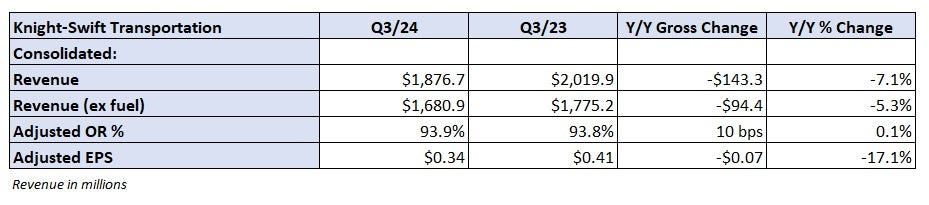

Knight-Swift Transportation beat third-quarter expectations Wednesday after the market closed. Guidance introduced for the first quarter was worse than expected.

Knight-Swift (NYSE: KNX) reported adjusted earnings per share of 34 cents, which compared favorably to the consensus estimate of 32 cents and management’s guidance of 31 to 35 cents. The result was 7 cents lower year over year.

The company reiterated fourth-quarter adjusted EPS guidance of 32 to 36 cents, which bookended a 34-cent consensus estimate at the time of the print. First-quarter guidance of 29 to 33 cents was light of a 36-cent consensus estimate.

Click for full article: “Knight-Swift starting to see positive TL rate negotiations”

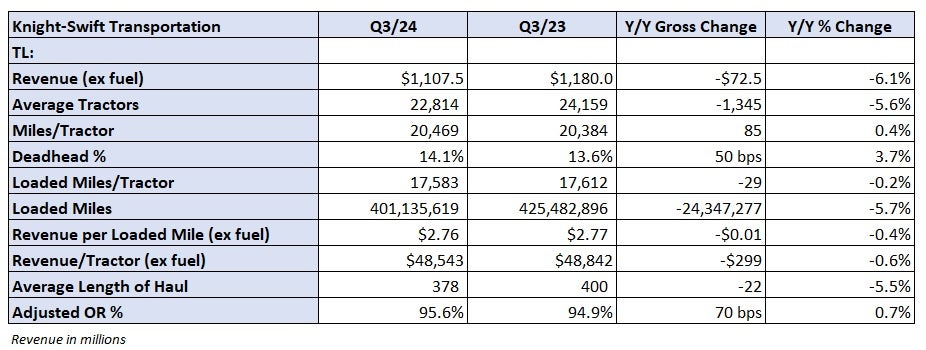

Knight-Swift’s truckload segment reported a 6.1% y/y revenue decline as average tractors in service were down by a similar percentage. Efforts to improve equipment utilization led to flat miles per tractor in the quarter and a slight decline in revenue per tractor.

Revenue per loaded mile excluding fuel surcharges was flat at $2.76. Knight-Swift said it saw rate increases on its “more recent truckload bid awards” and on spot activity. It said average spot rates are still higher than contractual rates and that both are still at “unsustainable levels.”

The unit posted a 95.6% adjusted operating ratio, 70 basis points worse y/y but 160 bps better than the second quarter. The legacy fleet recorded 250 bps of sequential OR improvement while U.S. Xpress’ operations were a 220-bp drag on the segment in the quarter.

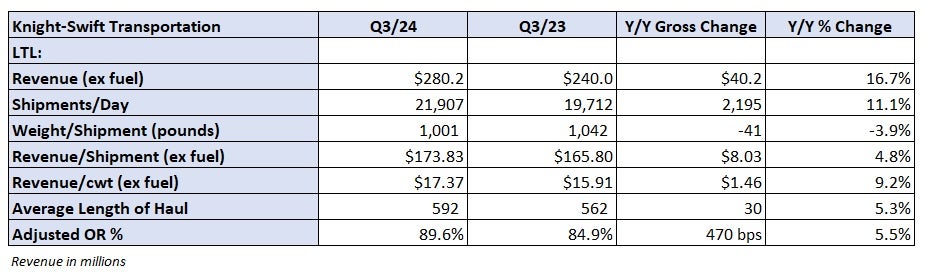

Less-than-truckload revenue increased 16.7% y/y as shipments increased 11.1% and revenue per shipment was up 2.9% (4.8% higher excluding fuel). The unit recorded an 89.6% adjusted OR, which was 470 bps worse y/y. Costs associated with opening new terminals were the reason for the margin erosion in the quarter. Knight-Swift opened 16 new locations in the third quarter after opening 18 in the first half of the year. It expects to add four more terminals by year-end.

It also acquired Dependable Highway Express at the end of July for $185 million, adding 14 terminals to the network. In total, service center growth this year has added 1,500 doors, a 32% increase.

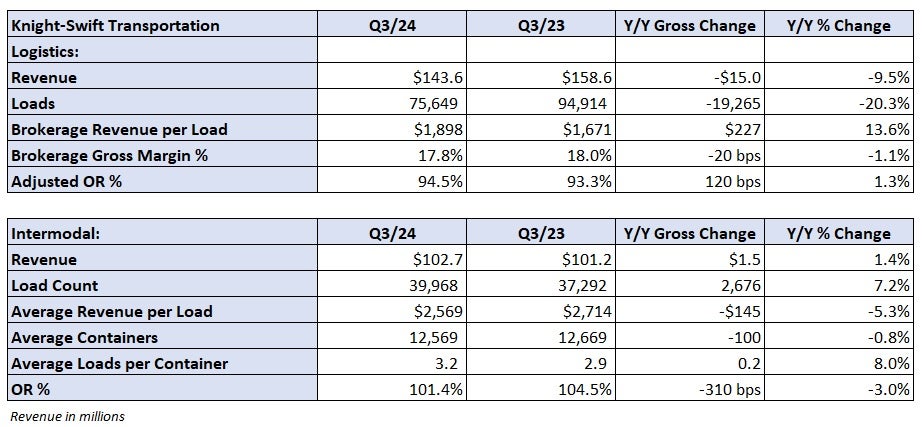

The logistics segment, which includes truck brokerage, saw revenue fall 9.5% y/y as a 21.1% decline in loads was partially offset by a 13.6% increase in revenue per load. The unit reported a 94.5% adjusted OR, 120 bps worse y/y.

Losses within the intermodal unit narrowed in the quarter. The division posted a 101.4% adjusted OR, which was a sixth consecutive operating loss.

Knight-Swift will host a call to discuss third-quarter results at 5:30 p.m. EDT on Wednesday.