The U.S. labor market was more fiery than analysts expected in December 2024, adding 256,000 nonfarm jobs and slightly reducing the unemployment rate to 4.1%, per the Bureau of Labor Statistics.

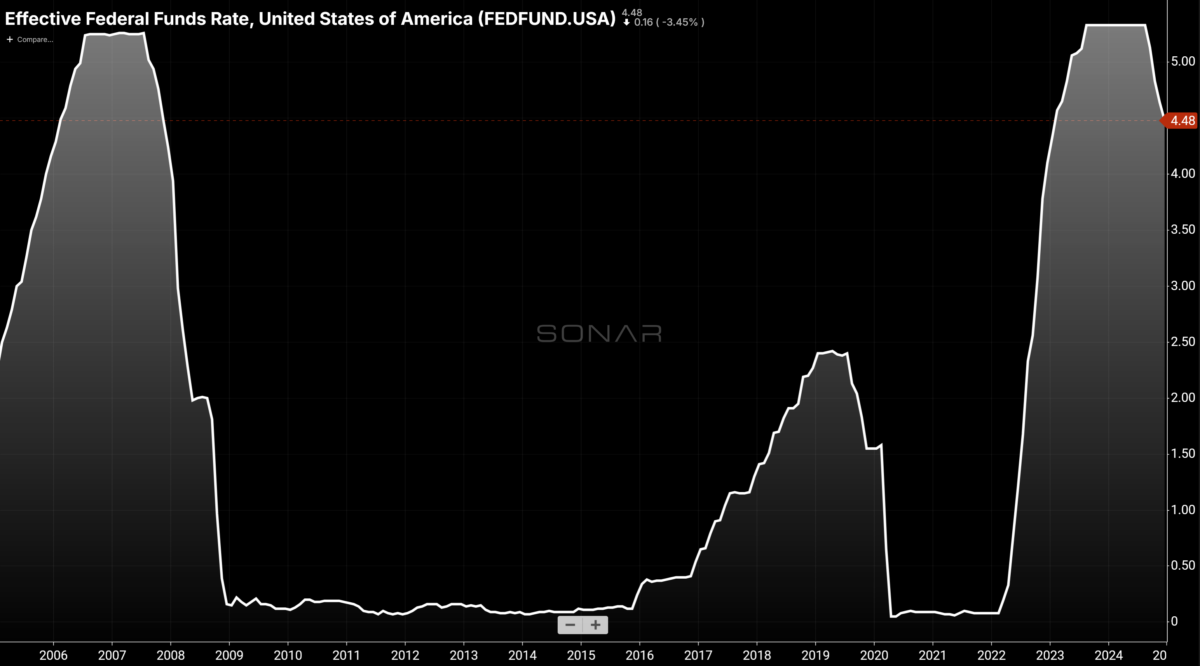

The robust employment growth — coupled with stable job openings and minimal layoffs — is a double-edged sword, however. The Federal Reserve has already cast doubt on its willingness to continue cutting interest rates in 2025 as inflationary concerns re-emerge; a robust jobs market will only further justify this hawkish pivot.

Better than a lump of coal?

In December, the U.S. economy continued its upward trajectory with substantial job gains in key sectors, such as health care, government and social assistance. Health care alone contributed 46,000 new jobs, underscoring the sector’s persistent demand. Additionally, retail trade rebounded by adding 43,000 positions after a previous decline, reflecting an uptick in consumer confidence and spending resilience.

Oren Klachkin, a financial market economist at Nationwide, stressed to Reuters the wary optimism among businesses: “Business leaders are going to navigate the economic environment with caution until it becomes clear how they need to adjust their headcounts.” This wait-and-see approach is mirrored across various industries, supporting a measured yet positive outlook on employment levels.

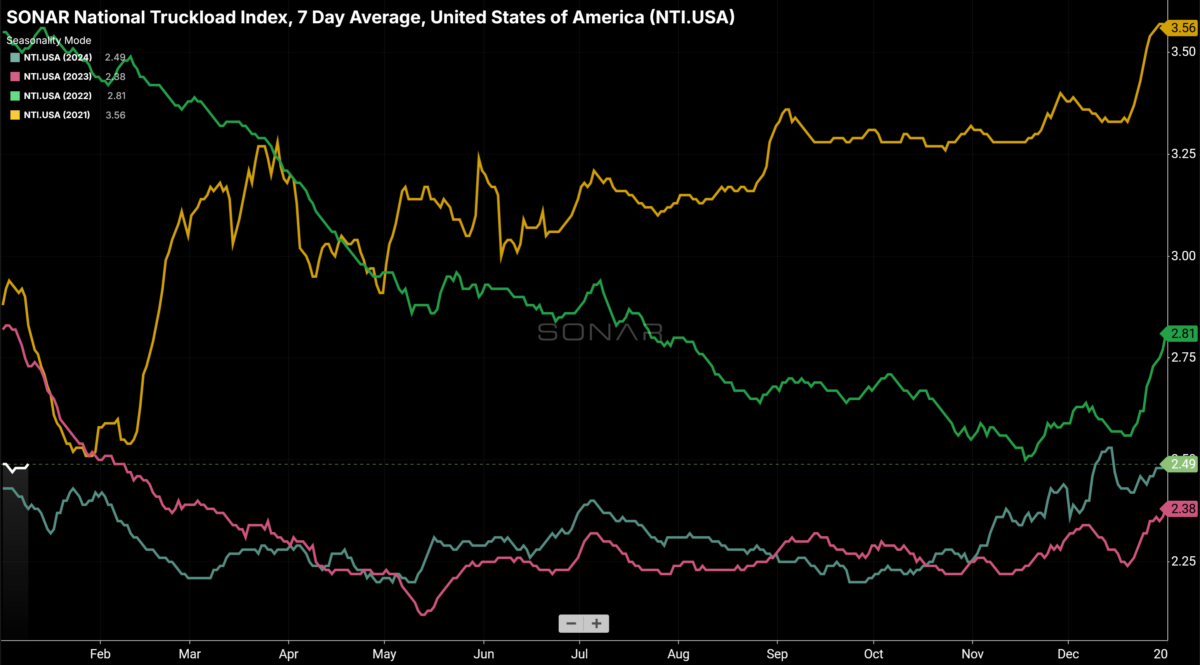

The trucking industry benefits directly from the overall strength of the labor market. With employment in the transportation and warehousing sector more or less stable — growing by 9,600 jobs in December, despite a slight loss of 800 truck transportation jobs — the sector as a whole is positioned to support continued economic growth.

A stable labor market suggests carriers are less likely to face harsh wage competition, a common concern during periods of labor scarcity. This stability allows trucking companies to better forecast staffing needs and focus on operational efficiencies rather than wage hikes to attract drivers.

To learn more about FreightWaves SONAR, click here.

Of course, what is good for carriers is not necessarily good for their employees, as newly licensed truckers seeking to become employee drivers could face stagnating wages.

Declining layoffs in the transportation sector indicate that companies are finally set to maintain their workforce levels, likely in response to sustained demand for freight services. This approach not only preserves institutional knowledge but ensures that companies are well prepared to meet upcoming logistical demands, especially as consumer spending continues (albeit somewhat perplexingly) to drive retail growth.

When doves cry

The Fed closely monitors the labor market as a key indicator for adjusting monetary policy. In fact, keeping unemployment rates low is one-half of its “dual mandate” — the other being price stability.

December’s strong employment figures and slight reduction in unemployment suggest the labor market is stabilizing, which will give the Fed cover to moderate its rate-cutting tempo in 2025. Carl Weinberg, chief economist at High Frequency Economics, notes that “there is no signal here of any sudden collapse of the labor market here or imminent recession,” implying that the Fed is likely to refrain from aggressive rate cuts going forward.

To learn more about FreightWaves SONAR, click here.

With the labor market displaying stability and wage growth remaining moderate — average hourly earnings increased by 0.28% from November — the Fed should find little impetus to alter its current monetary policy. Brian Coulton, chief economist at Fitch Ratings, supports this outlook, stating, “The Fed will take some comfort from the decline in monthly wage gains to 0.28% from 0.37% in November. It doesn’t look like we are seeing a renewed acceleration in job demand or tightening in labor market conditions – the picture looks broadly stable.”

As the Fed considers its policy moves, the trucking industry must navigate both macroeconomic trends and sector-specific challenges. The current labor market conditions provide a favorable environment for trucking companies to stabilize their workforce and optimize operations. However, the industry must remain vigilant against potential disruptions such as shifts in trade policies, fuel price volatility and unforeseeable threats from Mother Nature.

But sustained demand for freight services, driven by consumer spending patterns and retail sector growth, should keep the party going just a bit longer.

For more insights on the trucking industry’s labor market dynamics and economic outlook, subscribe to FreightWaves’ newsletters and stay updated with the latest trends and analyses.