Freight broker Landstar System joined a chorus of carriers, logistics providers and analysts Thursday, saying it expects a turnaround in market conditions by this summer.

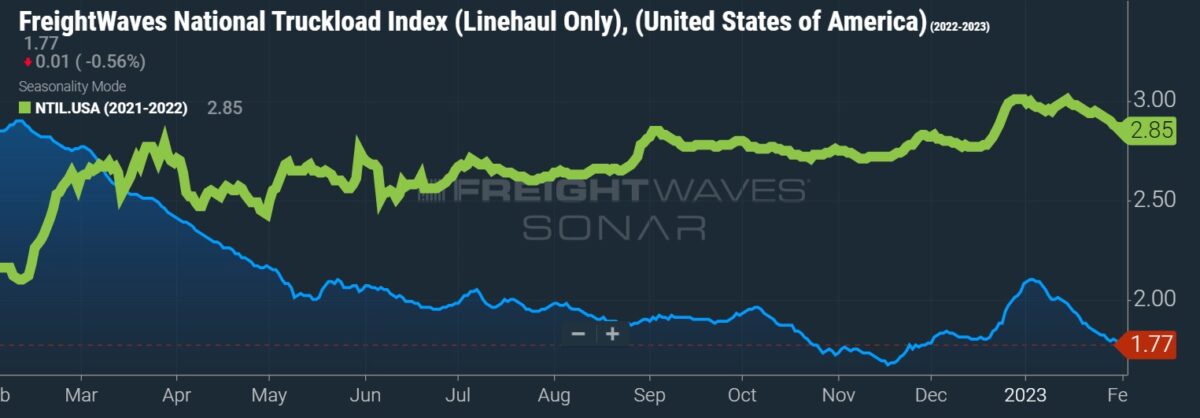

Management from the company told analysts on its fourth-quarter earnings call that trucking cycles historically last 12 to 18 months. February 2022 was the peak for Landstar, which points to a market recovery this summer, assuming normal time frames hold.

“Being a believer in cycles, I would project that things will start to improve and we’ll get a little bit more rate, seasonality as it climbs into the third and fourth quarter,” President and CEO Jim Gattoni said.

From the fourth quarter of 2019 to the most recent quarter, Landstar’s revenue has grown 68%. Gattoni said revenue won’t revert to prior trough levels given all of the additional costs in the system and that a 20% to 25% decline seems likely for this trough. He believes the market will “stop dropping” in the second quarter, with normal seasonal trends taking hold in the back half of the year.

Landstar (NASDAQ: LSTR) reported fourth-quarter earnings per share of $2.60 Wednesday after the market closed, in line with the consensus estimate provided by Seeking Alpha and 39 cents lower year over year (y/y). The number came in at the bottom end of management’s guidance range.

Revenue totaled $1.67 billion, a 14% y/y decline as loads hauled by truck fell 6% and revenue per load was down 7%. Dry van loads were down 5% with revenue per load off 11%. The company’s power-only offering, “other truck transportation,” reported a 19% y/y revenue decline with loads falling 16%. The unit mostly hauls consumer-related freight via linehaul service for parcels and less-than-truckload carriers.

Total revenue was $125 million lower than the midpoint of management’s forecast as loads and yields were weaker than anticipated. The company’s operating calendar included the week after Christmas this year, which management estimates produced an additional $65 million in revenue.

“The current macroeconomic environment made for challenging comparisons against our record 2021 fourth quarter performance despite the extra week of operations in the 2022 fourth quarter,” stated Gattoni in a news release. “Softer demand during a weaker than typical peak season resulted in more readily available truck capacity and truck rates and volumes below the record prior year levels.”

Total truck capacity on Landstar’s platform grew 7% y/y to more than 108,000 providers while trucks provided by business capacity owners fell 5% y/y (down 3% from the third quarter).

Variable contribution, or revenue less purchased transportation and agent commissions, declined 11% y/y to $234 million. Contribution margin was up 50 basis points to 14% as purchased transportation costs as a percentage of revenue were down 160 bps. Rates paid to truck brokerage carriers were down 294 bps in the quarter as the spot market further loosened in the period.

“People start getting scared when everybody starts putting out that rates are falling through the floor and the trucks get a little scared. So they start cutting rates on their own so they can get freight,” Gattoni said.

He noted that purchased transportation rates in the quarter were some of the lowest Landstar has paid in the last 10 years.

Gross profit margin was off slightly y/y to 10.7%. Landstar includes variable costs like trailer depreciation and select information technology and insurance-related costs in its gross margin calculation.

Q1 guidance falls short

Landstar is facing a tough comp in the first quarter. Loads executed during the first quarter of 2022 were the second highest in the company’s history while revenue per load was the highest. Guidance calls for revenue between $1.4 billion and $1.45 billion and EPS between $2.05 and $2.15, compared to consensus estimates at the time of the print of $1.49 billion and $2.18, respectively.

Loads hauled by truck on Landstar’s platform were down between 10% and 12% y/y in January, with revenue per load off between 15% and 17% y/y.

Revenue per load normally declines by a mid-single-digit percentage from the fourth quarter to the first. The metric in the fourth quarter was already 11% below that of the first quarter of 2022. Brokerage revenue from modes other than trucking is expected to be down by more than 40% y/y during the first quarter. The company will also contend with higher wages and insurance costs in the period.

Landstar generated $623 million in cash flow from operations in 2022, more than double the amount recorded in 2021. Debt to capital was 10% at the end of the year.

More FreightWaves articles by Todd Maiden

- Old Dominion handily beats Q4 expectations; shares up 8%

- Old Dominion appoints new president and CEO

- Saia’s 6.5% GRI outpaces LTL peers