Road, rail and port projects may have to be curtailed or delayed because of the effect that rising inflation is having on the purchasing power of the $1.2 trillion infrastructure bill enacted last year.

The Infrastructure Investment and Jobs Act (IIJA), which President Joe Biden calls a “once-in-a-generation” funding bill, sets aside roughly $660 billion over five years for grants and program funding for freight, transit and other transportation projects overseen by the U.S. Department of Transportation (DOT). Biden takes credit for helping to secure the legislation by forging bipartisan support for it prior to signing it into law in November.

As of mid-May, roughly $79 billion of that amount has been announced for grant and program funding for highway, rail and port infrastructure. The White House has been moving quickly to get the money into state coffers but acknowledges that inflation could affect how much the historic funding levels will be able to accomplish.

“The cost of construction materials have gone up dramatically,” said Katie Thomson, who directs implementation of the IIJA for DOT, at a forum this week hosted by the Eno Center for Transportation (Eno).

“Some of it is unique to the current economic environment and inflation, and some of it is a trend in escalating construction costs that we’ve been seeing in the transportation sector for quite a while now. For us it doesn’t make a difference what the cause is, whether acute or chronic, it’s something that we need to address.”

Thomson, who previously served as vice president of worldwide transportation at Amazon, said she was also hearing from states about challenges in hiring workers, as well as a lack of competition among bidders.

“When they’re putting out these projects to bid, they may only be getting up to three bids, all coming in high, and not seeing the kind of robust competition among contractors,” she said. Project sponsors are “being left … with bids on projects at a much higher cost than they had anticipated.”

Given the increasing inflation risks, DOT is working to reduce the time between when competitive grants are announced and when an application is accepted and a grant agreement is signed, Thomson noted, “so that those dollars can have an impact earlier.”

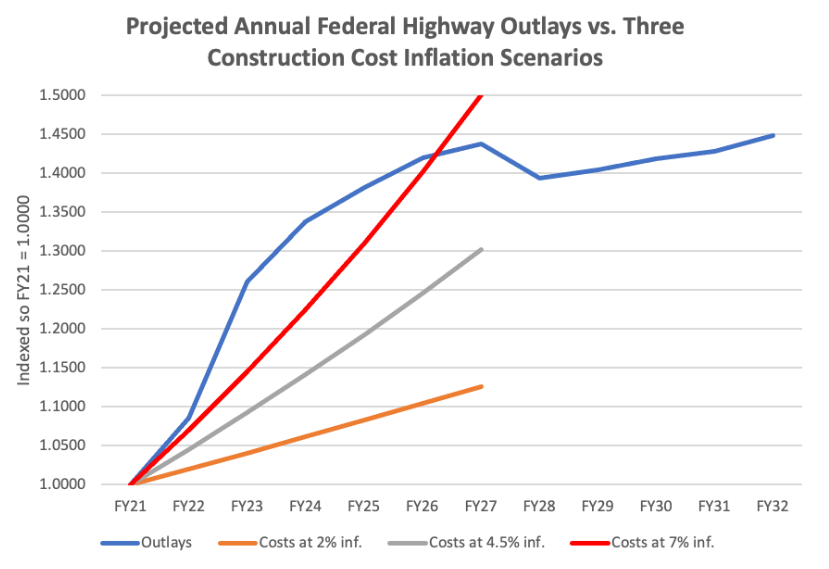

Jeff Davis, a senior fellow at Eno, put a hard-number forecast on inflation’s impact on IIJA funding (see chart).

Davis looks at the five-year IIJA funding period as being six years, from 2022 to 2027 rather than ending in 2026, because 2027 is the peak year for actual funding outlays. He says outlays for highway projects under IIJA total $385.7 billion — $92.3 billion higher than would have been the case without the increase provided by the law.

Adjusting for inflation under three scenarios, however, severely cuts back on the funding increase. Under 2% annual highway cost inflation, $19.8 billion of the $92.3 billion increase will be eaten up by higher costs, according to Davis. An additional $28.5 billion will be consumed by higher costs under a 4.5% cost inflation scenario, for a total of $48.3 billion being negated.

And if a 7% percent annual cost inflation forecast is used, a further $30.9 billion will be eaten up — leaving just $13.1 billion of the original $92.3 billion spending increase.

That means if states have several infrastructure projects lined up on which they want to begin construction at the same time, they may have to delay them, Davis told FreightWaves, adding that inflation could change both the number and timing of projects.

“So while the states may know how much money they are receiving for highway projects, the question will be, what will they be able to buy with it?”