Second-quarter earnings for Kuehne + Nagel, the world’s second-largest logistics provider, underscore how supply chain disruptions that hurt the bottom line of goods’ owners can drive profits as customers seek extra help navigating shipping complexity and uncertainty.

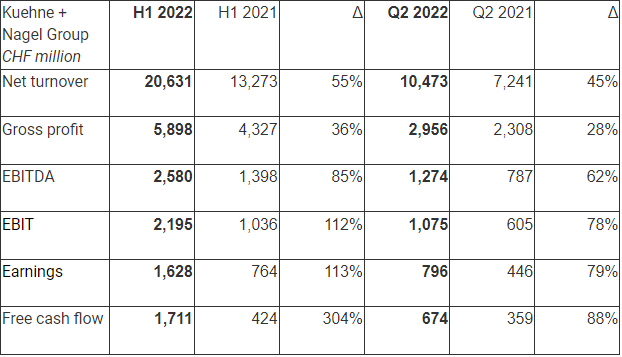

Elevated yields continued to exceed exceptionally high freight transportation and warehousing costs, pushing up revenue 45% to 10.4 billion Swiss francs ($10.9 billion) and operating profit 78% to $1.1 billion versus the 2021 June quarter, Kuehne + Nagel (OTCUS: KHNGY) said Monday. Quarterly and first-half revenue was nearly double the same periods prior to the pandemic, and pretax income quadrupled from 2019, even as freight volumes eased from a year ago.

It was the third consecutive quarter with operating profit in excess of $1 billion. The company’s freight networks are operating at full capacity, which is furthering customer interest in digital tools to increase efficiency.

The logistics service provider achieved strong results, led by its ocean and air segments, despite headwinds from COVID lockdowns in China, the invasion of Ukraine, soaring fuel prices, high inflation and port congestion.

Switzerland-based Kuehne + Nagel said it has been able to pass on higher expenses to customers, much like airlines have done for fuel expense, but high yields also reflect the level and intensity of service required to keep shipments flowing.

CEO Detlef Trefzger suggested this year’s dip in freight volumes was mostly due to supply constraints than weak demand and that second-half demand is picking up, downplaying reports that large retailers have cut back orders because inventories are too high.

“We don’t see a major difference because small-and-medium size accounts are starting to build up their inventory. So we see a positive outlook,” he told analysts during a web briefing.

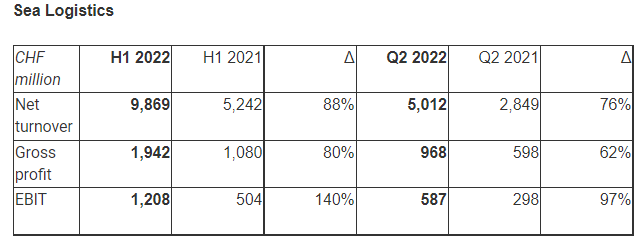

Despite a 2.4% dip in ocean volumes to 1.1 million twenty-foot equivalent units (TEU), Kuehne + Nagel’s ocean revenue increased 76% to $5.2 billion, while operating profit jumped 97% to $610 million during the second quarter versus last year. Organic container volumes — eliminating extra business from acquisitions in 2021 — fell 4%. The decline in TEUs was less than the 5% experienced by the overall ocean market. Operating costs are much higher than usual because ongoing supply chain disruptions minimize the effectiveness of automated tools and require extensive manual interventions to ensure cargo isn’t stuck or delayed, Trefzger said.

“The bottleneck in the market is logistics experts. We have a lot of vacant jobs and we see it’s getting better month over month with our recruiting initiatives and with our industry being more and more attractive, especially for young people who want to grow into a cool industry,” he said.

Kuehne + Nagel has been holding back on adding customers because of transport shortfalls, but will strive for volume growth as soon as more vessel and equipment capacity becomes available, something it doesn’t expect to happen for at least six to 12 months, the chief executive said.

Air cargo adds to bottom line

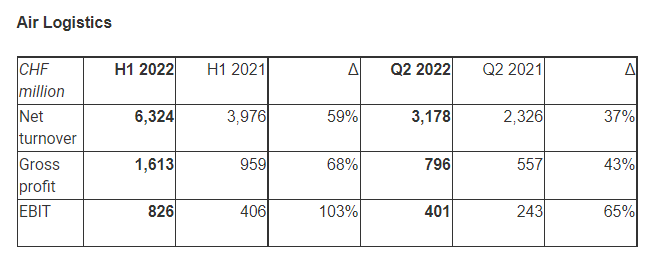

Slower demand, the closure of Russian airspace in response to Western sanctions over Ukraine and the May lockdown of Shanghai that forced rescheduling and diversion of many shipments dragged down organic airfreight volumes by 7% in the second quarter versus a marketwide decline of about 5%. Comparisons are skewed by the May 2021 acquisition of 88% of Apex Logistics, a major airfreight management company in the Asia-Pacific market, which nominally boosted the air division’s tonnage by 3% and pretax earnings by $181 million. Second quarter air cargo revenue increased 37% to $3.3 billion, with operating profit up 65% to $417 million, reflecting the high-yield environment influenced by a shortage of air capacity and the positive influence of the Apex acquisition. More than 50% of K + N’s gross air profit turned into total operating profit. The capture rate was up 9% from the first half of 2021 because of the added efficiencies gained through the Apex deal.

The lingering impact of China’s mass quarantine in Shanghai resulted in a 19% drop in air cargo volume during June, but volumes are recovering now, led by double-digit growth in pharmaceutical and aerospace throughput, said Trefzger.

K + N said its workflow digitization transformation for automating documentation, quotation, booking and status updates saved 10% in man-hours since the end of 2021, with an estimated cost savings of 20% and 1.7% contribution to operating profit in the air logistics unit alone. The e-Touch initiative could soon deliver 5% to profitability, said CFO Markus Blanka-Graff.

Kuehne + Nagel currently moves 65% of shipments on dedicated freighters and only 35% in the lower hold of passenger aircraft, in line with the market’s overall capacity distribution. Trefzger said the balance isn’t expected to change this year because airlines will dial back peak-season travel offerings for the slower winter season and some major markets, such as China, still don’t allow unrestricted foreign travel, further limiting capacity.

Pay for performance

Shippers should realize that logistics services going forward will be two to three times more expensive on average than before the pandemic because high service levels and infrastructure investments need to be rewarded, management said.

“Good service will be paid well with our efficient systems and customer orientation, how we solve problems for customers, the flexibility we deploy on a daily basis with our logistics experts,” CFO Blanka-Graff said.

Kuehne + Nagel said trucking volumes increased significantly, leading to a 12% increase in revenues and record $83 million operating profit for the January-June period.

Since June, the company has been using biofuel for road transport of Moderna’s COVID-19 vaccines from the production site in Spain to a distribution center in Belgium, eliminating most carbon dioxide emissions in the process.

Contract logistics revenues increased 9% in the second quarter, as the company continued to expand service offerings in the e-commerce and pharmaceutical sectors. Business in North America and Asia is growing at twice the speed of Europe, in line with the company’s strategy, and 80% of lease commitments are backed by customer contracts. Warehouse utilization is 98%, meaning buildings are essentially full.

In May, K + N began construction of a 1.4 million-square-foot regional distribution center for Adidas in Mantova, Italy.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Boeing, Airbus raise 20-year outlook for air cargo on express growth

Kuehne + Nagel’s 2021 earnings swell on 50% air, ocean margins