Kansas City Southern ready to build $75M rail bridge in Laredo

Kansas City Southern is set to begin construction on a second international rail bridge at the Laredo, Texas-Nuevo Laredo, Mexico, border crossing.

Construction is scheduled to begin in October or November and expected to be completed by the end of 2023. The new $75 million rail bridge will parallel Kansas City Southern’s current one across the U.S.-Mexico border, where the Class I railroad already processes about 26 trains a day in a 24-hour period.

The addition of a second bridge will double cross-border rail container capacity in the Laredo-Nuevo Laredo region, said Oscar Del Cueto Cuevas, president of Kansas City Southern de Mexico (KCSM), a wholly owned subsidiary of KCS.

“It will double capacity for us, because right now with the current rail bridge, we have crews working in four-hour windows — four hours of trains moving north and then four hours south,” Del Cueto Cuevas said. “With the new rail bridge, we’re going to have a 24/7 interchange between Mexico and the U.S. by rail, operating with the second span there in the Nuevo Laredo-Laredo area. Trains will be moving north and south 24/7.”

Del Cueto Cuevas gave a presentation Thursday at the U.S.-Mexico Border Environmental Forum in San Antonio. The two-day event hosted by the North American Development Bank focused on cross-border partnerships, climate conservation finance, water issues, social and governance trends and other topics.

KCSM includes railways serving northeastern and central Mexico as well as key port cities including Veracruz, Tampico and Lazaro Cardenas.

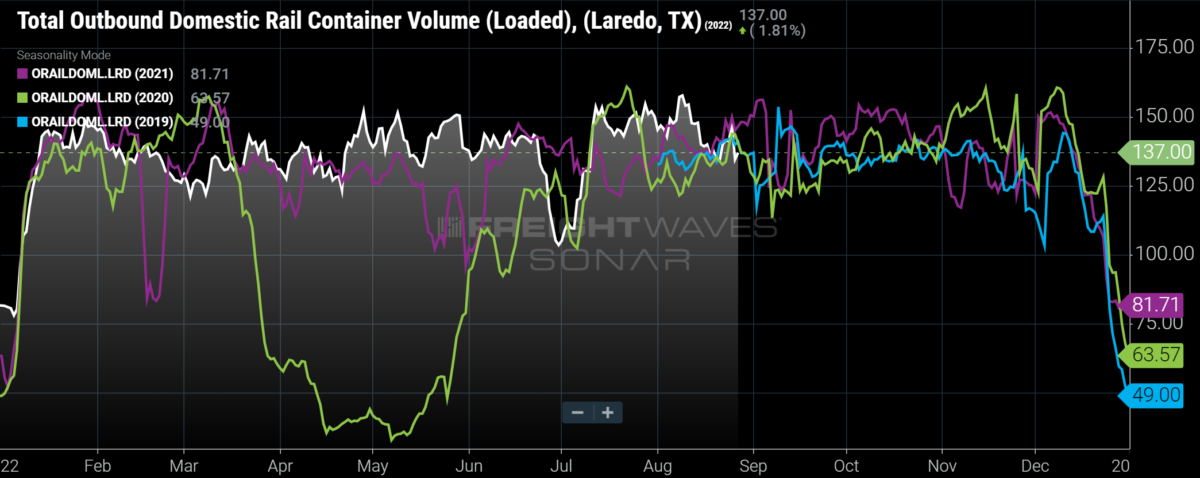

Laredo’s outbound domestic intermodal volume (ORAILDOM.LRD) in August is tracking roughly the same totals during the same period over the past few years, according to the FreightWaves SONAR chart below. Expanding capacity via a second bridge could cause intermodal volumes to increase significantly.

Del Cueto Cuevas also discussed Kansas City Southern’s pending acquisition by Canadian Pacific (CP), which recently received permission from U.S. federal regulators to pursue the deal.

CP said it expects the acquisition’s review by the Surface Transportation Board to be completed in early 2023.

Shareholders of CP (NYSE: CP) and KCS (NYSE: KSU) approved the $31 billion deal last December. CP and KCS say the merger would create a single rail system known as Canadian Pacific Kansas City (CPKC), with a network that would include approximately 21,400 total miles of track, about 6,900 miles of that in the U.S.

The network would extend from Canada across the U.S. and into Mexico, and CP and KCS say the new rail system would create an “end-to-end” merger because the existing CP and KCS systems don’t overlap.

“This is a very good news for the U.S., Canada and Mexico,” Del Cueto Cuevas said. “It will provide opportunities to grow exports from Mexico into the Canada and the U.S. markets.”

U.S.-Mexico trade has been strong all year, said Ken Roberts, founder and president of WorldCity, a media company focused on the impact of export-import trade on the nation’s ports and border crossings.

“Five out of the top 10 record monthly trade totals between the United States and Mexico have been in 2022,” Roberts told FreightWaves.

Mexico ranks as the No. 2 trading partner of the U.S., according to the latest trade data for the month of June, with Canada at No. 1. Mexico’s total trade with the U.S. increased 19% year over year to $67.9 billion in June, compared to the same period in 2021.

“The growth in trade between the United States and Mexico this year has largely been because of oil on the import side and gas on the export side,” Roberts said. “Oil imports from Mexico to the U.S. are up almost 80% year over year, and the value of gasoline that the U.S. is exporting to Mexico is up almost 60% year over year.”

Roberts said the U.S. has exported over $20 billion year to date in gasoline to Mexico, a pace that could continue with the ongoing Russia-Ukraine war.

“A lot of the demand for oil and gas has been driven by prices at the pump,” Roberts said. “I think that we’ll see some moderation in gas and oil prices, but the Ukrainian situation is not resolved and that’s one of the drivers in this whole thing. China then counterbalances that because it keeps having [COVID-19] lockdowns and its economy is showing signs of sputtering. Gas prices are still elevated from where they were before the pandemic, but they’re already well below where they were two months ago, and I just wonder how that continues to play out.”

Texas firm to construct truck and trailer parking facility near Houston

Houston-based DryPort Capital recently announced plans to build a truck and trailer parking facility in the city of Katy, about 30 miles west of Houston, according to the Houston Business Journal.

The 19-acre site will include 325 tractor/trailer paved parking spaces, LED lighting, private gate access, 100-foot-wide drive aisle and security fencing and cameras, as well as showers and restrooms.

DryPort Capital has named the project Riggy’s West 10. It is scheduled to break ground in December and be completed in 2023. Terms of the transaction were not disclosed.

DryPort Capital, a real estate logistics investment firm, currently manages three truck and trailer parking facilities in the Houston area, totaling 653 spaces.

Omni Logistics opens new shipping hub in Dallas

Omni Logistics announced Thursday it has opened a 366,711-square-foot logistics facility in Dallas.

The facility totals three warehouses and features 83 dock doors. The gated campus is a Customs Trade Partnership Against Terrorism certified facility.

The campus is located about 8 miles from the Dallas/Fort Worth International Airport and 17 miles from Dallas Love Field Airport.

Dallas-based Omni Logistics is a global third-party logistics provider operating in over 100 locations in 21 countries. The company, boasting 4,500 global employees, generated over $2 billion in revenue in 2021.

New Mexico port expanding with help from federal grant

The Department of Transportation recently awarded a $1.1 million grant aimed at increasing commercial capacity and trade flow through the U.S. Mexico port of entry in Santa Teresa, New Mexico.

The grant will be used to create an integrated logistics hub, being referred to as the Tradeport, according to a news release from authorities in Doña Ana County. The Tradeport site is located near the Santa Teresa port of entry, a commercial and noncommercial gateway on the U.S.-Mexico border. It contains a commercial truck crossing into Ciudad Juarez, Mexico.

“This latest announcement marks several wins for projects underway at the industrial park such as the grade separation of Industrial Avenue and the state’s commitment to expanding capacity out of the port of Santa Teresa,” Fernando Macias, Doña Ana County manager, said in a statement.

Authorities did not provide a timetable for the project’s completion.

Watch: Van and Reefer contracted rates decline this week.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Texas, California border-crossing projects key to US-Mexico trade growth

RebeccaEnglish

SDDFVSD