The port of Shenzhen, China. ( Photo: Shutterstock ) [/caption]

The port of Shenzhen, China. ( Photo: Shutterstock ) [/caption]

This morning, a super-team of Stifel equities analysts covering all modes of transportation and categories of logistics companies came together like Voltron and issued a research report detailing their view of the risk to transport stocks posed by tariffs and a potential trade war. David Ross (trucking), Bruce Chan (global logistics), Mike Baudendistel (railroads), Ben Nolan (ocean shipping), and Joe DeNardi (airlines) presented their perspectives on the origins, purpose, and likely outcomes of the Trump administration’s pivot toward protectionism.

Even a large-scale trade war is unlikely to reshore large volumes of industrial production back to the United States because the country is already experiencing a widespread shortage of blue-collar labor (it manifests itself in the trucking industry as a driver and maintenance technician shortage), Stifel said. And shippers will wait to see how severe, and more importantly how permanent the tariffs will be before undergoing costly adjustments of their supply chains. At this point, according to Stifel, the most likely outcome is that shippers moving goods with inelastic demand will pass on rising costs in the form of higher consumer prices, while other manufacturers will be forced to eat the costs. Thus, the main risks to the transport sector from a trade war are twofold: rising consumer prices leading to inflation and suppressed demand, and compressed corporate profit margins.

[caption id="" align="alignnone" width="1486.0"] ( Graph: Stifel Financial Corp ) [/caption]

( Graph: Stifel Financial Corp ) [/caption]

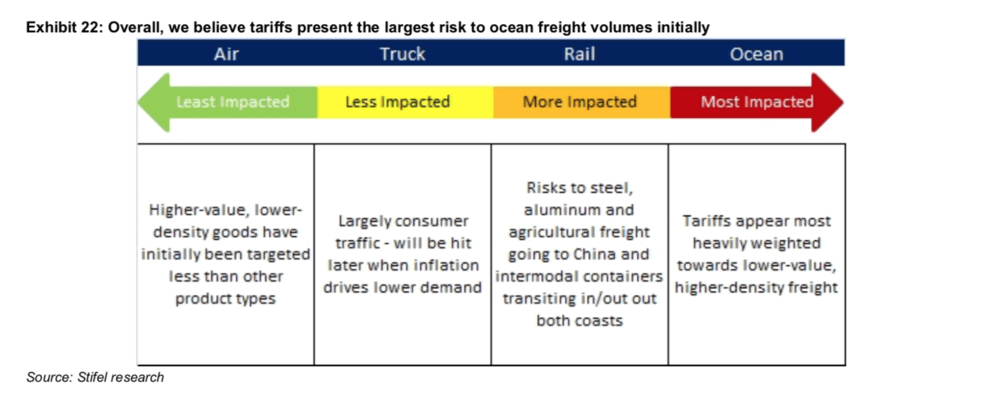

Stifel believes the mode most exposed to trade war risk is maritime shipping, particularly dry bulk haulers carrying commodities like steel, iron ore, coal, bauxite, and grains that have been specifically targeted by tariffs. Nolan noted that every ton of steel production re-shored to the United States implies a reduction of imported iron ore by two tons and imported metallurgical coal by one ton. “Tariffs appear most heavily weighted towards lower-value, higher-density freight,” Stifel wrote. Container shipping would only be modestly affected, Nolan said, while tanker vessels carrying petroleum products are not at risk.