In the last decade, shippers have gained access to a range of solutions aimed at increasing real-time visibility into shipment status and location, including ELDs, supply chain visibility platforms, and carrier-specific GPS tracking systems.

Despite these real-time visibility advances, shippers often lack insights into long-term performance trends and hidden inefficiencies across their facilities. These inefficiencies lead to increased operating costs in the form of higher accessorial fees and truck rates.

In addition to driving up transportation costs, shippers that fail to identify and correct operational issues within their facilities compromise their reputations with carriers, which can have a negative long-term impact on their access to quality capacity at competitive rates. Carriers rely heavily on facility reviews to guide their business decisions—recent research by Convoy revealed that 84% of carriers often or always read facility reviews before deciding on whether to bid on shipments. Even when carriers choose to bid, negative facility ratings can drive them to increase their rate per mile in an attempt to recoup potential lost earnings from longer wait times and other inefficiencies.

What Constitutes an “Average” Facility?

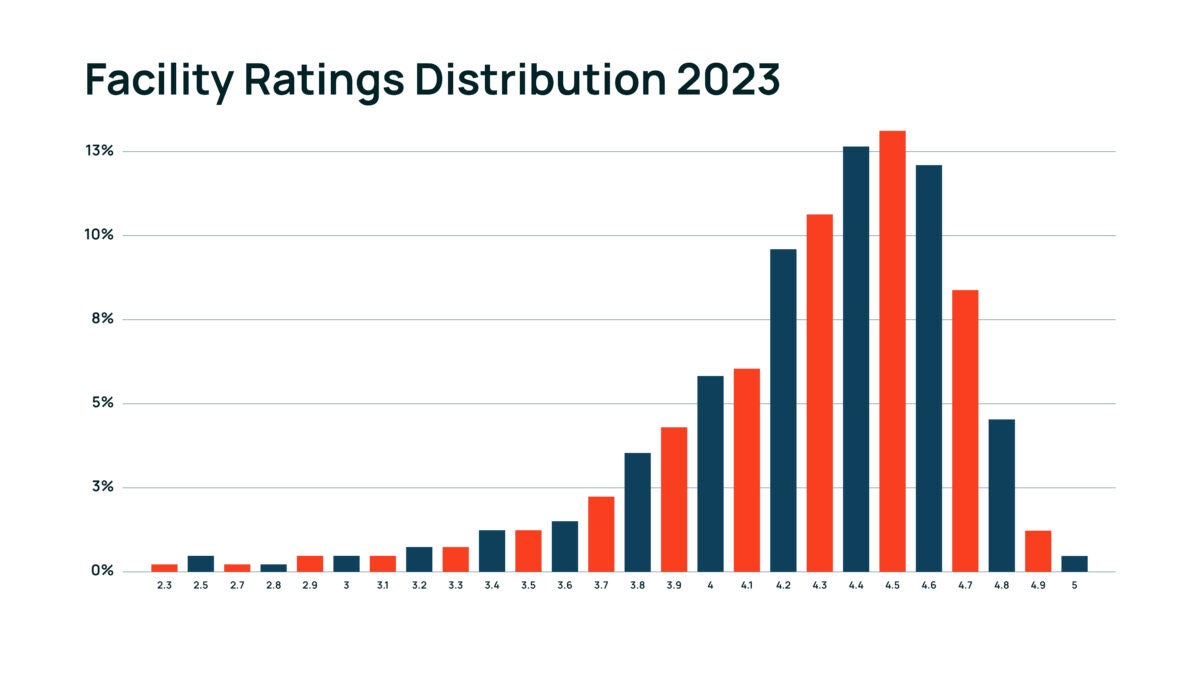

One of the initial challenges shippers face in identifying operational issues is a misunderstanding about what constitutes an “average” facility. Transportation teams often operate under the assumption their facility ratings aren’t cause for concern, while carriers actually see their facilities as subpar. This is based on the distribution of facility ratings, which in Convoy’s network have historically “skewed left”—in other words, carriers tend to give facilities higher ratings in general, which skews what constitutes an average facility rating.

For example, on a five-point scale, it would be natural for shippers to assume that a three-point rating implies average or acceptable performance. Convoy’s research, however, revealed that the average facility rating came in at 4.3, and a score of four or lower would actually place in the bottom 20% of all facilities. To break into the top 15% of facilities, a shipper needs to be rated at least 4.7 out of five.

Data from Convoy’s network indicates that the average facility rating is 4.3 on a five-point scale, and that any score below 4.0 ranks facilities in the bottom 20%.

To improve facility ratings and become a shipper of choice, transportation teams need to understand the underlying causes of low ratings. In Convoy’s research, shippers tend to be downrated for many of the same reasons, with long wait times, poor communication, and subpar facilities leading to lower facility scores.

Reducing dwell time is the single most important thing shippers can do in order to improve their facility ratings. Convoy found that 84% of five-star ratings cite short dwell as the top reason for the positive rating, while 82% of lower ratings cite long dwell as the top reason for the negative rating. In fact, every additional hour of dwell time, on average, decreases facility scores by 0.2 points on the five-point scale.

Good communication — specifically, clear instructions and respectful interactions — is cited as the second-largest factor for driving facility ratings. Facility condition came in third place.

To get a better understanding of the factors affecting their scores, shippers can access detailed facility trend data that’s automatically generated by digital carriers like Convoy. That data — combined with custom analyses and conversations with carriers — can then be used to address the root causes of facility inefficiencies.

With data from at least 80 loads per facility per year, shippers can get a statistically significant view of individual facility performance and also benchmark their facilities against each other to see which are their top and bottom performers. Additionally, they can see how their facilities stack up against other shippers in their industry or geographic region.

Collaborating to Understand Low Ratings

Convoy recently worked with a Fortune 500 manufacturer to pinpoint problems and optimize operations at one of its largest facilities. The company was experiencing high detention costs due to long dwell times on their drop-and-hook loads.

At the time, carriers rated this facility 3.5, landing it in the bottom 5% across Convoy’s network. Their reviews hinted at broader scheduling and operational issues.

When Convoy’s shipper insights team compared drivers’ actual transit times to their appointment times, they quickly uncovered the problem: Drivers were arriving so early for their appointment times that they were waiting hours to unload.

“For instance, a driver would pick up a shipment at 9 a.m. and arrive at the manufacturer’s facility around 12:30 p.m. — but the delivery appointment time wasn’t until 6 p.m. The driver held onto the trailer for close to six hours longer than necessary,” according to a recent Convoy case study. “In these cases, drivers don’t get the most out of their full 11 hours of service, which hurts their productivity and reduces their earnings. The result: negative facility ratings and reviews, higher truck costs and higher accessorial costs.”

Convoy provided lane-by-lane transit recommendations that the manufacturer’s 3PL now executes, leading to significant improvements across the company’s operations. The manufacturer saw a 53% reduction in excess transit time, a 60% reduction in pickup dwell time, a 22% reduction in truck costs and a shocking 70% reduction in detention costs.

These operational improvements also drove the facility rating up from 3.5 to 4.4, taking it from one of the lowest rated facilities to above average.

Better Data Benefits Both Shippers and Carriers

As digital carriers continue to gather shipment data at an accelerating rate, shippers stand to benefit from the ability to identify performance trends and anomalies. By systematically addressing inefficiencies at the facility level using a combination of self-service tools and in partnership with digital carriers, shippers can improve their team’s productivity, increase operational performance, and ultimately drive down their transportation costs.

As facility performance improves, carriers benefit as well, creating a virtuous cycle. Positive carrier experience increases the likelihood of carriers returning to a given facility. Repeat carriers drive higher quality, more consistent performance. And higher performance results in positive ratings and reviews, increasing shippers’ access to capacity.

Click here to learn more about partnering with Convoy.

This article is published jointly with our partners at Convoy. To view more Future of Freight content, click here.