In its brief four-year history, Hyzon Motors has experienced far more stormy than sunny days. As it struggles to survive, the commercial fuel cell manufacturer is focusing on the U.S., where it sees hydrogen and zero-emission refuse trucks worth pursuing.

Chasing the SPAC money

A spinoff of Singapore-based Horizon Fuel Cell Technologies, Hyzon went public in July 2021 in a reverse merger with special purpose acquisition company Decarbonization Plus Acquisition Corp. It received $550 million in proceeds from the business combination, money long since spent.

Horizon sold a lot of fuel cells in China before standing up Hyzon in 2020. It took over General Motors’ former fuel cell research facility near Rochester, New York. Hyzon recently sold the location for $2.9 million.

The company chose the U.S. for the same reason that Willie Sutton robbed banks: It’s where the money was, former CEO Craig Knight told me during the height of the SPAC frenzy.

But building the business in the U.S. proved difficult. Those willing to try a retrofitted fuel cell truck didn’t want to pay for the privilege. So, Hyzon focused on the Netherlands, China, Australia and New Zealand, where companies at least made deposits for trials. Knight maintained in 2022 those markets were farther along than North America.

Hyzon exiting markets that keyed early success

On Monday, Hyzon said it is exiting Europe and Australia. It set aside $17 million to write down the value of equipment, cover other impairments and pay severance to an unknown number of employees. A company spokesperson declined to provide any details beyond what Hyzon reported in a news release and an 8-K filing with the Securities and Exchange Commission.

“This was a complex and difficult decision,” CEO Parker Meeks said in the news release. “Given the challenges of bringing new technology to market in an emerging industry, we believe we need to focus our efforts on the North American market and refuse industry as well as overseeing our large fleet trial programs which commence this summer.”

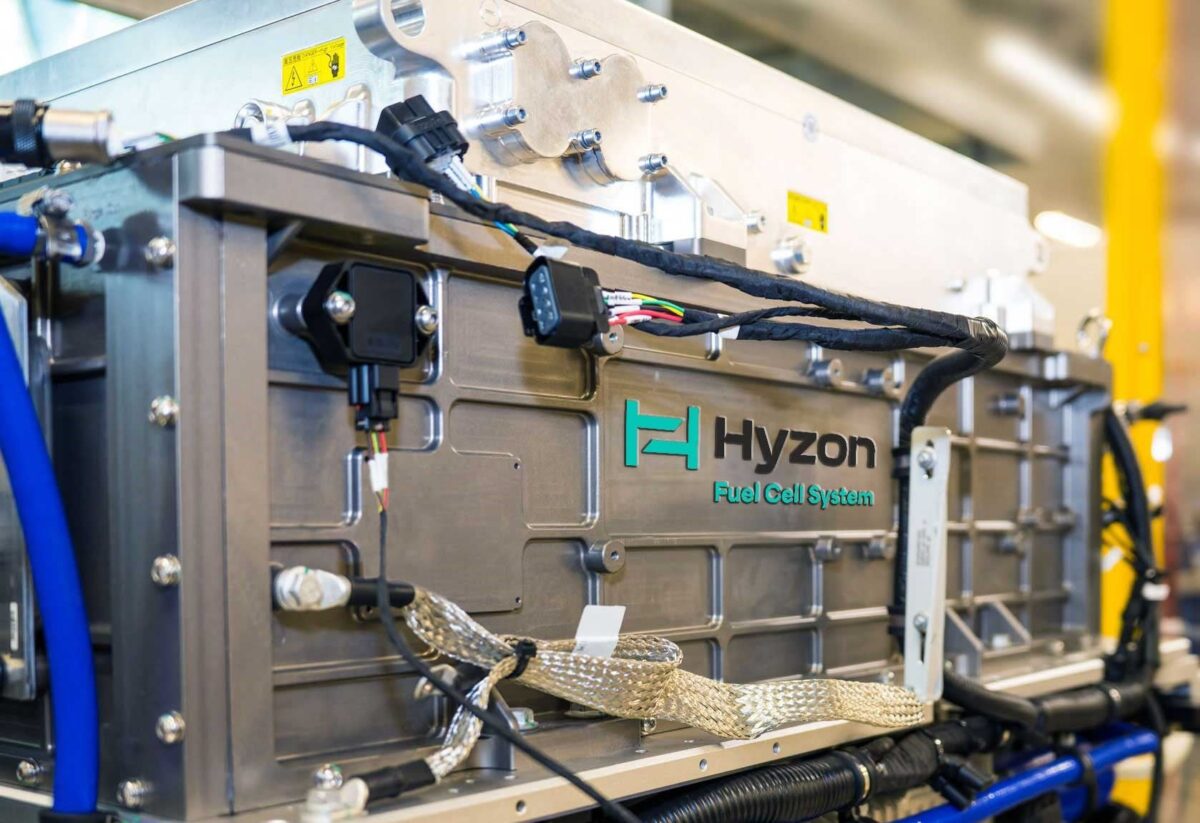

Hyzon’s focus is making fuel cells for upfitting conventional trucks and the refuse market in North America.

Government support for fuel cell-powered transportation in Europe and Australia has waned, according to Hyzon. It said many European countries have ended hydrogen subsidies. Hyzon units that make a cabover in Europe and a rigid platform in Australia are winding down. But Hyzon could return to those markets as a fuel cell supplier to OEMs.

Europe has ongoing hydrogen fuel cell activity. For example, Hylane in Germany rents fuel cell trucks, including Hyzon models and the Hyundai Xcient. The cellcentric joint venture of Daimler Truck and Volvo Group manufactures fuel cells for both companies. Production is planned in the second half of the decade.

The China problem

China, where Hyzon still has a presence, has proved difficult. Knight was fired as CEO in August 2022, and Hyzon co-founder and Chairman George Gu left his role after a short seller’s allegations that Hyzon fabricated fuel cell orders in China. That led to an SEC investigation. Hyzon agreed to pay the SEC $25 million over the phantom orders.

Knight paid a personal fine of $100,000 and returned a bonus as part of the SEC proceeding. The agency said he should have had a better handle on what was happening in China. Knight has since returned to Horizon as an adviser on a project to develop electrolyzers to make green hydrogen.

The SEC investigation pushed Hyzon to the brink in 2022. But under Meeks, a former McKinsey practice leader, Hyzon cleared up many of its financial messes, fought off a delisting by the Nasdaq and restructured the business.

“Historically before the restructure that we had kicked off with the leadership change, we were spending too much on the vehicle side,” Meeks told me in June 2023. “We were not [placing] enough focus on the fuel cell side. And we were doing way too many different vehicle variants in way too many different places.” At its peak, Hyzon had a portfolio of 20 vehicles.

No reverse stock split in sight

With the days of easy money over, the company has struggled to raise additional capital. Its stock price has languished below $1 a share since January. Hyzon again faces delisting from the Nasdaq as soon as July 22.

Hyzon applied July 5 to transfer from the Nasdaq’s highest-tier Global Select Market to the lowest-tier Capital Market, which has less stringent capitalization rules. That could help get an additional 180 days to get its stock price up. Hyzon’s cash and equivalents was about $82 million at the end of Q1. It will report Q2 results in early August.

Where numerous startups in similar situations have conducted reverse stock splits – swapping one new share for a multiple of existing shares to artificially raise their price above the Nasdaq threshold of $1 – Hyzon has not pursued such a move.

Though it ceded operational control as part of the SEC fallout, Horizon – which once had 60% of Hyzon’s equity – still has more than 40%. It sold more than 7 million shares between Feb. 5 and June 4, according to SEC filings.

For more than a year Hyzon has been open to being purchased. It has retained PJT Partners to help raise capital. If it cannot raise more money, Hyzon would consider additional layoffs and a possible bankruptcy reorganization.

A bigger stack

Under Meeks, Hyzon has delivered four retrofitted fuel cell-equipped trucks to Performance Food Group. The distributor and marketer of food and food-related products might come back for as many as 45 of Hyzon’s single-stack 200-kilowatt fuel cells if a demonstration proves out.

The 200-kW stack is unique compared to competitors like Bosch, cellcentric, Ballard and Cummins, which use multiple stacks to increase available power.

Meeks sees the refuse market, with its high-power needs and relatively short routes, as ideal for a fuel cell application. Hyzon announced a joint development agreement with New Way Trucks and unveiled the first hydrogen-powered refuse truck for the U.S. market at WasteExpo in May. It expects trials with major refuse collection fleets to begin this summer.

California spending port fine money on electric infrastructure

The ports of Long Beach and Los Angeles are beginning to spend money collected for containers hauled into and out of the ports by diesel-powered drayage trucks on heavy-duty electric truck charging infrastructure.

With a combined budget of $135 million, a group headed by the Mobile Source Air Pollution Reduction Review Committee will install 207 charging stations across eight locations. The ports of Los Angeles and Long Beach each committed $12.5 million.

“With more than 23,000 trucks working the harbor, the investment potential provided by the Clean Truck Fund rate is a key to our air quality efforts,” Port of Long Beach CEO Mario Cordero said in a statement.

The ports began charging $10 per twenty-foot equivalent unit and $20 per forty-foot equivalent unit under its Clean Truck Fund in April 2022. In November, each port contributed $30 million to the Hybrid and Zero Emission Truck and Bus Incentive Voucher Program to offset purchases of electric trucks.

Briefly noted …

Daimler Truck North America’s sales fell 5% in the second quarter compared to a year ago, but overall Daimler saw a 69% increase in electric trucks to 648.

Nikola’s recent 1:30 reverse stock split achieved its desired result. The electric truck maker and hydrogen distributor regained compliance with Nasdaq, ending a second threat of delisting.

The Scioto Post in Ohio reports Kenworth is laying off several hundred workers at its Chillicothe, Ohio, plant. A Kenworth spokesperson said the truck maker does not respond to speculation.

Volvo Group and Westport Fuel Systems are moving ahead with Westport’s High Pressure Direct Injection fuel system two-and-a-half years after Cummins chose not to pursue HPDI with Westport.

Cummins is receiving a $75 million Department of Energy grant – its largest individual award ever – to repurpose part of its engine plant in Columbus, Indiana, to make zero-emissions components and electric powertrain systems.

Truck Tech episode No. 73: Orange EV yard trucks proving ideal use case for electric trucks

Thinking about attending the Future of Freight festival in November? Here’s a discount offer to make your decision easy.

That’s it for this week. Thanks for reading and watching. Click here to subscribe and get Truck Tech delivered to your email on Fridays. And catch the latest episodes of the Truck Tech podcast and video shorts on the FreightWaves YouTube channel. Send your feedback on Truck Tech to Alan Adler at aadler@firecrown.com.