Volumes at the ports of Los Angeles and Long Beach deteriorated even further in November, with no rebound expected until the second quarter of next year — possibly even the second half.

The Port of Los Angeles had 13 “blanked” (canceled) sailings in November, following 20 in October. Carriers will blank 11 more sailings this month. “We haven’t seen numbers like those since the start of the pandemic,” said Port of Los Angeles Executive Director Gene Seroka during a press conference Wednesday.

Jeremy Nixon, CEO of shipping line Ocean Network Express (ONE), told the press conference his company has been blanking about 20% of its sailings since October and expects to take out about half its capacity around Chinese New Year, which will be celebrated in 2023 on Jan. 22.

“It doesn’t surprise me for a moment that we’re seeing negative growth rates compared to last year because 2021 was off the charts in terms of volumes,” said Nixon.

West Coast import plunge continues

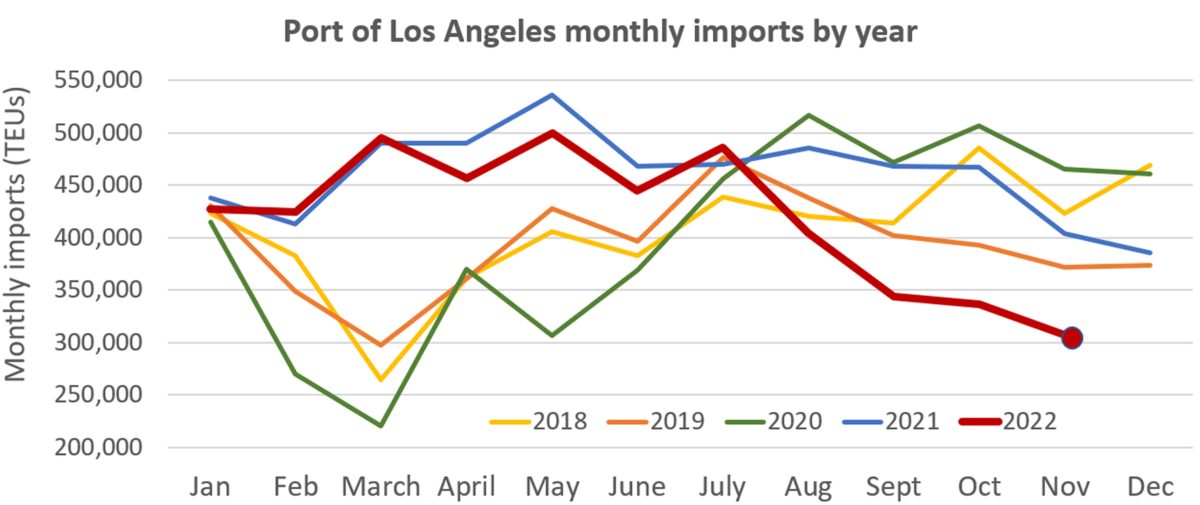

Los Angeles reported total November throughput of 639,344 twenty-foot equivalent units, down 21% year on year (y/y).

Empty containers came in at 242,148 TEUs, exports at 90,116 TEUs.

Imports sank to 307,080 TEUs, down 24% y/y and 9% versus October. This November’s imports were 17% below those in November 2019, pre-COVID.

Both Seroka and Nixon pointed to the continued absence of a West Coast port labor contract as a key culprit. The previous contract expired on July 1, pushing volumes to East and Gulf Coast ports. “Once that last remaining question mark is taken off the table, we’ll hopefully see more cargo coming back to the West Coast from this East Coast ad-hoc routing,” said Nixon.

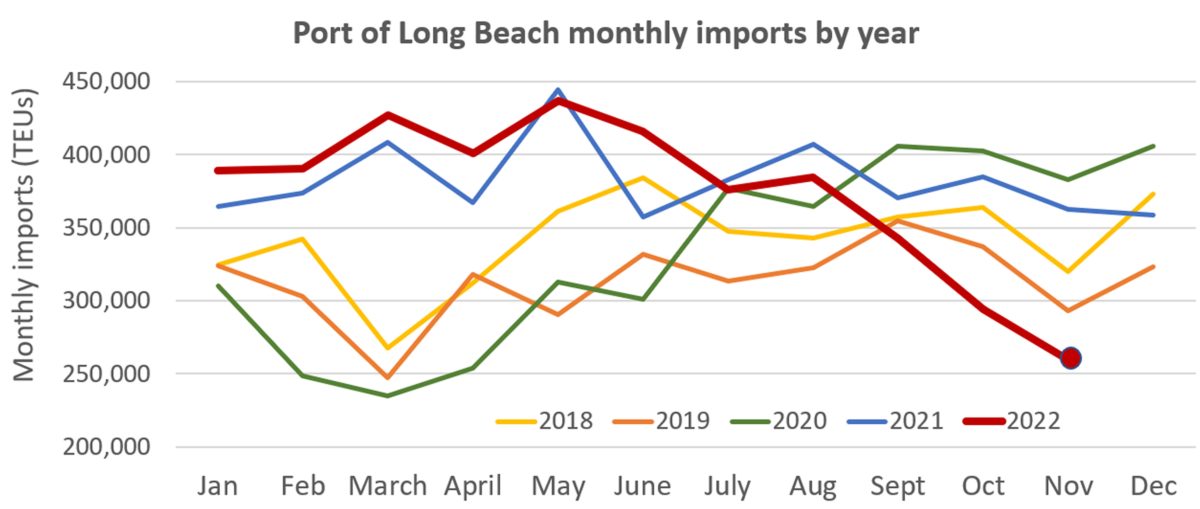

At the neighboring Port of Long Beach, total November throughput came in at 588,742 TEUs, down 21% y/y. Empties totaled 204,313 TEUs and exports totaled 124,988 TEUs.

Long Beach’s containerized imports fell to 259,442 TEUs, down 28% y/y and 12% compared to October. Imports this November were 11.5% below imports in November 2019, pre-pandemic.

No rebound until 2nd half of 2023?

Asked about the outlook for 2023, Nixon highlighted the impact of the Lunar New Year holiday. It is being held earlier than usual next year, and Nixon believes factories will be offline longer than usual.

“It looks like most of the factories in China and Vietnam are going to take quite a long break this time,” he said. “Typically, they will take two weeks off. [In 2023] we’re looking at four to five weeks. Factories will close around Jan. 7 and [the break] will run till about Feb. 6. Then there will be quite a long ‘rain shadow’ afterwards as it will take time to get production up and running.

“We’re prepared for a very soft February in terms of sailings coming out of Asia,” he continued. Given two-week sailing times across the Pacific, he said “that will manifest itself for LA arrivals as a very soft February and March as well.

“We’ll probably see some pickup in seasonality around March, April and May,” he noted.

Seroka said, “We also see some normality coming back into play in Q2 and beyond if we can flush out a lot of the inventory at the retail level and push it through during these holiday season sales.”

According to Nixon, “It’s going to be a slow first half for cargo volumes. But we expect at some point there will be a rebalancing. When that comes, probably toward the second half of 2023, it’s going to be back to business as usual.

“Traditionally, in the U.S. market, we see a quick correction. It tends to go into these things earlier and come out of them quicker than our other container shipping markets.

“One thing we’ve learned is that things go up and things go down, but when we get periods like this, when the cargo volume drops away, it normally indicates that at some point down the line, cargo volumes will come back up again above the average median. And if there is a very long period of low cargo volume, that generally means there will be higher cargo volumes later on.”

Click for more articles by Greg Miller

Related articles:

- Plunge in US imports accelerates; volumes near pre-COVID levels

- US imports from China falling faster than from other countries

- Container shipping rates still sinking, no sign yet of market floor

- Zero ships waiting off Southern California for first time since 2020

- Los Angeles imports keep sinking as East Coast gains more ground

- After steep September slide, US imports stabilize in October