No one evokes images of the 1937 Hindenburg airship disaster when talking about diesel or gasoline. Yet without handling precautions, both can be flammable like hydrogen.

“If you talk to some of the folks that have been in the industry for a while, or people that really understand the physics behind hydrogen, those folks realize it’s just another fuel source,” said Charles Shappell, engineering director for Faurecia Hydrogen Solutions (FHS), told me. “It’s no more or less dangerous. It’s just a little different in how you have to handle it.”

I recently visited with Shappell at FHS’ facility in Farmington Hills, Michigan, curious about its manufacturing of hydrogen tanks.

As greater acceptance and early adoption of heavy-duty hydrogen-powered fuel cell trucks grows, the safety question is front and center. Shappell enters those conversations prepared.

“I give a little bit of a safety talk anytime I [meet] somebody who doesn’t have that experience. What’s in their mind is the Hindenburg and this great explosion. But in fact, what you had there was kind of the perfect combination of hydrogen and atmospheric oxygen and a flammable shell around the thing that created the conditions for that to happen.”

In the real world, such an explosion is highly unlikely.

“It’s very, very difficult to get hydrogen to combust because it’s so reactive. If we have a leak, it very, very rapidly dissipates into the atmosphere, combining with water vapor or combining with the oxygen to become water vapor,” Shappell said. “For a very, very brief amount of time, you can potentially have the right mixture of hydrogen and oxygen to create an explosion.”

Weapon-tested tanks

Hydrogen tanks must meet a global technical regulation covering on-road use. Part of that includes withstanding a ballistics test. A 30-caliber bullet, common to sniper rifles, is the ordnance of choice.

“You do have to actually shoot the tank with a projectile,” Shappell said.” Typically, it’s just one hit on the tank. And then you have to go back through your cycling testing to make sure you can live through that.”

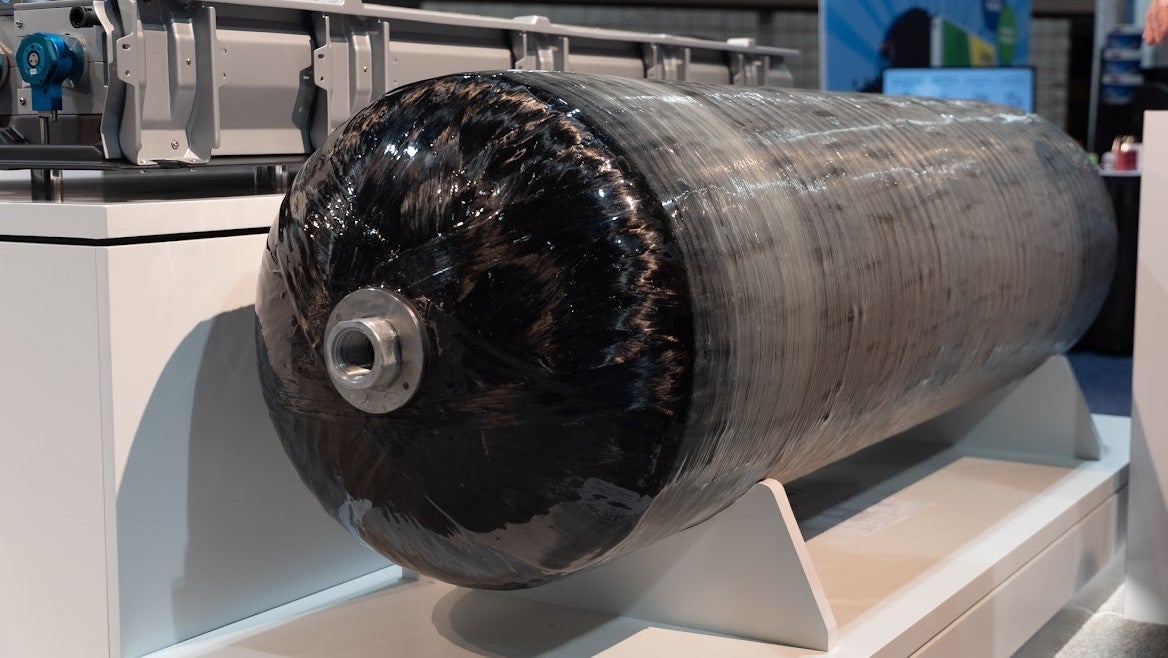

An up-close examination of a hydrogen tank gives the impression of a shrink-wrapped metal canister . The bigger the canister, the bigger the hydrogen fueling system. The wrapping has evolved over time so less very expensive carbon fiber is used than in previous years.

“When you look at the tanks from a generation ago, typically they are a lot thicker. Now we use analysis tools to define the best configuration for the winding itself before we even build any tanks. One of the big focuses for us is to ensure this technology is as cost-effective as it can possibly be so that it’s a viable competitor to diesel.”

Scaling the business

Five years ago, high-pressure hydrogen tanks were a low-volume exercise not far from laboratory testing. Just hundreds and thousands were produced a year.

“What we’re doing is scaling that technology [with] our vast amount of manufacturing experience and putting together our plan to make these in the hundreds of thousands, which really helps us reduce the costs,” Shappell said. Early customers include Hyundai Motor Corp., which will begin importing its Xcient fuel cell from South Korea in the third quarter.

The hydrogen storage tank market is geographically divided but North America is expected to lead in coming years because of rising investments by the Department of Energy. Faurecia competitors include Worthington Industries, Air Liquide, Hexagon Purus and Linde, among others.

“The level of interest among OEMs has increased significantly, especially due to the incentives that are part of the IRA [Inflation Reduction Act],” Shappell said. “A lot of the OEMs that were on the fence, in terms of where technology was going and what the fit for the fuel cell vehicles was, have become more aggressive at pursuing fuel cell as a part of that mix.”

Hydrogen more than truck fuel

As discussed here two weeks ago, the coming of higher-power battery charging could push hydrogen fuel cells off the table before they arrive in meaningful numbers.

“My philosophy about hydrogen is much broader than fueling a truck,” said Randal Kaufman, sales director at energy consultant Black & Veatch. Even a megawatt charger is only a receptacle for the electricity it would dispense.

“If the utility says you can’t have power for five years, then what are you going to do? With hydrogen, it’s not just trucks we’re talking about. We’re talking about aviation, maritime, trains. Batteries are really heavy. And there’s a trade-off on weight versus [freight] capacity.

“Right now, we are experiencing the most money, the most momentum and the most interest in hydrogen on a broad scale the world has ever seen,” Kaufman said. “If we truly want to have clean, resilient energy as part of our society, [hydrogen] should be considered.”

Navistar puts up strong mpg in SuperTruck 2 project

While we’re waiting for Navistar’s first Class 8 electric truck — a glimpse of a prototype was seen at the 2022 Advanced Clean Transportation Expo — the Traton Group subsidiary is boasting some impressive miles-per-gallon numbers from its SuperTruck 2 entry.

Hybridization and a 170% improvement in freight efficiency over its International SuperTruck I entry added up to 16 mpg. That’s unrealistic for a diesel truck today but a demonstration of what’s possible with dream big investment dollars.

The partnership with the Department of Energy also used technical approaches to weight reduction from rolling resistance technologies, aerodynamic improvements and powertrain technologies.

“The team concentrated its design on high-voltage electrification, utilizing hybrid technology on a path toward full electrification that has the potential to be commercialized in fully electric vehicles,” Russ Zukouski, Navistar chief engineer, global innovation and principal investigator for SuperTruck programs, said in a news release.

Briefly noted …

Departments of transportation in eight states are sharing funds and developing an online community for alignment and collaboration by stakeholders on autonomous vehicles.

Lightning eMotors has launched production of its next-generation ZEV4 work trucks based on a General Motors medium-duty platform built by Navistar. These follow the GM 4500HD-based school buses and shuttle vans.

Workhorse Group sold its first Horsefly delivery drones to Valqari, a Chicago-based smart mailbox company.

Nova Bus, a subsidiary of Volvo Group, is ending bus production in the U.S., with plans to close its Plattsburg, New York, manufacturing and delivery facility by 2025. The plant has 300 employees.

Ceva Logistics will test a heavy-duty hydrogen-powered fuel cell truck in a partnership with Toyota Motor Europe.

Thanks for reading. Click here to get Truck Tech via email on Fridays. And tune in to Truck Tech on FreightWavesTV on Wednesdays at 4 p.m. EDT.

Next week’s guest is Tim Reeser, CEO of Lightning eMotors, whose electrification niche is Class A school buses and airport shuttles. Like many transportation startups short of money, Lightning is hoping to raise new capital to help it remain independent.

The Truck Tech newsletter returns on July 7.

Bruderly David

Addison Bain, retired Hydrogen Manager at KSC, produced the definitive report on hydrogen safety wrt Hindenburg…