In a video and blog post on LinkedIn, a media pitch and in overdue federal filings, TuSimple Holdings talks up its patent portfolio in autonomous trucking. The intellectual property hoard is impressive, but the timing is strange. Could this be a marketing push to attract interest in the U.S. business for which it is “exploring strategic alternatives”?

The San Diego-based company has amassed 591 patents in autonomous trucking, including 72 granted globally since the beginning of the year. In a blog post on LinkedIn, the 8-year-old startup says it is focusing on practical solutions to the complex challenges required to bring autonomous semi trucks to market.

A news release Thursday highlighting fourth-quarter financial results and the filing of its Securities and Exchange Commission 10-K for 2022, prominently mentions TuSimple’s core technology patents and intellectual property:

- ADS onboard software: perception, tracking and fusion; prediction and planning; and control modules.

- Core AI and data: data collection, deep learning and machine learning capabilities.

- ADS hardware solutions: sensors, actuators, communications and ADC.

- Offboard toolchain: map production, simulation and regeneration.

- AV operations: oversight, commercial operations, safety and integration.

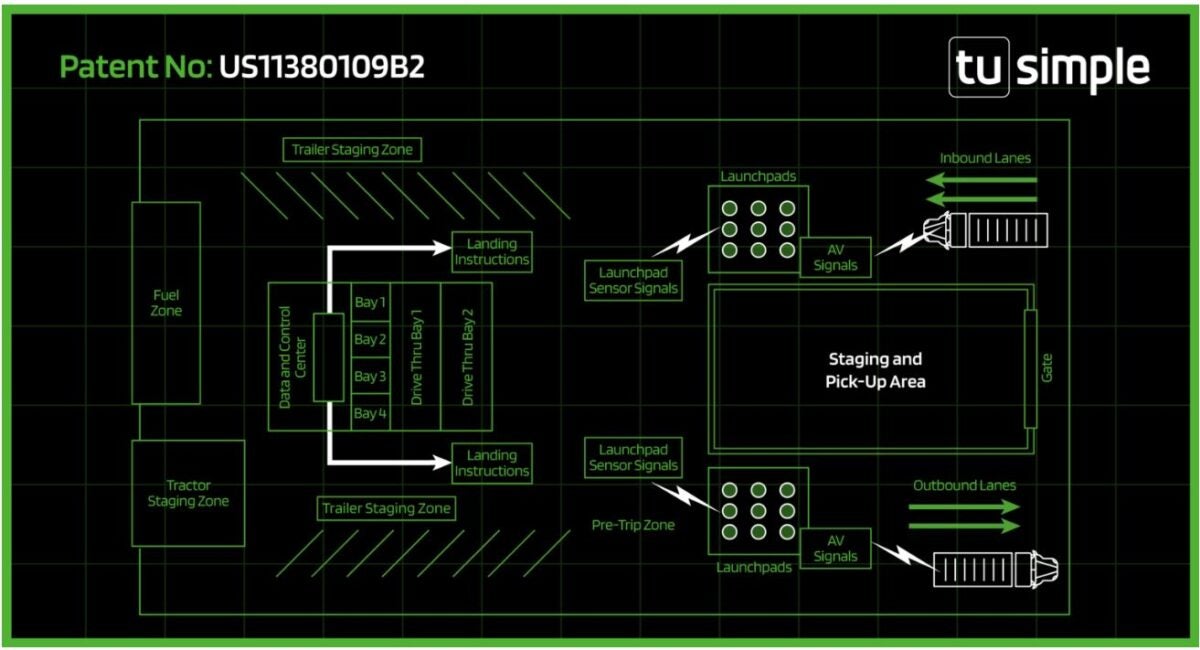

In a video and blog post, this chart breaks down how those patents are allocated.

‘Something we have long promoted’

The company offered an interview with Paul Liu, global head of intellectual property, but reneged when I asked whether the IP portfolio would be part of a possible sale of the U.S. business and related questions.

“TuSimple’s patent portfolio is something we have long promoted,” a spokesperson said in an email. “We have some of the most talented employees in the industry and their continued development of our autonomous driving system is something to be celebrated regardless of whether TuSimple is exploring strategic alternatives for its US operations.”

What about the other guys?

An apples-to-apples comparison of autonomous patents awarded and pending, trademarks, copyrights and trade secrets would be hard to compile. Based on the number of patents awarded and pending in autonomous trucking, here’s how a few leading companies responded:

Aurora Innovation has 1,510 awarded and pending patents comprising homegrown inventions and innovations obtained through strategic acquisitions. It contains older patents from Aurora’s focus on light vehicle ride-hailing products. Newer filings reflect recent advancements.

Kodiak Robotics has 100 patents filed that are under review. Plus has 438 awarded and pending patents worldwide. Torc Robotics does not disclose patent information and Waymo did not respond to an emailed inquiry.

Cummins CEO Jennifer Rumsey discusses battery cell partnership

Wednesday’s announcement of a planned joint venture by Cummins Inc., Daimler Truck and Paccar Inc. to make lithium iron phosphate (LFP) batteries in the U.S. broke some new ground in the trucking industry’s approach to its supply chain.

Working with a lesser-known Chinese battery technology company has advantages. The know-how could help create a local supply chain that should be easier to manage. And it should reduce worries about whether China will lock down exports of rare earth materials like cobalt and nickel.

Jennifer Rumsey, Cummins chair and CEO, and I talked about the potential for the partnership. The Q&A is edited for clarity and length.

Truck Tech: Who came up with the idea of a joint venture?

Rumsey: Paccar, Daimler Truck and Cummins all saw this opportunity and had an interest in coming together on this particular chemistry, LFP, to create a plan and share that investment because together we think we can create scale for a cell that will be uniquely suited for commercial vehicles. Paccar and Daimler can use that cell and the packs that they create for their trucks and Cummins can sell to other customers in commercial vehicle and industrial applications.

Truck Tech: When do you expect your production site to be announced and where would you expect that to be?

Rumsey: It’s going to take some time for us to hire the team and build the plant. Our plan is to start production in 2027 and scale up between the 2027 and 2030 time frame to that 21-gigawatt hour number.

Truck Tech: This is not a small amount of electricity. My math shows 21GWh is enough to power 16 million homes for a year.

Rumsey: We believe it’s something like 80,000 medium-duty trucks. Of course it depends on your exact range, design, but just an order of magnitude of what’s 21 gigawatt hours.

Truck Tech: How important is the onshoring of battery components given geopolitical considerations and the uncertainty at home?

Rumsey: The reality is a lot of the battery technology and manufacturing know-how today is outside the U.S. LFP in particular. A lot of that is in China. We believe we have a strong technology partner that has the technology and manufacturing know-how and we’re going to bring that to the U.S. Create a plant here in the U.S. Create jobs in the U.S. and, over time, localize the supply chain to support this battery cell plant here in the U.S. That ensures our industry has the cell that will meet our needs as we electrify and also ensure that we have security of supply over time.

Truck Tech: How much of a factor are the incentives from the IRA and the CHIPS and Science Act in deciding to go forward with this?

Rumsey: Cummins has been pretty active in advocating for regulation and incentives. We think [they] are necessary to really drive innovation and scale these technologies. Today, they’re more expensive. Our customers need to know that the solutions that they are purchasing are going to allow them to continue to be successful. And that there’ll be an infrastructure to support them. The value of regulation and these incentives, in particular the IRA, is [that] it helps to offset some of the higher cost. It creates certainty for investment in these new technologies.

Truck Tech: Some think incentives are tantamount to the beginnings of an industrial policy. Do you subscribe to this?

Rumsey: As you go into these new technologies, we need policies and complementary measures that can help to decarbonize from wells to wheels. Incentives help drive the economics of who’s going to pay for this and how you drive innovation and scale up and bring cost down. Without [incentives], decarbonization will struggle.

Cummins Chair and CEO Jennifer Rumsey talked about the new joint venture to bring battery cell production to the U.S. (Photo: Cummins)

Briefly noted …

Peterbilt marked the production of the 100,000th Model 389 long-hood Class 8 tractor at its plant in Denton, Texas.

TuSimple (above) filed its overdue financials for the fourth quarter and full year of 2022, losing $138.4 million or 61 cents a share including layoff costs.

ZF has developed a new electric motor that eliminates the need for rare earth magnets used in traditional electric drive motors.

The Oman Investment Authority is betting on Michigan LFP battery startup Our Next Energy (ONE) with an undisclosed investment.

The Volvo Trucks Customer Center has completed structural upgrades to the facility’s customer experience track in Dublin, Virginia, tripling the size of the 3-mile custom-designed course.

That’s it for this week. Thanks for reading. Click here to receive Truck Tech by email on Fridays. And catch up with the latest episodes of Truck Tech on Wednesdays at 4 p.m. EDT on the FreightWaves YouTube channel. Next week’s guest will be Salim Youssefzadeh, CEO of truck-as-a-service and infrastructure startup WattEV.