Asset-light third-party logistics provider Landstar System Inc. (NASDAQ: LSTR) on Wednesday reported first-quarter 2020 earnings per share of $1.04, modestly lower than the consensus estimate of $1.10 and well off the year-ago report of $1.58.

No reference was made to the fatal accident in January for which the company has $8.5 million of loss exposure or 16 cents per share per event. However, the insurance and claims expense line was roughly $10 million higher than in the prior-year period.

In the press release, President and CEO Jim Gattoni commented that trends for the first 12 weeks of the year “performed as we anticipated.” However, that came undone during the final week of the quarter as stay-at-home mandates spread.

Citing the “highly unpredictable economic environment,” the company is not providing second-quarter 2020 earnings guidance.

“We believe our 2020 first quarter results and operating trends will in no way provide any indication regarding what our financial results may be with respect to Landstar’s 2020 second quarter,” Gattoni continued.

In highlighting the company’s variable cost structure, the release went on to outline a scenario in which the company could generate second-quarter earnings in the range of 70-85 cents per share on a revenue decline of 20% to 30%.

“This in no way should be interpreted as any sort of guidance, but rather a demonstration of the resiliency of the Landstar model, and that Landstar’s ability to generate earnings is somewhat insulated from the possible effects of a prolonged recession.”

Additional COVID-19 Benefits

Landstar is paying bonuses as incentive for those working during the pandemic. The company will pay $50 to each agent dispatching a load and each business capacity owner (BCO) delivering a load during the month of April. The company expects to incur $6 million to $7 million in incremental expenses in April as it believes its BCOs will deliver 60,000 to 70,000 loads during the month.

Landstar is also paying up to $2,000 to any BCO who tests positive for COVID-19 or is placed under a mandatory quarantine.

“Additionally, in the event that current market conditions persist, it is possible that Landstar will provide additional financial pandemic relief to its agents and/or BCOs during the 2020 second quarter which could impact the Company’s earnings.”

First Quarter 2020

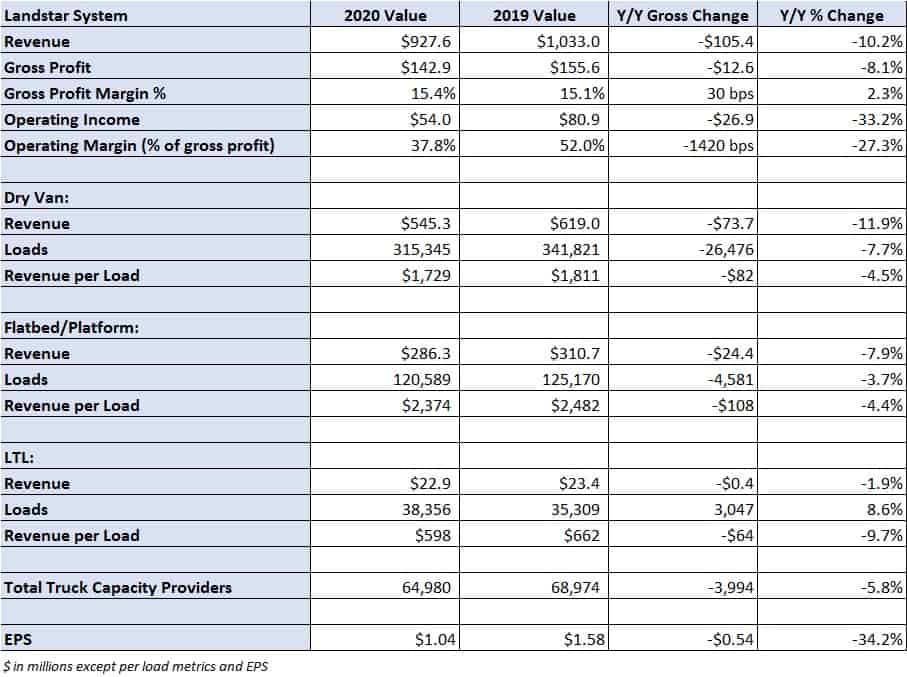

Landstar reported a 10.2% year-over-year revenue decline to $928 million in the quarter. Dry van revenue was 11.9% lower at $545 million, as loads declined 7.7% with revenue per load falling 4.5%. Flatbed revenue was 7.9% lower at $286 million, as loads declined 3.7% and revenue per load was down 4.4%. The company’s gross profit margin improved 30 basis points in the period to 15.4%.

Landstar believes its revenue and earnings will be “significantly adversely impacted by the current economic environment.” However, it expects to generate sufficient operating cash flow to pay its employees, agents and capacity providers. Further, the company plans to continue to pay its regular quarterly dividend of 18.5 cents per share and fund its ongoing technology initiatives.

However, the company plans to exercise prudence with respect to its future share repurchasing. In the first quarter, Landstar repurchased 1.18 million shares for $116 million.

Landstar ended the quarter with $211 million in cash and short-term investments and undrawn revolving credit capacity of $216 million.

“Although we expect the COVID-19 pandemic to have a significant adverse impact on our results of operations in the 2020 second quarter, we expect our financial position to remain strong throughout this unprecedented time,” Gattoni concluded.

The company will host a conference call to discuss these results with analysts and investors Thursday at 8 a.m. Eastern time.

clete

you must be a broker carrier, i hear you guy’s complain about landstar freight all the time. quit hauling it if you don’t like the rate.if i was in charge, if you did’nt have landstar on the door ,you would’nt be hauling any landstar freight!!!

TRUCKER SINCE 2005

LEGACY LOGISTICS out of Mason City, IA, is non paying, BEWARE

Franklin

Landstar has cut rates dramatically for drivers in order to cover their losses, Their Bottom line is so much more important than the drivers who haul the loads.

Alan

You don’t know how it works at landstar , why would you make a assumption, that the rates have been cut, landstar doesn’t make money if loads aren’t moved, landstar doesn’t make rates,

clete

you must be a broker carrier, i hear you guy’s complain about landstar freight all the time. quit hauling it if you don’t like the rate.if i was in charge, if you did’nt have landstar on the door ,you would’nt be hauling any landstar freight!!!