The airfreight supply chain is nervous it won’t be ready to support a massive global rollout of COVID-19 vaccines that could begin within months.

A fast-track development process, the complexity of handling medicines with stricter temperature requirements and lack of clear shipping specifications from pharmaceutical companies make it difficult for logistics providers to plan for vaccine delivery under expedited conditions, freight transportation experts say.

Cold-storage infrastructure, special processes and training are some of the critical requirements for preventing spoilage.

Only 28% of airlines, logistics providers, airports and others with a role in the delivery process said they feel well prepared to efficiently and safely handle the emergency distribution, according to a survey of 181 companies released Wednesday by The International Air Cargo Association (TIACA) and Pharma.aero, a coalition of interests that promotes best practices in pharmaceutical shipping.

Nearly a fifth of the respondents said they feel very unprepared.

Many airlines, warehouses and trucking companies are well equipped with refrigerated facilities and containers for handling perishable food products, drugs and biological samples, but some vaccine candidates must be kept at much colder temperatures than existing resources can meet. And the initial wave of doses is likely to be much greater than normal shipping patterns for pharmaceuticals.

“Traditionally, [vaccines] have been shipped in much smaller quantities. And the infrastructure does exist to do that. But we’re talking about an entirely different scale here. So our continued messaging to the pharmaceutical shippers is: The more open and forthcoming you can be about your requirements, the faster the industry can react and get prepared,” said Neel Jones Shah, global head of airfreight at freight forwarder Flexport, during a media briefing.

“Whether you need a lot of physical investment, or investment in creative solutions, that all takes time. It takes time to develop the solution, but it also takes time to figure out where you’re going to implement it. And time is something we will run out of very quickly once this vaccine gets its authorization,” the TIACA board member said.

In many countries, governments are taking the lead in vaccine development and distribution.

Countries and trading blocs have already ordered more than 5 billion doses, with double or triple that amount eventually needed over two years by some industry estimates. Air volumes will depend on the location of regional production and how much vaccine can be moved over the road by truck.

Flying blind

Freight companies aren’t able to properly strategize or deploy cold-chain infrastructure without clarity on a number of critical variables — number of doses, production timelines, shipping routes, packaging type, amount of dry ice needed for mobile coolers and storage space — according to the air cargo groups.

“The logistics industry is blind,” said Nathan de Valck, head of cargo product and network development for the Brussels Airport Company and Pharma.aero chairman. “How to decide on what, when and where to invest with no solid market information and in a challenging economic environment” is a risky gamble right now.

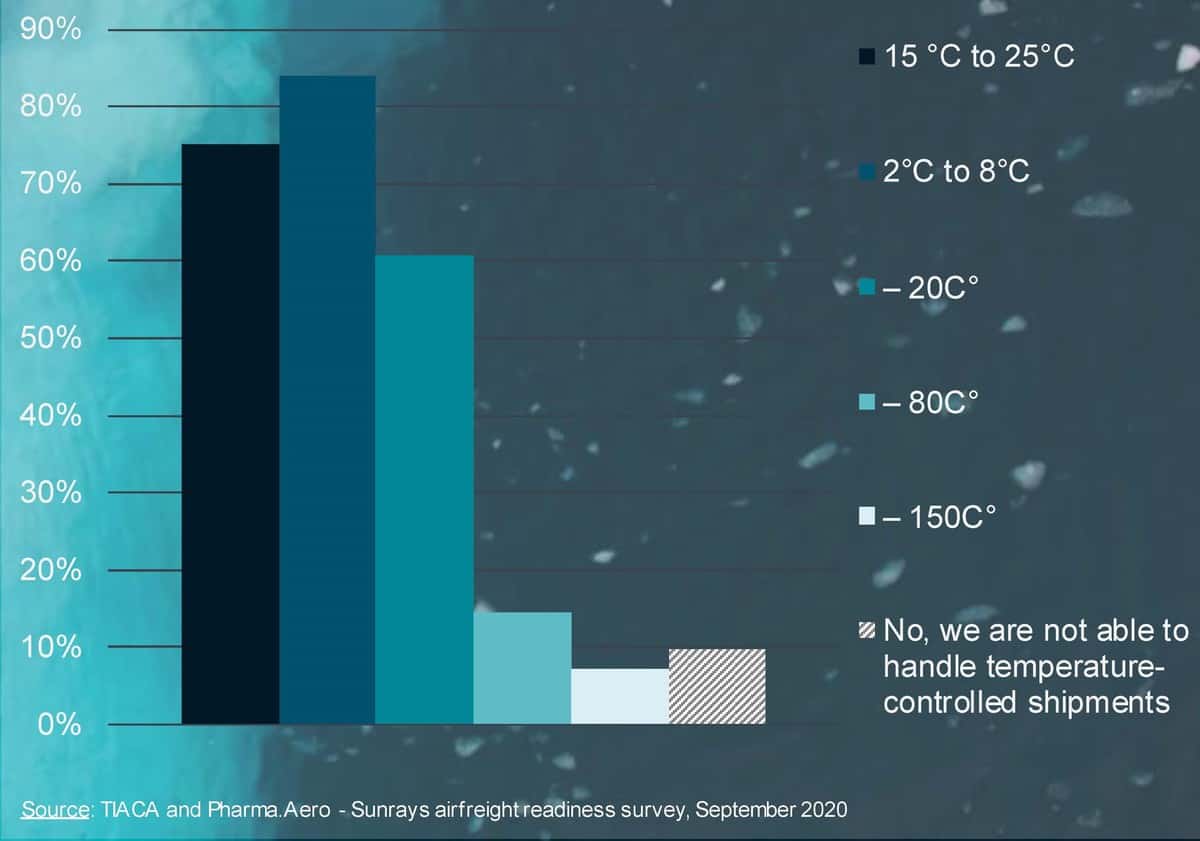

Perhaps the biggest unknown is what vaccines will be approved first by drug regulators. Conventional vaccines can be kept above freezing, between 2 degrees and 8 degrees Celsius (35 degrees to 45 degrees Fahrenheit). Others being developed are preserved at minus 20 C. But some vaccines in Phase 3 clinical trials have a higher protein base that allows for faster development, but also requires storage at minus 80 C or below to prevent product degradation.

Johnson & Johnson and Eli Lilly this week paused coronavirus clinical trials to study why recipients experienced adverse reactions. Last month, AstraZeneca put the brakes on its COVID-19 vaccine trial after two people became sick. The vaccines, which don’t require subzero storage, could fall behind others in the race to market.

Stringent pharma requirements

The logistics expectations of pharmaceutical manufacturers are higher for COVID-19 vaccines than regular medicines, according to TIACA and Pharma.aero. Shippers are demanding:

- Express service at every step of the journey, with customs procedures ironed out in advance to avoid any delay.

- Tight security to prevent counterfeit activity and theft.

- Guaranteed delivery times.

- Visibility through wireless sensors that can track and record time, location and temperature status in order to verify product integrity or alert distribution partners to intervene if the temperature deviates.

- Transparency — accurate information on existing airfreight capacity, lead times for each trade lane and reliable information on the capabilities of all service providers.

Temperature deviation is the biggest concern of pharmaceutical companies. Airlines and airports have gotten better at not leaving temperature-sensitive products waiting on the tarmac in warm weather, with some using special cooler units to transport and store unit load devices until they are loaded on the aircraft. Recovery time is also important to get the ULDs into chillers and keep the temperature constant.

According to the survey, companies that are close to drugmakers and in regular contact felt more prepared for the distribution challenge than those with limited, or no, direct contact. Slightly more than half the survey respondents felt some level of preparedness, but confidence was much lower for airports and ground handling agents than for airlines and freight forwarders. Packaging and cool-equipment providers said they were ready to go.

Logistics companies that are involved in supporting clinical trials are also in good shape, the survey showed.

The results underscore that pharmaceutical manufacturers need to make sure they engage all providers as early as possible to define how the supply chain will work, Emir Pineda, manager of aviation and trade logistics at Miami International Airport, said on the call.

Nearly 50% of respondents said they planned to introduce premium service for life sciences shippers and 42% said they may do so. Fewer companies, 36%, said they will invest in additional physical or digital infrastructure, with 41% on the fence.

Only about 15% of those surveyed said they had the capability to handle ultra-cold vaccines.

The survey is part of Project Sunrays, a joint effort by TIACA and Pharma.aero to better understand industry readiness for vaccine distribution and develop guidelines for end-to-end collaboration.

Pineda said each air cargo stakeholder should map its existing capabilities at each location and make the information available to customers and partners. The International Air Transport Association last month introduced a free online platform that provides a detailed list of independently validated aviation logistics facilities around the world and their capabilities, including equipment, services and certifications.

He also recommended logistics companies secure needed resources as early as possible, saying, “We need to anticipate as best we can even when information is lacking.”

Korean Air, for example, is taking many of those steps. A new vaccine transport task force is monitoring vaccine developments, securing necessary equipment and facilities, strengthening monitoring and security procedures to deal with exceptional situations and conducting simulations of diverse scenarios, the company recently said.

The two air cargo organizations called on customs and border agencies to facilitate and expedite clearance of all coronavirus vaccine-related supplies. Nongovernmental organizations can help build capacity in areas with smaller airports and fewer cold-storage facilities, they said.

“You can’t understate how important it is for governments to be on board. We know what happens when governments and industry aren’t on the same page. Things get backed up at borders, clearances aren’t achieved quickly. And we fail the world when we do that,” Flexport’s Jones Shah said. “So collaboration with governments is critical. It’s happening, but not on the global scale or the level that we need to be successful.”

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED NEWS:

Air cargo’s moon shot: Get COVID vaccine to the world

U.S. Air Force could deploy freighters to fly truckloads of vaccine