Freight broker Landstar System achieved more financial records during the 2022 first quarter. Fresh highs in revenue, gross profit and net income were some of the highlights. The Jacksonville, Florida-based company reported earnings per share of $3.34 in the quarter, well ahead of the initial guidance range of $2.70 to $2.80 provided at the end of January.

President and CEO Jim Gattoni addressed recent weakness in the spot truckload market on a call with analysts Thursday. He said the declines in spot rate indexes are far greater than what Landstar is seeing internally, noting revenue-per-load fluctuations at Landstar have historically been half of what the broader market experiences.

Landstar’s (NASDAQ: LSTR) business capacity owners (BCOs) have “sticky” freight relationships, which include dedicated contracts. They also use Landstar trailers to haul loads, which many brokers don’t provide. “The rates tend to hold a little more than when doing a true spot move,” Gattoni said. He does expect Landstar’s business to “trend down” but not likely at the magnitude of the general spot market.

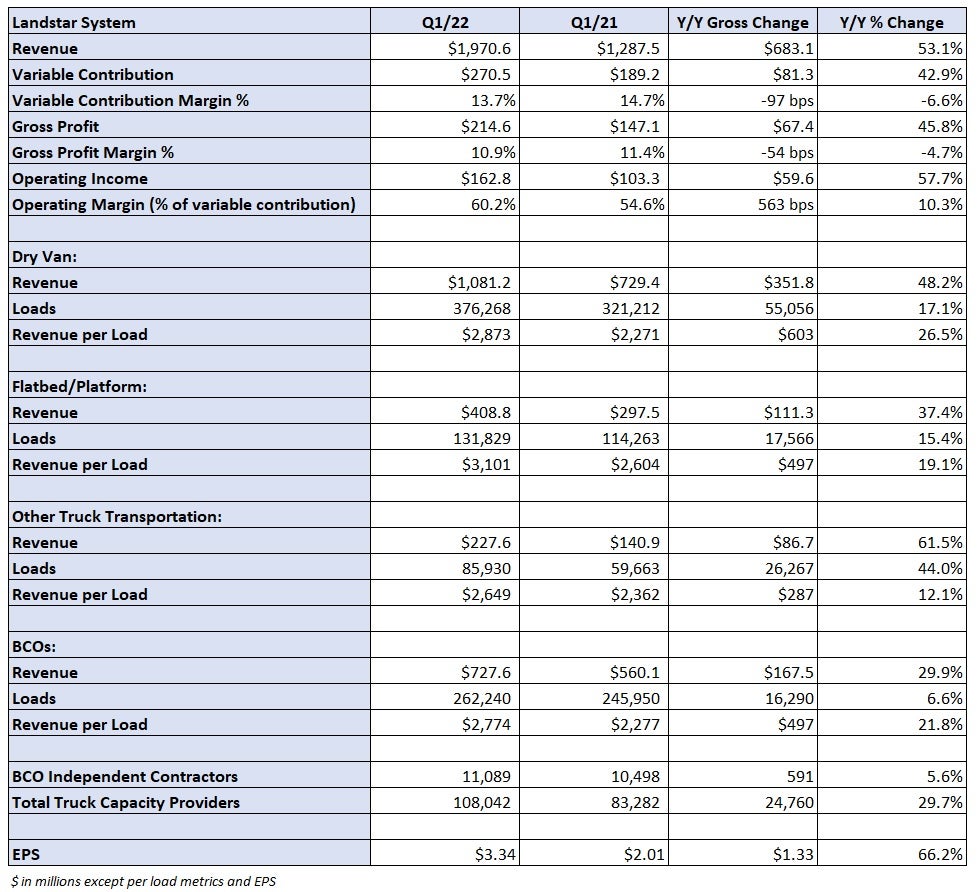

Revenue increased 53% year-over-year in the quarter to $1.97 billion. Landstar had warned at the end of February that it could see a $100 million revenue hit in the quarter (up to 18 cents in EPS) due to the invasion of Ukraine, which impacted two of its independent agencies with administrative operations in the country. However, the actual impact to those agents was less severe, and the company saw better-than-expected growth in its domestic operations.

Total loads hauled by truck on the platform were up 20% year-over-year, with revenue per load climbing 22%, easily outpacing initial guidance ranges of 12% to 14% and 14% to 17%, respectively. Revenue per load for loads hauled by truck was flat in March compared to February, representing an actual decline in the core rate when accounting for a more than $1-per-gallon jump in diesel prices.

Modest deceleration in the metric was recorded in March and so far in April. Year-over-year increases in revenue per load were 25% in January, 29% in February and 17% in March.

Revenue per mile for dry van loads hauled by BCOs increased sequentially by 5% in January and 3% in February but was down 0.1% in March. So far in April, revenue per mile is down 5% from March. It’s important to note that the metric excludes fuel surcharges, which are passed through to BCOs from customers and not recorded in Landstar’s revenue or purchased transportation expenses.

“In our view, the overall environment for Landstar continues to remain robust,” Gattoni said. “Revenue per load continues at all-time highs, and demand for our truck transportation services remains elevated. 2022 is setting up to be another great year for Landstar.”

Q2 guidance strong but ‘little signs of softness’

“Let’s not say that we’re not seeing little signs of softness,” Gattoni said.

He acknowledged the recent dip in rates and that consumer durables demand (revenue up 68% year-over-year in the first quarter) is slowing after more than six quarters of high growth. Landstar’s substitute linehaul loads — mostly e-commerce-related freight moved between the hubs of parcel companies — were up but largely offset by lower revenue per load in the period.

“There’s no individual area within our commodity base that we’re saying we’re seeing any real weakness,” Gattoni said.

Automotive revenue was up 83% year-over-year in the quarter as the industry appears to have snapped back following labor and parts shortages last year. Also, when China lifts lockdowns, a significant amount of freight is expected to hit Landstar’s network.

“Disruption is good for us so when they … start shipping stuff out of Shanghai again, I think that will all be a positive,” Gattoni said.

Landstar’s second-quarter guidance calls for revenue of $2 billion to $2.05 billion and EPS in a range of $3.22 to $3.32, compared to consensus estimates ranging from $2.74 to $2.78. Revenue per truck load is expected to increase by a midteen percentage year-over-year with loads hauled by truck increasing 11% to 13%.

Other Q1 highlights

Variable contribution, or revenue less purchased transportation and agent commissions, increased 43% to $271 million, but the margin fell 100 basis points to 13.7% as purchased transportation costs increased 120 bps. Gross profit margin, which includes other variable costs like trailer depreciation and certain IT- and insurance-related expenses, was down 50 bps to 10.9%. The sizable revenue increase pushed the operating margin, operating income as a percentage of variable contribution, 560 bps higher to 60.2%.

Total capacity on the platform increased 30% year-over-year to more than 108,000 providers, and BCOs ticked slightly higher from the fourth quarter, up 6% year-over-year. Given the recent growth in BCO count, Landstar believes future additions will occur at the lower end of the historical sequential range during the second quarter.

Debt-to-capital was 17% at the end of the quarter. Landstar generated $95 million in cash flow from operations compared to $70 million in the year-ago quarter. The company repurchased $109 million of stock in the period.

Read more

Click for more FreightWaves articles by Todd Maiden.

- Knight-Swift says trucking downturn would favor carriers with large trailer pools

- P.A.M. Transportation scores record Q1 on higher rates

- Prologis: Logistics real estate market in ‘unprecedented territory’