Freight broker Landstar System missed fourth-quarter expectations Wednesday after the market closed.

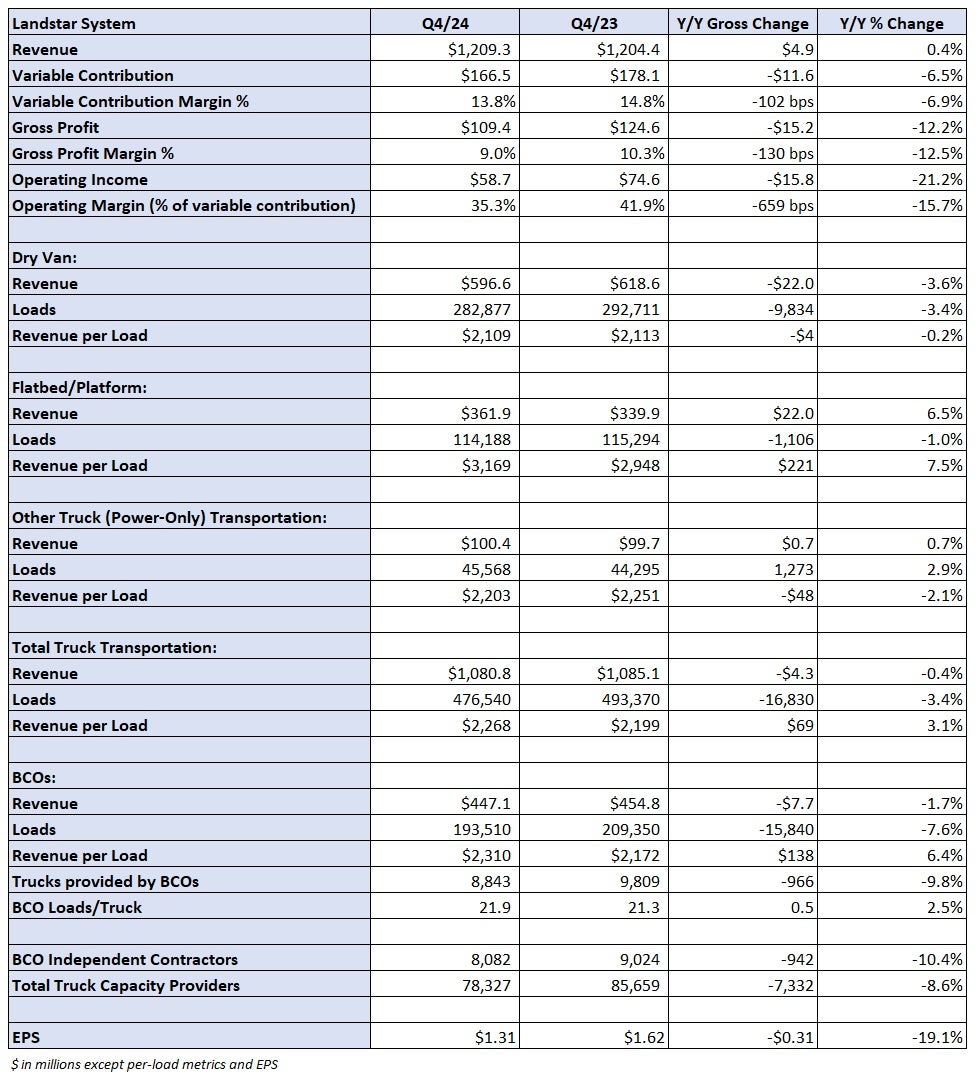

The Jacksonville, Florida-based company reported earnings per share of $1.31, which fell short of the $1.34 consensus estimate. Management’s guidance range was $1.25 to $1.45.

Revenue of $1.21 billion was up 0.4% year over year and slightly ahead of the $1.2 billion consensus estimate (in line with management’s forecast of $1.15 billion to $1.25 billion).

Total loads hauled by truck fell 3.4% y/y (compared to management’s forecast of down 4% to up 1%). Revenue per load was up 3.1% (compared to guidance of flat to up 4%).

Click for full article – “Landstar stuck between cycles; Q1 guidance disappoints”

Landstar (NASDAQ: LSTR) issued first-quarter EPS guidance of $1.05 to $1.25, well shy of the $1.36 consensus estimate. A revenue forecast of $1.075 billion to $1.175 billion was also below consensus of $1.19 billion.

Loads hauled by truck are expected to be 7% to 2% lower y/y in the first quarter, with revenue per load 2% lower to 3% higher y/y.

Landstar will host a call to discuss fourth-quarter results with analysts at 4:30 p.m. EST on Wednesday.

Click for full article – “Landstar stuck between cycles; Q1 guidance disappoints”