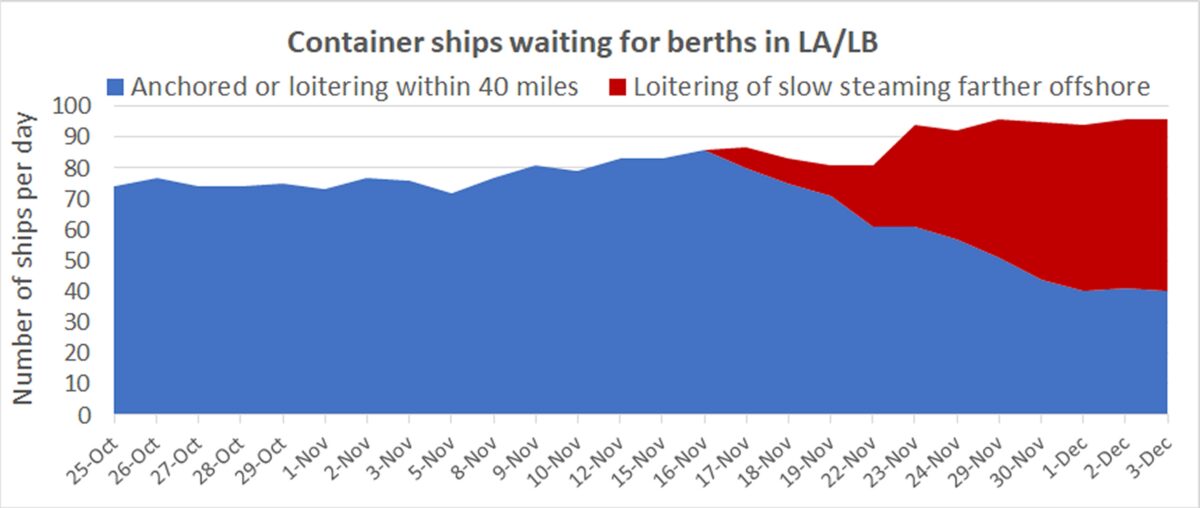

There were 40 container ships waiting for berths within 40 miles of the ports of Los Angeles and Long Beach on Friday. But there were also 56 container ships waiting farther out to sea, putting the actual tally at an all-time-high of 96, according to new data from the Marine Exchange of Southern California.

The Marine Exchange has just unveiled its new methodology for counting container ships waiting outside the 40-mile “in port” zone.

A new queuing system has been in place since mid-November that encourages container ships to wait outside of a specially designated Safety and Air Quality Area (SAQA) that extends 150 miles to the west of the ports and 50 miles to the north and south.

This has sharply reduced the number of ships closer to shore, leading to suggestions that efforts to tackle port congestion are cutting into the offshore queue — a misconception that should be dispelled by the Marine Exchange’s new counting method.

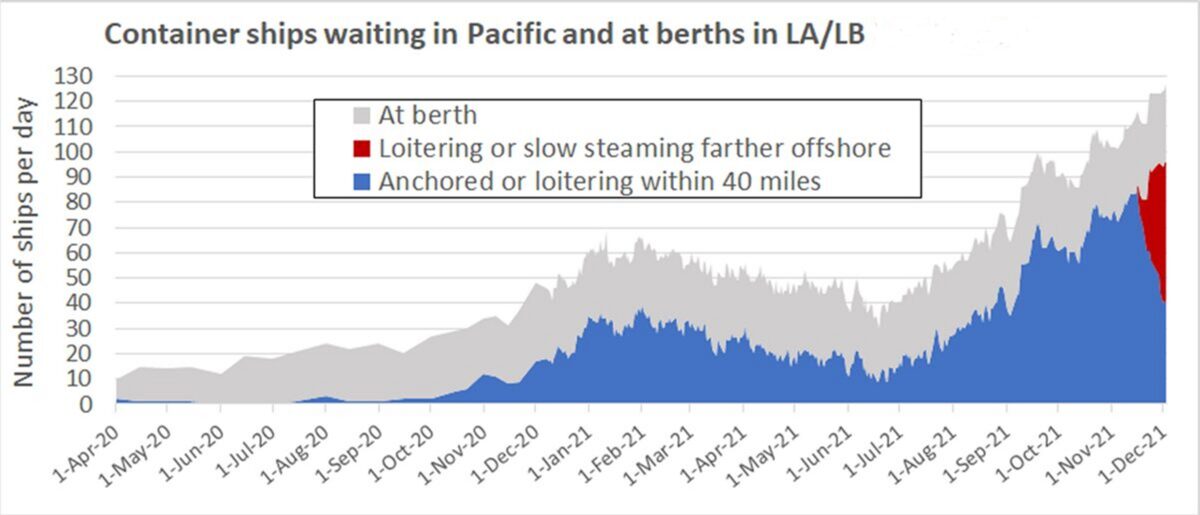

In addition to the 96 ships waiting offshore on Friday, there were 31 container ships at terminal berths, bringing the grand total to 127, at or near an all-time high. The total number of container ships either at berths or waiting offshore continues to rise: It is up 25% from the beginning of November, 41% from the beginning of October and 79% from the beginning of September.

New methodology approved

The new queuing system reserves a ship’s spot in line based on its calculated time of arrival (CTA), as opposed to the previous first-come, first-served system that entered a ship in the queueing list when it came within 20 miles of the ports.

The CTA is derived from when a ship would have hypothetically arrived from its last port of call, as calculated by the Pacific Maritime Monitoring System. The ship can then wait anywhere it wants outside the SAQA — even on the other side of the Pacific — knowing it has a spot saved in line based on its CTA.

Capt. Kip Louttit, executive director of the Marine Exchange of Southern California, said in his daily report on Friday, “The new methodology for determining the container-ship backlog for the ports of Los Angeles and Long Beach was approved by the working group this morning.”

The methodology, he explained, is to “take the traditional count of container ships anchored or loitering inside 40 miles of the ports” and then “add container ships loitering and slow-speed steaming across the Pacific outside the SAQA whose CTA is before the time of the report.” (Prior to Friday, American Shipper used the same methodology to estimate the total queue.)

The new queuing system was designed to improve safety and air quality, not reduce the number of ships in the queue. It doesn’t seem to have increased the backlog, either. The recent rise in the overall number of ships waiting at sea is in line with the historical pattern.

“Sanity check: The container-ship backlog was 86 on Nov. 16 when this new queuing system started and 10 more today is reasonable,” said Louttit.

The 96 ships in the queue had an aggregate capacity of 732,263 twenty-foot equivalent units. In 2020, the customs value of imports to the Port of Los Angeles averaged $43,899 per TEU. Assuming ships are at or near capacity, and cargo values are in line with last year’s, this implies there is roughly $32 billion of cargo in Southern California’s offshore queue.

Click for more articles by Greg Miller

Related articles:

- Ships in California logjam now stuck off Mexico, Taiwan and Japan

- California ship pileup still piling up — but out of sight, over horizon

- Congestion, falling arrivals hit Southern California import volume

- How to make a billion when your ships are stuck at anchor

- $25B worth of cargo stuck on 80 container ships off California

Jaxx

With all this waste a new small port could have been rigged..