Asset-light third-party logistics provider Landstar System’s Inc. (NASDAQ: LSTR) fourth quarter results came in light of analysts’ expectations and its own guidance.

The company reported earnings per share (EPS) of $1.27, well below the consensus estimate of $1.42 and the company’s prior guidance of $1.40 to $1.46.

“During the 2019 fourth quarter, we incurred $7.2 million of unfavorable development of prior year claims that drove actual insurance and claims costs to 5.7 percent of BCO revenue in the quarter,” Landstar President and CEO Jim Gattoni stated in a press release issued after the close Wednesday. The company’s original guide for the fourth quarter assumed insurance and claims expenses to be 3.6% of BCO revenue.

BCO revenue is generated from independent contractors that provide truck capacity to Landstar under exclusive lease arrangements.

New guidance impacted by recent accident

Landstar’s first-quarter 2020 guidance assumes revenue in a range of $915 million to $965 million with loads hauled via truck and revenue per truck load declining in the mid-single-digit range year-over-year, similar to the trends the company has witnessed so far in January.

Gattoni said that little has changed in the macro environment thus far in January, noting “soft demand, weakness in the U.S. manufacturing sector, and readily available truck capacity.” He said the first quarter of 2019 was seasonally the strongest quarter of the year, presenting a difficult comparison for the 2020 first quarter.

The company’s official EPS guidance of $1.10 to $1.20 excludes the resolution of a fatal accident that occurred in January. The company has $8.5 million of loss exposure or $0.16 per share to this event.

“In early January, a BCO with a motor carrier subsidiary of the company was involved in a tragic vehicular accident involving a fatality. The company is still in the process of obtaining all the facts concerning this incident and, as such, it is too soon to estimate the ultimate financial exposure of this tragic accident,” Gattoni stated.

However, Gattoni went on to explain that the accident will likely impact Landstar’s results.

“Current facts as known to us indicate that it is probable this accident will adversely impact the financial results of the Company’s 2020 first quarter. It is highly likely that, once all facts are determined, the estimated ultimate cost of this tragic accident will reduce first quarter diluted earnings per share to an amount below the low-end of the Company’s 2020 first quarter diluted earnings per share guidance,” Gattoni continued.

The new first-quarter earnings range of $1.10 to $1.20, along with the potential financial impact from the accident, place the company’s new guide well below the current first-quarter 2020 consensus estimate of $1.34.

Lackluster trends in fourth quarter

While insurance and claims expenses were headwinds to results and guidance, a much softer macro environment highlighted by excess truck capacity and lower freight rates took a toll on the company’s earnings results.

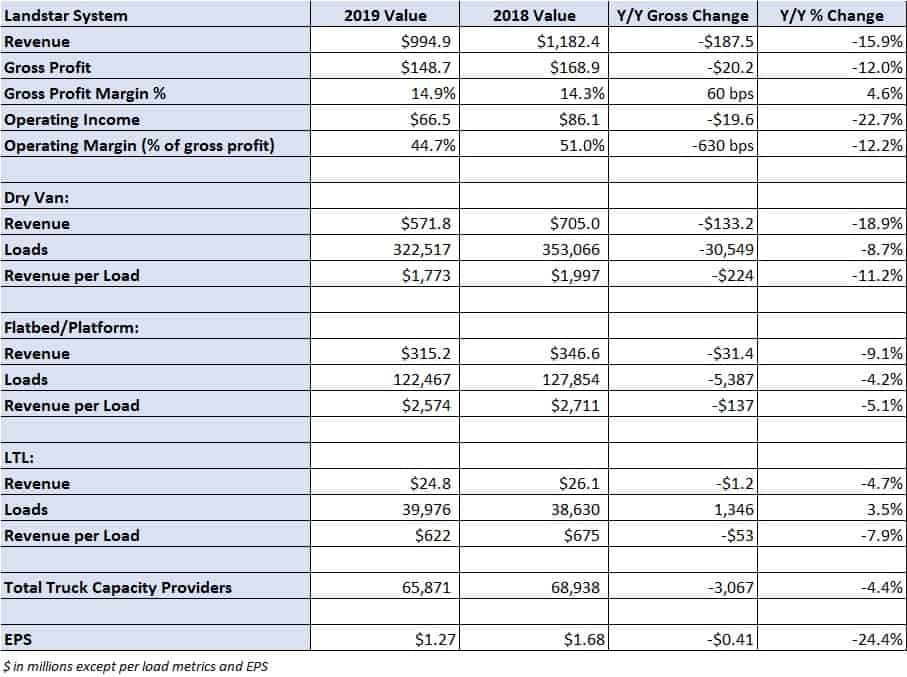

Total revenue was 16% lower year-over-year at $995 million, within management’s prior guidance range of $970 million to $1.02 billion. Dry van loads declined 9% year-over-year with an 11% decline in revenue per load.

Landstar’s platform business managed to hold up better with loads down 4% year-over-year and revenue per load down 5%.

“Soft demand, driven by slowing production in the U.S. manufacturing sector, and more readily available truck capacity drove Landstar’s truck rates and volumes below prior year levels in the 2019 fourth quarter,” Gattoni stated.

The company will host a conference call to discuss these results with analysts and investors Thursday at 8 a.m. EST.

John

I told you for the past few years right on this forum that landstar was due for a major insurance problem. I guess corporates business model is Lower your hiring standards by more than half, hire a bunch of immigrants that can barely speak English and force everyone to fight over bottom feeding freight and cancelled loads. Landstar if it’s true that there was a major payout and people died definitely has blood on their hands. Give me a break. I’m just a driver and I saw their greed overcome their common sense. Especially that guy

John

I told you for the past few years right on this forum that landstar was due for a major insurance problem. I guess corporates business model is Lower your hiring standards by more than half, hire a bunch of immigrants that can barely speak English and force everyone to fight over bottom feeding freight and cancelled loads. Landstar if it’s true that there was a major payout and people died definitely has blood on their hands. Give me a break. I was just a driver and I saw their greed overcome their common sense. Especially that guy Gerkins who started ruining the company but I’m sure loved his millions of dollars in pay and stock options. If somebody died he is as guilty as the driver that was involved. Tell me why a CEO deserves 100 times a drivers pay and can’t even hit earnings?

Christopher Williams

Thanks for the info. I have been hoping for some proof to support what I’m experiencing as a BCO. Thanks.

Billy Dean Taylor

I am a b c o with Landstar. I’m not a financial wizard I understand some of the things that are in this report and some I do not, but one thing I know… Landstar is a good company… they treat me good and I’m happy to be a part of this company. Now that being said I will pray for Landstar. I will pray for all of its leaders to help guide this company in the right direction. That’s the best I can do its pray.