Knight-Swift Transportation (NYSE: KNX) announced Monday further expansion into the less-than-truckload market. The carrier acquired RAC MME Holdings, parent of LTL carrier Midwest Motor Express and truckload carrier Midnite Express, for $150 million in cash.

Bismarck, North Dakota -based Midwest Motor Express was founded in 1918 and operates 33 terminals (800 doors) throughout the Upper Midwest and Northwest. Through carrier partners like Pitt Ohio, Saia (NASDAQ: SAIA) and Southeastern Freight Lines, it provides next-day and second-day service throughout the U.S. The company also provides a full lineup of international logistics services through its non-vessel operating common carrier Midwest Motor Express Global Lines.

West Fargo, North Dakota-based Midnite Express provides full truckload service with a fleet of company and owner-operator trucks. It also provides contract logistics and warehousing services.

Collectively, the group is known as MME, which has approximately 460 tractors, 930 trailers and 800 employees.

MME is expected to generate $137 million in revenue, $27 million in adjusted earnings before interest, taxes, depreciation and amortization (deal price less than 6x EBITDA) and $16 million in operating income during 2021. The deal is expected to add 6 cents per share to 2022 adjusted earnings compared to Knight-Swift’s current consensus estimate of $4.87.

| Acquisition price | $150 million |

| MME revenue run rate | $137 million |

| Knight-Swift revenue run rate | ~$5.5 billion |

| Earnings accretion | 6 cents per share in 2022 |

| Recent acquisitions by Knight-Swift | AAA Cooper, UTXL, Eleos, Abilene Motor Express, Swift Transportation |

| Financing | cash, revolver |

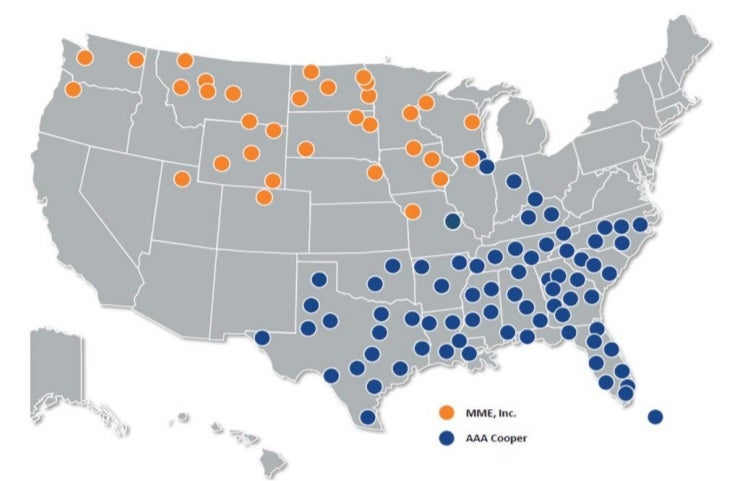

The transaction follows Knight-Swift’s $1.35 billion leap into the LTL arena with the July acquisition of Dothan, Alabama-based AAA Cooper Transportation (ACT). That deal onboarded $780 million in LTL revenue, approximately 70 terminals (over 3,400 doors), 3,000 tractors, 7,000 trailers and 4,800 employees.

“MME is our next step toward a nationwide LTL network,” said Dave Jackson, Knight-Swift CEO. “While preserving and supporting MME’s identity and culture, we expect to bring many synergies from Knight-Swift. MME and ACT have minimal regional overlap, and we expect they will be a benefit to one another.”

MME’s management will remain in place and continue to be led by Marlin Kling, president and CEO since 2006.

“We believe that combining our company with North America’s truckload industry leader, Knight-Swift, and being part of building the next nationwide LTL network is an exciting development for MME and its employees,” Kling said. “We look forward to achieving synergies, sharing best practices and creating value for all Knight-Swift stakeholders.”

Middle-market private equity firm Red Arts Capital led the ownership group, which included Prudential Capital Partners (NYSE: PRU) and Brightwood Capital Advisors, in the sale of MME.

Knight-Swift becoming a national player in LTL

Buying AAA Cooper was a transformational shift for Knight-Swift, which generates more than $5 billion in annual revenue from its TL, logistics and intermodal units, with the lion’s share tied to trucking.

Bringing on MME expands Knight-Swift’s LTL footprint north and west, overlapping very little with AAA Cooper, which operates a network covering El Paso, Texas, to the southern East Coast, with only a few locations in the Midwest.

Acquired at a purchase price roughly 10x EBITDA, AAA Cooper was originally guided to generate $140 million in EBITDA and $80 million in operating income during 2021. AAA Cooper was immediately accretive to earnings, adding 13 cents per share to second-half 2021 adjusted earnings and 29 cents per share to 2022 numbers.

Knight-Swift said its combined LTL operations account for 2021 pro forma revenue of more than $800 million, excluding fuel surcharges, making it a top-15 LTL provider. Both LTL carriers are running at a high-80% operating ratio, but the expectation is that the LTL operation will achieve a mid-80% OR in three years.

Investors see the value in owning an LTL

Led by Red Arts Capital, the ownership group bought MME just before the pandemic’s onset from the families that founded it. The transaction was well-timed. COVID-19 pulled forward years of demand for e-commerce and final-mile fulfillment as consumers were forced to buy goods online while stuck at home. The change in spending habits tremendously benefited all of trucking, notably the LTLs.

“We felt it was a great time to invest in LTL and that thesis has proved out,” Nick Antoine, co-founder and managing partner of Red Arts Capital, told FreightWaves in an interview. “Now … it’s a transition to a permanent home. I think it would be hard for us to find a better home for this business … so they can continue to grow for the next 100 years.”

Knight-Swift’s desire to possess a national LTL network, in addition to its TL operations, highlights the value in owning an LTL.

For starters, the LTL space is highly defensible, requiring significant capital to enter given the real estate (terminals) requirement. With only a few large competitors, compared to a highly fragmented TL market where the bulk of the fleets only have a couple trucks or as few as one, LTL rate negotiations tend to be less volatile. In fact, the industry as a whole has seen yields step methodically higher over the last decade.

Valuation multiples are higher as well. With a bigger portion of the balance sheet tied to appreciating real estate assets versus depreciating rolling stock, some LTL stocks are currently trading around 30 times earnings compared to the TLs, where many are trading just north of 10 times.

Even though Knight-Swift will run LTL separately from TL, there are some synergies.

Less-than-truckload carriers usually have significantly more customer accounts than TLs, which provides Knight-Swift cross-sell opportunities into its other three offerings. The LTL operation can also look to Knight-Swift’s TL operation for linehaul capacity and to unload heavier spillover freight that clogs LTL networks when overall truck capacity is tight.

The shorter distances between LTL terminals, ideal for e-commerce and final-mile fulfillment, could allow Knight-Swift to become more involved in multistop TL services.

“E-commerce is having a huge impact on expectations for fast shipping times. It’s changing the fabric of our supply chain,” Antoine continued. “Last mile is part of that local pickup and delivery that LTL provides. I think that lends to a tailwind for LTL.”

Antoine also likes the dynamics around driver retention in LTL, noting turnover is traditionally far lower compared to TL.

“One of the things that we loved about LTL, going into the space, was that drivers get to be home every night for the most part. This offers an opportunity to continue to invest in a space where you’re improving quality of life.

“We think this is a great place for the long tailwind and certainly some of the reasons why we invested in the space,” Antoine concluded.

Red Arts Capital is focused on investments in primarily family-owned companies providing supply chain, transportation and logistics services. Its portfolio includes volume LTL provider Sunset Pacific Transportation and Canadian third-party logistics provider Radius Logistics, which it acquired in January.

Scudder Law Firm represented Knight-Swift in the transaction with Stifel and Greenberg Traurig LLP advising Red Arts Capital.

Dick Bischoff

So Knight-Swift owns two small regional players that survive off the largesse of other carrier partnerships feeding them business. Would be interesting to see how much business they own within their own footprint versus what they are fed by other carriers?

Laura Diederich

★Makes 💵$140 to 💵$680 per day online work and I received 💵$16894 in one month online acting from home. I am a daily student and work simply one to a pair of hours in my spare time. Everybody will do that job and online ask extra cash by simply .

open this link HERE↠↠↠☛ http://www.EarnApp3.com

Keri Burke

[ JOIN US ] I get paid more than $30 to $87 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily $10k from this without having online working skills . Simply give it a shot on the accompanying site…

copy and open this site .…………>> http://Www.NETCASH1.Com

Bernice Bosworth

[ JOIN US ] I get paid more than $30 to $87 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily $10k from this without having online working skills . Simply give it a shot on the accompanying site…

copy and open this site .…………>> http://Www.NETCASH1.Com