The nation’s largest flatbed carrier, Daseke Inc. (NASDAQ: DSKE), could see more “doors open” if it continues to succeed on its turnaround plan. An improving capital structure could lead to the resumption of acquisitions, providing the catalyst for the carrier’s next phase of growth. Of course, all of this hinges on its ability to continue to execute, according to CFO Jason Bates.

In an interview with FreightWaves, Bates said he believes a couple more quarters of improved execution will provide the company with more avenues to improve its capital structure. “If we can put up two or three more really solid quarters and develop kind of a consistent trend and a positive direction, that may catch the eyes of ratings agencies and lenders and may open some additional doors for us,” Bates said.

An improved capital structure would include a bump to credit ratings, a lower cost of capital, lower interest rates and less debt leverage. Daseke could even issue new equity as it has done twice since its shares went public in February 2017. This would allow the Addison, Texas-based company to get back to doing what it did for much of its first decade of existence — buying other flatbed fleets.

Too many too fast led to restructuring

Daseke is a company of companies, executing more than 20 acquisitions in the flatbed trucking space since its founding by namesake Don Daseke in 2009. Some of the fleets acquired carry heavy equipment for Caterpillar (NYSE: CAT) and the U.S. Department of Defense and aircraft wings for Boeing (NYSE: BA). What started out as a fleet of 60 tractors generating $30 million in annual revenue grew to more than 6,000 units with revenue exceeding $1.7 billion in 2019.

However, difficulty integrating nine deals in the 2017-2018 two-year stretch alongside a declining industrial backdrop that sent flatbed rates and truck utilization lower, prompted the carrier to hit the pause button and retool the game plan.

The company’s two-phase restructuring plan is expected to be fully implemented by year-end. Phase one was completed at the end of the first quarter, producing an annual run rate of $30 million in operating income improvement. Phase two plans to boost that run rate an additional $15 million by the time 2020 concludes.

The overhaul includes consolidating separately operated flatbed trucking companies acquired through acquisition, disposing of underutilized tractors and trailers, and reducing headcount. Daseke has rolled up six of its 16 stand-alone fleets and is divesting the assets from its oil rig transportation unit Aveda Transportation and Energy Services. At the close of the second quarter, Daseke reported it had reduced its tractor count by 10% year-over-year, with nondriver headcount being reduced by a similar amount.

Daseke’s restructuring began in earnest in early 2019 with the addition of now-CEO Chris Easter, who joined the company to fill the newly created chief operating officer role. In May 2019, three new board seats were filled with individuals who had experience as operational leaders. The overhaul accelerated when the company’s former chairman and CEO, Don Daseke, stepped down in August 2019. Easter stepped in to lead the company on an interim basis, immediately upgrading the first phase of the cost improvement plan. Easter was named permanent CEO in February. Bates joined the team at the end of April.

Several cost and efficiency opportunities remain

On the potential for future headcount reductions or further consolidation of separately run units, Bates said “most of the heavy lifting” was done in the second half of 2019 and “there’s not too much more activity” planned at this time. He said the company continues to monitor the markets, COVID-19 and the election but they “feel pretty good” with the current level of resources.

While there were tangible changes like asset and headcount reductions that provided immediate results, more subtle initiatives have driven improvements and are likely to drive the next stage of the restructuring. Bates said increased usage of information and data has improved decision making across all of its brands. Information flow has improved throughout the organization now that some of the smaller and underperforming fleets are managed by the better-operating units. This has allowed management to better implement best practices.

“We have some runway to continue to demonstrate the turnaround that hopefully people are starting to see and take note of through the last couple of quarters.”

“One of the benefits of this portfolio approach is you have some of these guys that are out there operating at a really, really high level and they’re very capable, very knowledgeable operators, they’re very process-oriented and very, very focused on cost control,” said Bates. He said some of the lower-performing fleets didn’t have these processes in place, and now they have the opportunity to see how the operation should run.

Bates doesn’t expect a formal rollout or “phase three” of the business improvement plan. He believes improved decision making and the continual evolution of best practices across the entire organization will be the primary margin catalysts for the carrier in 2021 and beyond. The company established a long-term goal of a sub-90% operating ratio (OR), operating expenses expressed as a percentage of revenue, during its second-quarter earnings presentation for core trucking operations, which account for roughly 80% of revenue.

More quarters like Q2 and the buying spree could resume

Daseke reported second-quarter adjusted net income (after preferred dividends) of $6.7 million or 10 cents per share, outpacing analysts’ expectations for a 9-cents-per-share loss. The result was also well ahead of second-quarter 2019’s $2.1 million profit, excluding costs associated with restructuring and transforming the business.

Even with revenue declining more than 20% year-over-year in the quarter, cost actions from the restructuring initiatives drove an improved financial performance. Importantly, the carrier bolstered its liquidity position and reduced debt in the period. Daseke ended the second quarter with $240 million in liquidity and net debt of $532 million, improvements of $91 million and $118 million, respectively, from the year-ago period.

Shares of DSKE surged more than 25% on the better-than-expected earnings report, closing up 19% for the day. The one-day spike followed a 43% runup in the stock heading into the earnings report, which was propelled by a favorable second-quarter update issued in mid-June citing improvement in freight demand and liquidity. The stock is up 60% since the second-quarter report at $6.63, almost 8x higher than it traded in the early days of COVID-19 when it gapped down to 86 cents.

The company’s debt leverage ratio — net debt-to-adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) — declined to 3x from 3.2x at the end of the first quarter and below the 4x leverage covenant required by its lending agreements. Not facing any debt maturities until 2022 (revolving credit facility) and 2024 (term loan), Bates believes the company can be “opportunistic” when accessing capital markets. The hope is continued operational improvement will allow the company to minimize its interest expense and improve the balance sheet.

“We have some runway to continue to demonstrate the turnaround that hopefully people are starting to see and take note of through the last couple of quarters,” commented Bates.

The bulk of Daseke’s debt is on a term loan with a variable interest rate. The average interest rate on its term loan debt was 7.4% in 2019, declining to 6.3% during the second quarter. Each 1 percentage point change in the rate equates to roughly $5 million in interest expense. Further, an improved credit profile would allow the carrier to lower rates on its equipment term loans and leases. The company recorded $23 million in interest expense in the first half of 2020 after recording more than $50 million during 2019.

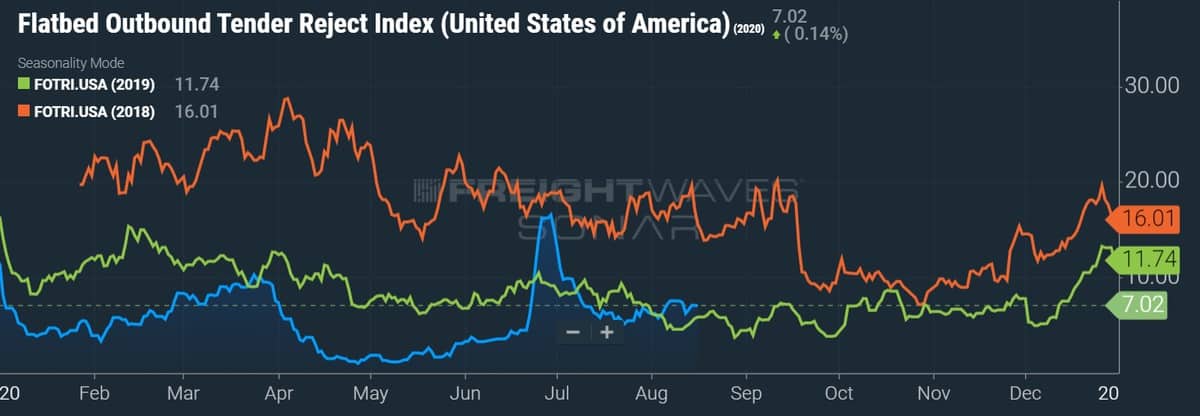

Of note, the recent financial improvement occurred through COVID and in the presence of a weak industrial economy. Demand for flatbed equipment has remained under 2019 levels for most of this year and is only a fraction of what 2018 provided. The Flatbed Outbound Tender Reject Index (SONAR: FOTRI.USA), a proxy for flatbed equipment demand, measures the number of flatbed loads tendered to and rejected by carriers. The mid-April to late-June stretch, the majority of second quarter 2020, was the worst on record. However, Daseke’s financial performance improved in the face of weak demand due to the cost initiatives.

On the second-quarter earnings call, management said volumes troughed in April, with only modest sequential improvement in May and June. They said July volumes moved “sideways” from June and indicated revenue may be flat sequentially from the second quarter to the third. Verticals like wind energy remain strong, lumber and building materials are holding steady, and the defense sector is now back online. This will help offset weakness in demand for aerospace and metals.

FOTRI briefly inflected positively in late June and has been closer to level with last year since. A nudge from the revenue side of the equation would certainly amplify the carrier’s cost actions.

“People who spent their entire lives building a business and they’ve got everything in this business, they don’t want to lose it all.”

Getting back to acquisitions?

Improving profitability and the balance sheet will allow Daseke to get back to its roots — growth by acquisition. Daseke holds approximately a 3% share of the roughly 200,000 flatbed tractors in service, suggesting there is ample room for consolidation.

Asked about the M&A pipeline in the flatbed space, Bates said regulatory pressures and an “unbelievable insurance market” are forcing more owners to contemplate a sale. “People who spent their entire lives building a business and they’ve got everything in this business, they don’t want to lose it all,” Bates said. “So, I think it’s caused people to be more open-minded about pricing and what they might be willing to sell companies for.”

The second quarter concluded with last 12 months’ free cash flow (FCF) of $175 million, which was aided by asset disposals and isn’t likely indicative of things to come, at least in the near term. FCF is cash flow generated from operations less the amount needed to fund capital expenditures (capex) and is usually redeployed to shareholders through dividends, share repurchases or accretive acquisitions.

Even with net capex forecast to be in a range of $75 million to $100 million during 2021, up from the $60 million to $65 million range in 2020, Bates said he feels “more than comfortable with our ability to generate free cash flow in excess of that going forward.” He said the company is now in a position where it won’t need to deplete cash to invest in the business any longer.

Daseke generated cash flow from operations in excess of $100 million in 2018 and 2019, which didn’t have the benefit of the restructuring plan. While capex steps higher in 2021 and potentially beyond, so should the company’s operating cash flow.

Bates said that a well-run asset-based trucking company has the ability to generate significant FCF, which he said they would use to “get back to growing.” He believes the recent success Daseke has had integrating past acquisitions will allow them to “expand the net” when vetting future deals. In the past, Daseke was focused on acquiring high-performing fleets and leaving management intact. He believes they will have success attracting fleets where the founder is looking to retire “now that we’ve demonstrated a capability to integrate companies into some of our better-performing companies.”

However, the acquisition game plan remains off in the distance as Bates said the company wants to get through the obstacles this year has presented and gain some clarity on the future.

“We can’t lose sight of the fact that before we can even think about those things, we need to focus on really shoring up and stabilizing what we’ve got here today, and I think we’re making good progress on that front as demonstrated by the last couple of quarters,” Bates concluded.