freight rates on track to top 2021

The COVID era’s transformative effect on trans-Pacific freight pricing is not over yet. This year is still on track to top 2021 in terms of freight pricing.

The rise of Maersk’s trans-Pacific market share implies an increase in long-term contracts as opposed to spot deals for larger U.S. cargo shippers. Maersk has been the most aggressive proponent of contracts — including multiyear contracts — at the expense of spot business.

Asia-U.S. annual contract rates are widely expected to be much higher in 2022 than 2021. Xeneta’s U.S. import index was up 99% year on year as of last month. Gary Friedman, CEO of Restoration Hardware (NYSE: RH), said on his latest quarterly call that RH’s contract rates for 2022 rose even more than they did last year. And last year, his company’s contract rates doubled.

In the spot market, some indexes show a moderation in rates, but to levels that are still well above where they were last year and far above pre-COVID numbers.

Drewry’s Shanghai-Los Angeles assessment was $8,782 per forty-foot equivalent unit last week (excluding premiums), the lowest it has been since early July 2021 and down 14% from rates at the end of last year. That’s the good news for shippers. The bad news is this is up 112% year on year and over triple pre-COVID levels.

For trans-Pacific freight rates across full-year 2022 to decline compared to full-year 2021, spot rates would have to collapse to less than half their current levels soon and remain severely depressed for the rest of this year. Spot declines would have to be extreme enough to offset the higher contract rates that leading carriers like Maersk have already negotiated.

Click for more articles by Greg Miller

Related articles:

- As transport stocks sink, Los Angeles port volumes soar

- Container shipping at the crossroads: The big unwind or party on?

- Retail boss warns on supply chain, likens demand risk to ‘Big Short’

- East Coast ports about to get slammed by a lot more ships

- Is this the calm before California ports’ next cargo storm?

- Supply chain whack-a-mole: West Coast eases, East Coast worsens

- What COVID spike, massive lockdowns mean to shipping

- Different container indexes, vastly different rates. Which is right?