Although Kansas City Southern (NYSE: KSU) declined to provide any guidance on 2020, opportunities to grow cross-border volumes, coupled with additional savings and operational efficiencies as a result of precision scheduled railroading (PSR), will enable the railroad to increase its profitability next year, KCS executives said during the company’s third-quarter earnings call on October 18.

“We believe that there is more to come. We’re not done yet certainly with our transformation, and we’ll have more to say about that over the coming months,” said Chief Executive Officer Pat Ottensmeyer.

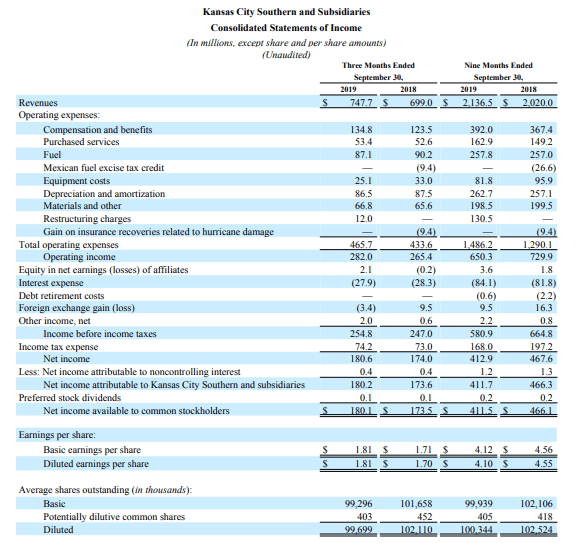

Record revenues helped the company generate a 3% increase in third-quarter profit compared with the same period in 2018. Reported net income for the third quarter was $180.6 million, or $1.81/diluted share, compared with $174 million, or $1.70/diluted share in the third quarter of 2018.

Adjusted diluted earnings per share were $1.94, 24% higher than the same period in 2018. The company said investors should consider the adjusted earnings because they take into account factors such as foreign exchange currency rates, the impact of adjustments to the 2017 provisional income tax benefit for the Tax Cuts and Jobs Act and other items that are not directly related to ongoing operations.

Kansas City Southern is in the midst of what executives called “whiteboarding,” or defining how to improve efficiencies at the railroad’s rail yards. The process, which KCS expects to finish sometime in the fourth quarter, looks at the two “pillars” of PSR, according to Sameh Fahmy, executive vice president of PSR. Those pillars are reducing switching, which has also been described as how many times a railroad “touches” a railcar, and reducing trains, which results in consolidating trains and cutting crew starts.

“We’re continuing to try to build a network that can haul more freight” and has capacity for additional volumes, whether those volumes are intermodal or manifest, said Chief Innovation Officer Brian Hancock.

Performance changes so far include a 17% improvement in gross velocity, from 11.1 miles per hour (mph) in the third quarter of 2018 to 13 mph in the third quarter of 2019, a 14% decrease in terminal dwell from 24.4 hours to 21.1 hours, and a 2% increase in train length, from 5,803 feet to 5,948 feet.

Looking ahead, the company is eyeing continued growth for cross-border volumes for several commodities, including agricultural products and minerals. Kansas City Southern is also anticipating to increase its volumes for petroleum and chemicals as a result of energy reform in Mexico, which has allowed the country to import energy products.

The company is also watching the possibility that some companies might be relocating their offices from Asia to Mexico, but that will depend on whether the U.S. Congress passes the modified trade agreement between the U.S., Canada and Mexico that will replace the North American Free Trade Agreement, or NAFTA.

Operating ratio (OR) in the third quarter was 62.3%, while the adjusted OR was 60.7%. In the third quarter of 2018, the OR was 62%, while the adjusted OR was 63.4%. Investors sometimes use OR as an indicator or profitability, with a lower OR implying greater profitability. Kansas City Southern defines OR as dividing operating expenses by revenues.

Third-quarter revenue rose 7% to $747.7 million even though carloads were flat year-over-year. Among the notable gains, increased refined fuel products and liquid petroleum gas shipments to Mexico helped fuel a 21% revenue increase in KSU’s chemicals and petroleum segment, while improved cycle times helped the minerals segment’s third-quarter increase by 15%.

Reported operating expenses were $465.7 million in the third quarter of 2019, compared with $433.6 million in the third quarter of 2018. But KSU said investors should consider adjusted operating expenses of $453.7 million.