The world’s largest logistics provider threw cold water on prospects for a measurable rebound in cross-border freight transportation during the normally busy months leading up to holiday shopping events.

Kuehne+Nagel and rival powerhouse DSV this week reported sharply lower earnings for the second quarter that aligned with the broader industry’s prolonged downturn, singling out airfreight as the weakest part of their businesses. Both emphasized that they have adapted to more normalized market conditions by focusing on cost measures, including the elimination of 1,900 office jobs in DSV’s Air & Sea division in the past seven months. But DSV slightly diverged on expectations for possible green shoots in the back half of the year.

The results, nonetheless, were significantly better than the years prior to COVID, which overturned the global economy and triggered a stampede for logistics services that could correct for systemic delays. K+N registered record profits in 2021 and 2022. And the second quarter of 2022 was the best quarter in DSV’s history.

Switzerland-based K+N said it has stepped up measures to control costs in response to the decline in demand for logistics services, especially for ocean and air shipping. The company, which ranks first in logistics by revenue, on Tuesday reported net revenue of 5.97 billion Swiss francs ($6.9 billion), 43% less than the year-ago period, and a 51% fall in operating profit to $605 million.

“Unfortunately . . . there is no peak season to be expected in 2023. There are no signals either on air or sea, at least not for the time being, so we have to be very cautious on that,” said CEO Stefan Paul during the quarterly call with analysts.

“But we do believe that we may be near an inflection point with a potential to return to a positive year-on-year volume growth versus easier comps in the second half,” he elaborated.

K+N’s size means it has extensive insight into thousands of supply chains.

Paul said his definition of a peak season is at least 10% to 15% volume growth from August to November.

“I would really be taken by surprise if this is going to happen after talking to many customers on a regular basis,” he said, adding that air cargo demand will likely remain stuck at current levels before picking up early next year. Container shipping might experience an uptick in the next few months, particularly in the fourth quarter.

K+N air cargo results descend

The hardest hit unit during the quarter was air logistics, which experienced a 16% decline in volumes compared with last year. Air results underperformed the overall market, which was down about 6% in throughput for the three-month period. The price of shipping by air is 40% to 50% lower than a year ago, according to reporting agencies, and is at pre-pandemic levels on most trade lanes when fuel surcharges are subtracted.

K+N is the largest global airfreight forwarder by tonnage. In 2022, it managed transport for more than 2.4 million tons of cargo. Airfreight volume in the first half was 1 million tons. Second-quarter operating profit for air cargo plunged 65% to $160.3 million as low volumes combined with low rates to drive down revenues by 48%.

Two airfreight niches that did well were perishables, which experienced low double-digit growth in volume, and semiconductors. The microprocessor business is still relatively small but is a new strategic focus for K+N. During the quarter, K+N won a large contract from a semiconductor equipment manufacturer, which will contribute to the use of sustainable aviation fuel.

The third-party logistics provider has several full-time charter aircraft at its disposal, including two new Boeing 747-8 freighters operated by Atlas Air. Those contracts are likely acting as a drag on earnings at the moment because the weak market makes it difficult to fill the planes. In April, K+N launched a dedicated freighter service to Birmingham, Alabama, to support Mercedes-Benz and other businesses.

Paul said the company’s air cargo results could modestly improve in the second half relative to last year because the downturn in international shipping was gaining steam then and has now flattened out. “We believe year-on-year volume declines may moderate to a high single-digit decline over the near term with a potential for return to growth before year-end,” he added.

In June, K+N signed an agreement to acquire Morgan Cargo, an airfreight forwarder in South Africa, the U.K. and Kenya. The company specializes in perishable goods and handled 44,000 tons of air cargo, as well as 20,000 standard ocean units, in 2022. The deal is expected to close during the current quarter.

K+N’s container shipping revenue fell 56% and operating profit was cut in half during the second quarter, but the company claimed it gained share in a market that contracted about 5%. Customers are placing a similar number of orders, but for less quantity, the leadership team said.

The contract logistics business posted strong results in the quarter, with earnings before interest and taxes growing 30% to $55.3 million.

Management said it was able to reduce unit costs by 14% from the first quarter through June. On the air side, K+N cut costs per 100 kilograms by 9% year over year. Unit costs for the ocean business were trimmed 13%.

Executives said they rolled out e-commerce offerings tailored to small businesses, which combined multiuser fulfillment centers with international and last-mile delivery, in pilot markets and intensified a sales push in Korea and Japan.

The workflow transformation that involves digitizing documentation, quotation, booking and status updates has saved 1.7 million work hours since being implemented last year in the air logistics sector and marginally increased profit margins.

DSV: Profit over growth

Lower volumes and rates in the Air & Sea division weighed down Denmark-based DSV’s revenues by 38% in the second quarter, with adjusted operating earnings 35% below last year’s mark at 4.71 billion Danish krone ($697 million).

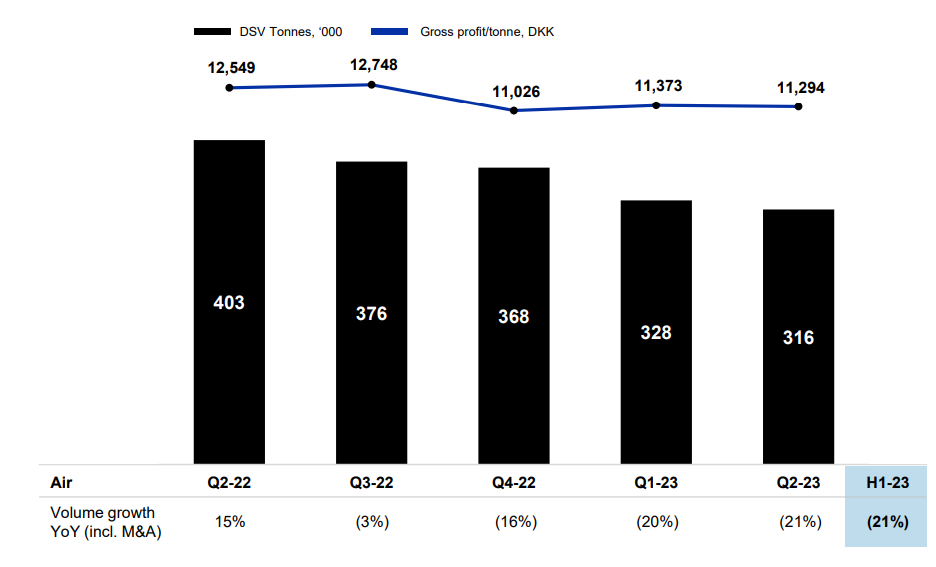

Air cargo tonnage contracted 21% from the prior year, with a decline in exports of retail goods and consumer electronics from the Asia-Pacific region leading the way. Ocean volumes fell 7%, the company said.

Air & Sea revenue was halved year over year, while sales shrank 9% in the smaller road transport unit and were up 1% in warehousing. Management speculated that it is taking market share in domestic and international trucking as it introduces new products.

Third-ranked DSV attributed poor air and ocean volumes versus competitors to its pricing discipline and focus on high-yielding cargo. K+N also is focused on more profitable shipments. Their strategy runs counter to many freight forwarders that are capturing business by heavily discounting rates.

“It is a tradeoff. If you protect the yields you see sometimes a little bit of negative development on the volumes. This is the way we have always done it in DSV,” said CEO Jens Bjorn Andersen. It is profit over growth. We do see some still behavior in the markets, which is maybe not super rational. We have decided to step away from those opportunities.”

DSV, like Kuehne+Nagel, is actually benefiting from sustained ordering in smaller batches, something that is not reflected by the volume figures alone.

Bjorn Andersen told analysts that the number of customer invoices being cut is actually 7 to 8 points better than total volume. With more shipments comes the opportunity for more fees.

“We would rather move two times 500 kilos for our customers than one time a thousand kilos. The profitability is twice as high. So internally, the developments look much better,” he said.

DSV raised its earnings guidance slightly on the assumption of improved trade volumes and “no significant worsening” of macroeconomic conditions, partially offset by lower air and ocean yields than in the first six months of the year.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Twitter: @ericreports / LinkedIn: Eric Kulisch / ekulisch@freightwaves.com