The outlook from management teams of several truckload (TL) and transportation companies participating virtually in the Bank of America Transportation and Industrials Conference this week hasn’t changed dramatically from their earnings reports a couple of weeks ago. However, sentiment is improving slightly as more of the economy is poised to come back online.

Thoughts on the overall market

John Kuhlow, interim CFO at J.B. Hunt Transport Services (NASDAQ: JBHT), said some “uncertainty remains,” but their strategy and expectations haven’t changed. Through the pandemic, the company has seen higher TL volumes year-over-year due to the market’s acceptance of its trailer pool service, 360box, but dedicated loads have flattened sequentially since the first quarter when they would normally see a sequential increase. The implication is that dedicated volumes will be lower year-over-year in the second quarter.

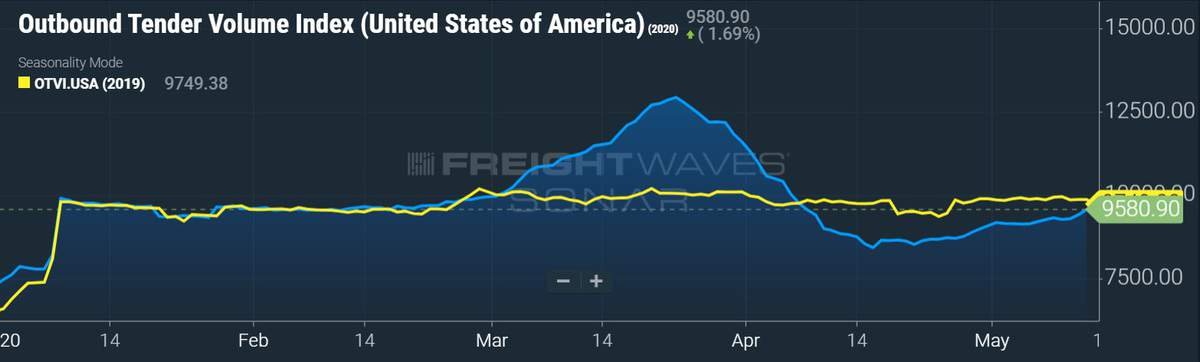

Werner Enterprises (NASDAQ: WERN) CEO Derek Leathers said the past six weeks have been “bumpy,” referring to the dislocation in the supply chain caused by surges in demand from “essential” businesses while shippers in “nonessential” segments have seen a dramatic fall-off. The wild fluctuations have created equipment imbalances in some geographies for the carrier.

U.S. Xpress (NYSE: USX) CEO Eric Fuller said volumes were consistent through April and into May. Ninety-six percent of the carrier’s clients were deemed “essential” and have remained open through the lockdown as many of them provide consumer products serving grocery, discount retail and home improvement stores. The latest week was the carrier’s highest revenue week of the year, which in other years would be viewed as in line with the traditional seasonal ramp-up in demand heading into the strongest month of the year, June.

Given the drastic volume declines experienced by the trucking sector due to shutdowns in the automotive, big box retail and restaurant sectors, U.S. Xpress’ recent volume performance is impressive. However, the carrier has made tractor utilization the priority as revenue per tractor per week was still lower year-over-year during the 2020 first quarter even with the improvement in miles per tractor.

Insight into a recovery

Werner’s dedicated business is heavily tied to discount stores, which remained open. While volumes slowed in April, following a mid-March surge as shelter-in-place mandates spread, the carrier is seeing signs of improvement as a phased reopening is nearing. Leathers believes that the rebound is near, but the second quarter will be tough. He believes carrier failures and continued firmness in TL fundamentals through the back half of the year will present a market that is “considerably better than it has been in a long time.”

Kuhlow said they are “seeing some encouraging signs and remain optimistic, but that it’s still too early to tell. Shelley Simpson, J.B. Hunt’s chief commercial officer and head of highway services, said their customers are still making plans around the reopening, noting that “nonessential” customers still have four to seven weeks of inventory that will need to bleed off before shipments increase while “essential” customers are behind on their inventories and will need to catch up.

J.B. Hunt’s head of dedicated and final mile, Nick Hobbs, said he is seeing “sprouts of green,” but retailers will need to move stagnant inventory at deep discounts to get volumes flowing in and out of distribution centers again.

Mark Rourke, CEO at Schneider National (NYSE: SNDR), said that entering the COVID-19 downturn they expected the second quarter to be the most difficult of the year, with May being the worst month. He said there has been a bit of a “curl” in activity with positive signs of a potential restart coming from its customers deemed nonessential. He said that when adding next week’s automotive manufacturing restart along with produce season, April may prove to be the trough of the downturn.

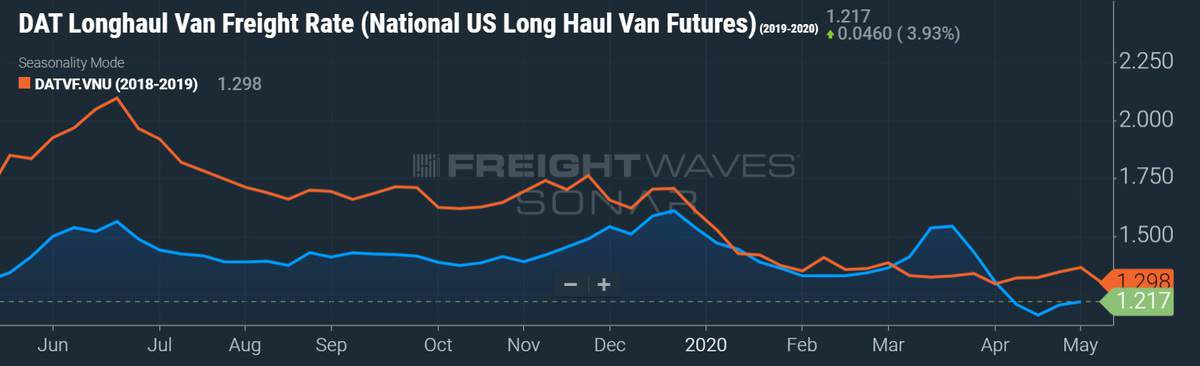

Rates not inflecting positively yet

On rates, Fuller said there is still a “quite a bit of pressure” on spot market rates. He said the freight market is improving but noted that a good deal of supply still needs to be purged before rates move higher. Fuller believes recent stimulus payments are acting to prop up some companies that wouldn’t have made it otherwise, potentially keeping carrier bankruptcies from being as extreme as they could have been. He said the companies that were teetering before the downturn are still likely to fail, just later than they would have without stimulus. Fuller still expects supply to “rationalize” later in the year and into 2021.

Fuller believes that spot rates have hit a floor and won’t move materially lower. He noted that rates are already below breakeven levels for some carriers as they don’t cover the variable costs associated with moving the load. He doesn’t believe spot rates are poised to run higher anytime soon, but said that it only takes a couple of percentage points change in supply or demand to move spot rates 20% to 30%.

Leathers said spot rates are running 20% to 30% below operating costs for many carriers. Werner currently has more spot exposure than it would like given the lack of backhaul opportunities in some of the busiest markets. As the year progresses, he sees upside to the company’s first-half 2020 rate guidance calling for a 5% to 7% decline in revenue per total mile in its one-way segment. He said tractors are being idled and more bankruptcies are likely as spot rates remain depressed and operating costs remain high, specifically referring to spikes in insurance and claims expense.

Leathers, too, believes that some carriers have been propped up by government stimulus payments and declining diesel prices but notes that this is only a short-term fix as many of them were on the brink of failure prior to the pandemic. He sees an economic resumption and truck capacity leaving the market as catalysts for “meaningfully” improved spot rates by year end.

Rourke said Schneider National has seen a “hardening” in spot rates in the past week after moving lower in April. He believes that rates are “starting to curl” using a line graph analogy. He cited low new-truck builds and higher insurance costs along with a flight to quality from shippers as reasons for capacity exiting and rates eventually climbing.

Simpson said spot rates “hit bottom three weeks ago or so and have bounced off of that bottom just slightly” across the one-way portion of J.B. Hunt’s network including intermodal, truckload and brokerage. She said spot volumes are “still anemic,” but price has improved off of a “fairly low base.”

Intermodal remains subdued

Given headwinds like excess truck capacity that is weighing on spot rates, very low diesel fuel prices and a Chinese restart that hasn’t resulted in containers hitting U.S. ports materially, the cost gaps between truck and intermodal has narrowed. As such, intermodal demand is in decline.

Simpson said normal seasonal intermodal project shipments haven’t materialized and that J.B. Hunt may not see them this year. She said continued pressure from truck is weighing on results in the company’s Eastern network. The company didn’t provide an update on contractual negotiations through bid season but stated that the long-term operating margin guidance of 11% to 13% still stands.

Schneider National reported year-over-year intermodal declines in the upper teens during April. Rourke said there has been sequential improvement in demand in recent weeks, but the declines are still in the mid-teen range year-over-year. They expect the intermodal environment to remain difficult throughout the entire quarter as intermodal loads like specialty retail were deemed nonessential and inbound traffic from Asia remains soft.

Once the shutdowns began in China, Rourke said that the company pivoted its intermodal franchise to capture more share in the East and Mexico. Those volumes were up 20% year-over-year during the first quarter, allowing the company to grow intermodal market share in the quarter. Rourke expects the company’s growth to continue to outpace the industry for the remainder of the year.

Werner has seen some intermodal freight migrate to truck, but Leathers believes that some of it will fluctuate back to rail over time as some of these catalysts reverse.

Dave

Yep. If you’re at a VC funded funny money startup that’s currently losing money you are probably doomed to either bankruptcy or massive downsizing in the near future. No startup is gonna get more $ if you aint either growing sales 1,000% per year (then losses don’t seem to matter) or if you are currently losing money month after month.

Start looking for new employment if you work somewhere bleeding cash. You have a 80 / 20 chance of being laid off in the next 90 days so best to look for something before everyone else is lined up out the door applying for anything decent in your area.

It’s amazing just how many of my friends are already laid off, furloughed or their company just closed the doors on them one day.

IT’S SAD OUT HERE ON THE FRONT LINES.