With revenue per load up and the number of loads being carried up as well, the network of drivers affiliated with Landstar Systems is showing healthy gains in the face of a national driver shortage.

In releasing its strong first quarter earnings report, Landstar—with its model of an extensive network of affiliated independent drivers and agents being utilized to meet customer demand—saw its management fielding numerous questions in its earnings call about the size of its business capacity owners, or BCOs. According to a report by CFRA transportation analyst Jim Corridore, “LSTR compensates its BCOs with about 65% of the revenues generated per load if they supply the tractor, and with 73% if they supply both a tractor and trailer.”

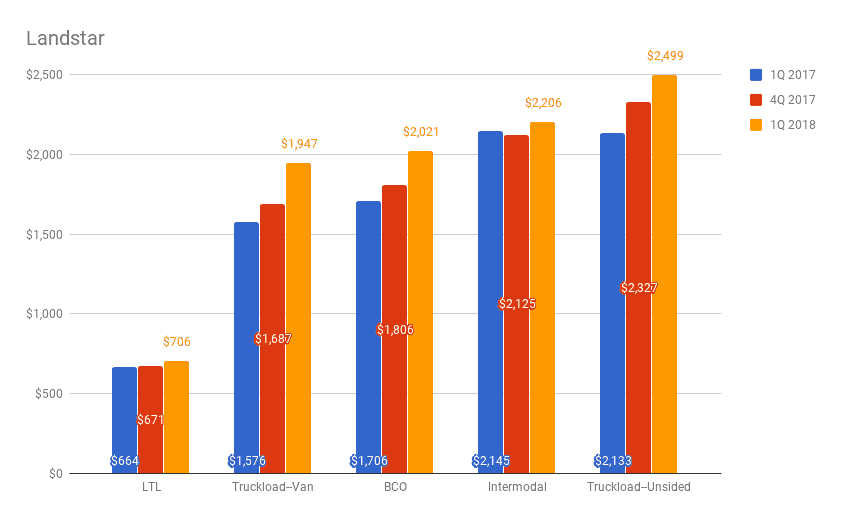

With that as the basis for payment, the Landstar-affiliated drivers have had a good run since the first quarter of 2017, though admittedly, all drivers have. Loadstar reported its revenue generated per load hauled by BCOs at $2,021 in the first quarter. A year ago, it was $1,672.. And just one quarter earlier, it was $1,806.

Under the category of “trucks provided by BCO Independent Contractors,” Landstar reported first quarter totals of 9,868. In the final quarter of 2017, it was 9,696. In the first quarter of last year it stood at 9,370. The first quarter was a record.

Joe Beacom. Landstar’s vice president and chief safety and operations officer, described that change between the fourth quarter of last year and the first quarter of this year as “relatively flat.” But on management’s conference call to discuss earnings, he touted the company’s annualized turnover in that category at 27%, which he said is a strong number compared to historical trends. “We’re up net about another 50 trucks in early April, so we like where the second quarter started,” Beacom said. “Once we get them in our network our agents take care of them, and see that they perform very well. I don’t expect that to change.”

The agents that Beacom referred to also are independent. Landstar said its network of agents is approximately 1,200.

The fact that the network grew last quarter undercuts the argument that the ELD mandate is taking a significant number of drivers off the road. Jim Gattoni, the company’s president and CEO, said in his opening remarks that the ELD mandate had an “insignificant impact” on the company’s operations in the first quarter.

The higher revenue produced for the BCOs was mirrored in the company’s broader statistics; it places about 45% of its revenues as coming from BCOs. Revenue per load for vans was $1,947 in the first quarter, up from $1,576 a year ago and $1,687 in the fourth quarter. That outpaced gains for what Landstar called “unsided,” i.e., flatbed, which was at $2,499 for the quarter and up from $2,133 a year ago.

In his prepared remarks released with the earnings, Gatonni said he expected prices to continue moving higher. Assuming continuation of tight trucking markets, he said, “I expect 2018 second quarter truck revenue per load to be higher than the 2017 second quarter in a 19 to 22 percentage range.”

But pricing is not what Landstar is focused on, Gattoni said. “Our goal is to focus on pushing more volumes through our team” he said. The company has stable margins for about 50% of its business, which is higher than counterparts in the “asset light” sector of the trucking world.

With volumes as the focus, Landstar did well in the first quarter. It hauled a total of 509,740 loads, compared to 455,550 loads in 2017’s Q1. The first quarter number was down slightly from the fourth quarter of 2017, a decline that is viewed as seasonal.

The financial performance set several records: record first quarter revenue, record quarterly gross profit, highest quarterly diluted earnings per share, operating income and the highest number of trucks provided by BCOs.

Despite the strong performance and the higher projections for earnings and revenues, investors appear to not like what they heard. Landstar’s earnings per share beat projections by 2 cts per share, and revenues of just more than $1 billion beat projections by $20 million. Still, at midday, shares were down more than 7.5% on day when broader markets were higher.

(Editor’s note: the story has been changed from the initial publication to reflect a Landstar-supplied number on the size of the agents’ network, and to accurately reflect revenue generated per load data from the fourth quarter of 2017).