Intermodal has attracted more freight thanks to tight truck markets, but growth rates will moderate.

Intermodal carriers are seeing the best volumes in years, thanks to tight supply in over-the-road trucking. But the rate of growth will ebb as the truck market returns to more normal levels, says an industry expert.

In a a conference call hosted by Stifel, Gross Transportation Consulting principal Larry Gross said North America is past the peak of the trucking shortage, with the upshot being that the growth in truck rates will moderate.

“Going forward the industry is in the process of correcting and adding the people and adding drivers, Gross said.

“The industry is going to get their driver cohort right sized, which is not to say that it’s going to be easy to recruit drivers, but it won’t continue to be as difficult and and wages will continue to have to go up but not to the extent that we’ve seen recently,” he added.

As reported in FreightWaves earlier today, employment in truck transportation rose for the fifth consecutive month, adding 4,900 to the payrolls in September, with the rate of change accelerating from a year ago.

Trucking rates peaked at 20% year-on-year growth earlier this year, Gross said. But thanks to the addition of more drivers, the rate of that growth will moderate next year with rates showing growth of 5% or below next year.

“In terms of rates, contract rates have been rising quite rapidly this year, but we do expect that rate of increase to drop back down,” Gross said. “Not necessarily down to zero, but certainly the rate of increase will up will slow down as we go forward here through 2019 and into 2020.”

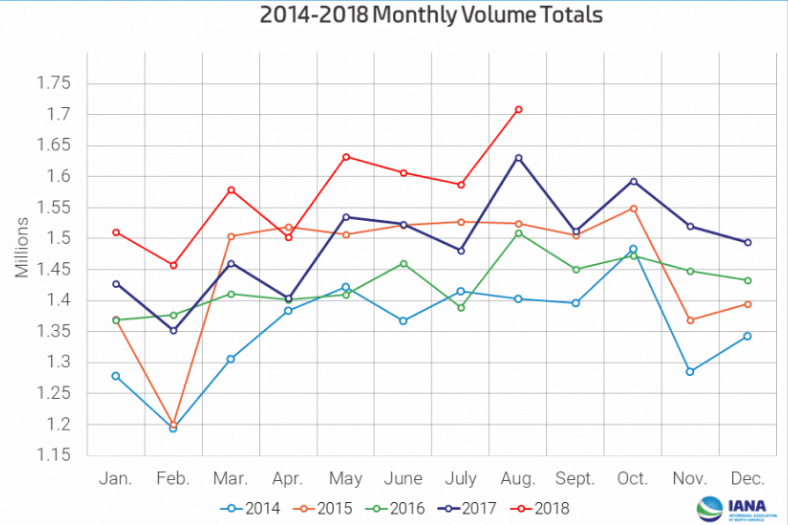

The spike in trucking rates has had the knock-on effect of pushing intermodal volumes to their best levels in four years, according to the Intermodal Association of North America. Gross says year-to-date revenue moves in the intermodal are up 6.5%, the best in two years.

Major intermodal players also expect strong growth this year. J.B. Hunt (NASDAQ: JBHT) expects its intermodal revenue to grow between 7.5% and 11% this year. Schneider National’s (NASDAQ: SNDR) intermodal revenue for the last 12 months in up 6.8% as of the second quarter.

But with more trucking supply coming into the market thanks to hiring, Gross says it will be much more difficult for the intermodal industry to put up those kinds of growth rates.

“Because the trucking situation is going to begin to normalize, it’s going to be a much more challenging situation for intermodal,” Gross said. “We’re not going to see the kind of large you over year increases in rates that we did in 2018.”

Container volumes coming into North America have been a major tailwind for the industry in the third quarter, with volumes through August up 5.2% year-on-year The fear of tariffs appears to have pulled forward import demand, Gross says. He says August is usually peak volume for the year, but the volume of containers imported peaked in July.

“There’s been strong performance for containers, but question is whether that actually reflects freight that was moved earlier than normal, either because of tariffs or fears of congestion or delays at ports,” Gross said.

“I am fairly certain we saw movement of cargo early as August is the peak for volume, but July was higher than August,” he added. “The rest of 2018 may see see more restrained growth because of the early cargo movement.”

There’s also the question of whether the railroad networks can keep up with the volumes entering intermodal. Even as volumes hit new highs, intermodal train speeds are at their slowest in two years, Gross says.

For example, containers brought into Chicago are being taken off trains and sent across town to another rail ramp due to service changes at major railroads, making Chicago a “big sorting hub,” Gross says.

“There continues to be a reliability issue with intermodal,” Gross said. “Terminal congestion and lower speeds are impairing equipment velocity. The lack of reliability is quite damaging from reputational standpoint and begs the question whether or not intermodal get its house back in order.”