It has been a particularly strange Q1 for dry bulk shipping. Usually, the larger ships — Capesizes with capacities of around 180,000 deadweight tons (DWT) that carry iron ore and coal — do poorly all quarter. This year, they did better in January than they had in a decade before succumbing to their usual slump.

Then came another oddity: The smaller bulkers began earning much more money than the Capesizes. As of Tuesday, Handysize bulkers (up to 35,000 DWT) were earning $19,400 per day, according to Clarksons Platou Securities. That’s almost double the $11,700-per-day rate of Capesizes — even though Capesizes carry five times the cargo.

Supramaxes (45,000-60,000 DWT) and Panamaxes (65,000-90,000 DWT) are also trumping Capes, at $20,700 and $18,800 per day, respectively.

This curious market inversion recently led to a Capesize being booked for a grain cargo, something “that rarely happens, if ever,” noted Breakwave Advisors.

The bullish view on all of this strangeness is that Capesizes did so well early in the quarter because the supply-demand balance is tight. They’ll rev back up again soon when seasonal headwinds wane. As for smaller bulkers, they’re a bellwether of global GDP — the shipping version of “Doctor Copper.” High rates signal a global economic resurgence, say optimists.

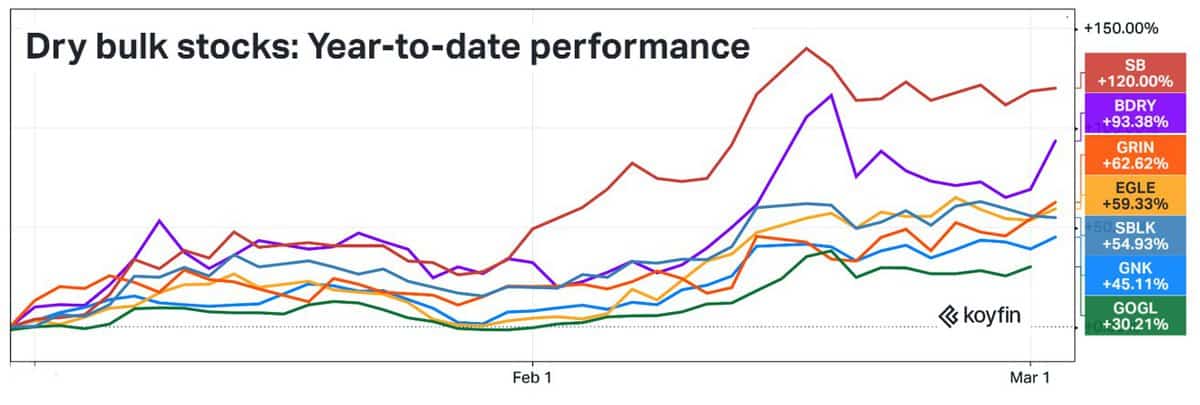

At least some investors agree. Dry bulk stocks have been on a roll in early 2021.

On Tuesday, the Breakwave Dry Bulk Shipping ETF (NYSE: BDRY) jumped 14%. It is up 93% year-to-date. The stock of Safe Bulkers (NYSE: SB) is up 120% year to date. Grindrod Shipping (NASDAQ: GRIN) is up 63%, Eagle Bulk (NASDAQ: EGLE) 59%, Star Bulk (NASDAQ: SBLK) 55%, Genco Shipping & Trading (NYSE: GNK) 45%, and Golden Ocean (NASDAQ: GOGL) 30%.

‘Day in the sun’ for smaller bulkers

“The Handys, which have been unloved for so long, are finally having their day in the sun,” affirmed Martyn Wade, CEO of Grindrod Shipping, which owns a fleet of Handysizes and Supramaxes. Wade was speaking at the Annual Capital Link Shipping Forum on Tuesday.

“The last time January finished stronger than December was actually in 2008,” Wade added. “You have to go back to the good old days of the last big market. We were looking at some of the voyage rates today and they are within a few bucks of their all-time highs.”

Sub-Capesize vessels carry grains and so-called “minor bulks” (bulk cargoes excluding iron ore, coal and grains). John Wobensmith, CEO of Genco Shipping & Trading, which owns a fleet of Capesizes and Supramaxes, asked the Capital Link forum, “When was the last time we’ve seen both a strong Atlantic Basin but also a strong Pacific Basin? That is what’s really driving the minor-bulk market.”

Wobensmith continued, “It’s a lot of fun to talk about all the grain. And don’t get me wrong: That’s definitely driving a lot of the spot market. But we’re also seeing a lot of cement, a lot of petcoke, [cargo] that is infrastructure-related.”

According to Wade, “Last month, between eight and 10 Ultramaxes [bulkers with capacity of 60,000-65,000 DWT] of steel went from South Korea to the U.S. and a half a dozen went to the Med and the Continent. There’s a lot going on. And it’s long-haul. And I don’t want to jinx it, but it’s very, very exciting times.”

Return of the Capes?

Cape rates topped $26,000 per day in mid-January before retreating all the way back to $10,300 per day in mid-February. On Wednesday, current Capesize rates jumped 14.5% to $13,900 per day, closing the gap with smaller bulkers.

“We’re in a little bit of a seasonal soft period,” said Wobensmith of the Capesize market. “We’re just coming out of the rainy season in Brazil. There’s [mining] maintenance. Vale [NYSE: VALE] in particular is still ramping up on the logistics side. My personal view is that when we get to the end of March and early April, we should start to see that seasonal upturn.”

Breakwave Advisors said in a new report, “Capesize rates have lagged and that is not surprising. Capesize fundamentals highly depend on iron ore that naturally exhibits the most seasonality of any other segment in dry bulk.

“As we enter March and miners begin to look for April loadings — most of the global chartering for Capesizes happens one month in advance — a tighter Capesize market is about to emerge,” predicted Breakwave. “With Panamax and Supramax rates providing significant psychological support to the overall market, the odds of another leg up for Capesize rates are looking quite good.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON DRY BULK SHIPPING AND SHIPPING STOCKS: Shipping stocks are suddenly surging across the board: see story here. Dry bulk shipping revs up after ‘extraordinarily bad decade’: see story here. How to go ‘straight to freight’ when betting on dry bulk: see story here.