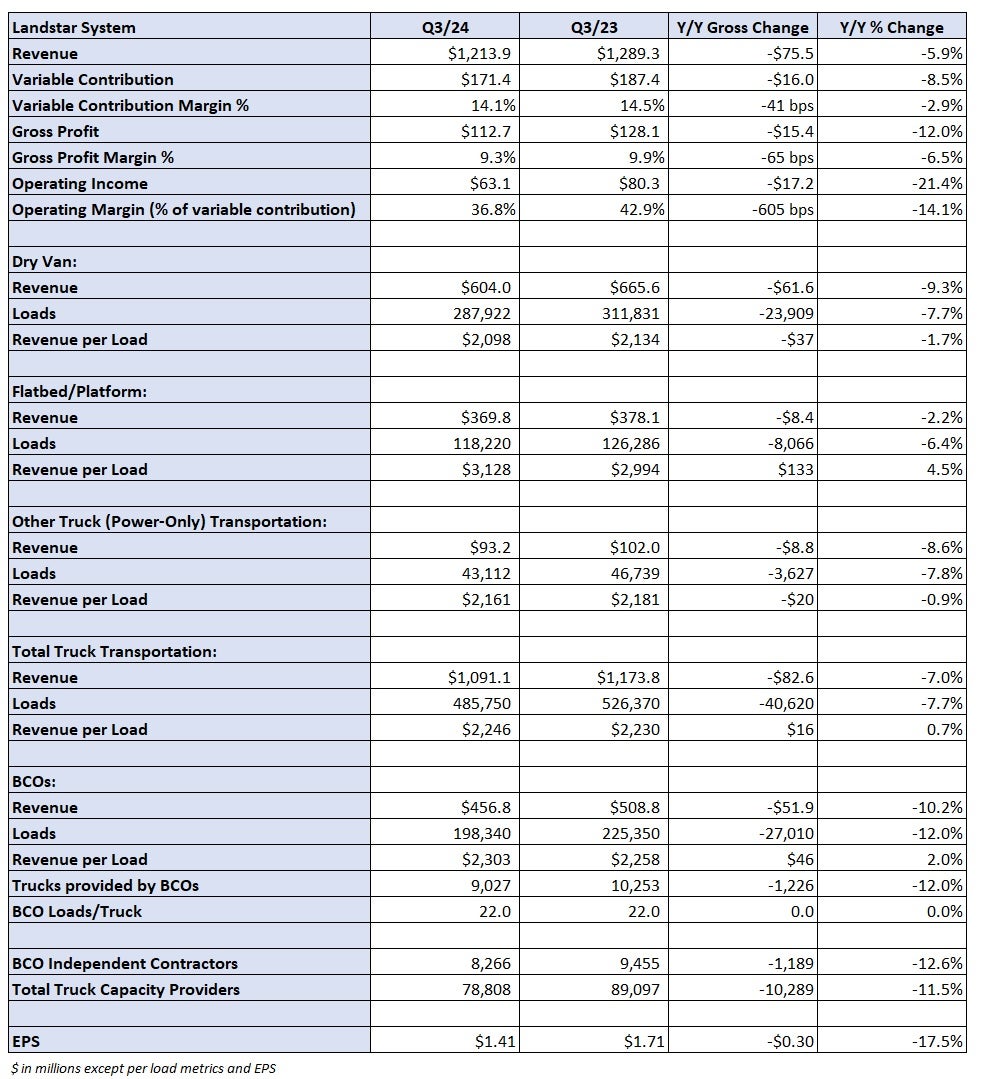

Landstar System pointed to the expectation of a “muted peak season” as the reason for its worse-than-expected fourth-quarter guidance. The Jacksonville, Florida-based freight broker reported third-quarter earnings per share of $1.41 after the market closed Tuesday. The result was 4 cents worse than the consensus estimate and at the low end its prior $1.35 to $1.55 guidance range.

A lower tax rate compared to the year-ago quarter was a 4-cent tailwind in the period.

Landstar’s (NASDAQ: LSTR) revenue fell 5.9% year over year in the third quarter to $1.21 billion (compared to guidance of $1.175 billion to $1.275 billion). Total loads hauled by truck declined 7.7% y/y (in line with guidance for a 10% to 6% decline), and revenue per load, or yield, was up 0.7% (compared to guidance of flat to up 4%).

Diesel prices were down 14% y/y, which was a headwind to yields.

Trucks provided by business capacity owners (BCOs) – owner-operators who haul almost exclusively for Landstar – were down 12% y/y and 1.7% from the second quarter. The sequential decline was the smallest since the 2022 second quarter.

The company views revenue per mile on BCO loads as a cleaner pricing metric as it excludes fuel surcharges. Revenue per mile was down 3% y/y on dry van loads in the quarter but remained 19% higher than pre-pandemic levels.

Landstar said cost pressures on this group have resulted in steady capacity attrition since the beginning of 2022. However, it believes the erosion isn’t structural and expects these operators to return when the market improves.

“The appeal of the spot market is a little bit hazy,” said Joe Beacom, chief safety and operations officer, on a Tuesday evening call with analysts. “You don’t see people willing to make the investment [in a truck].”

He said there is a good pipeline of potential BCOs but they are unlikely to lease a truck until rates inflect higher.

“If you don’t have that low cost to operate … and you have to go out and have a truck payment that’s at all elevated … do you really want to make the investment to come in at this time?”

BCO truck count is expected to be down sequentially by a similar percentage in the fourth quarter.

Q4 guidance disappoints

Landstar issued fourth-quarter EPS guidance of $1.25 to $1.45, well below the consensus estimate of $1.57. Expected revenue of $1.15 billion to $1.25 billion compared to a $1.24 billion consensus estimate for the fourth quarter.

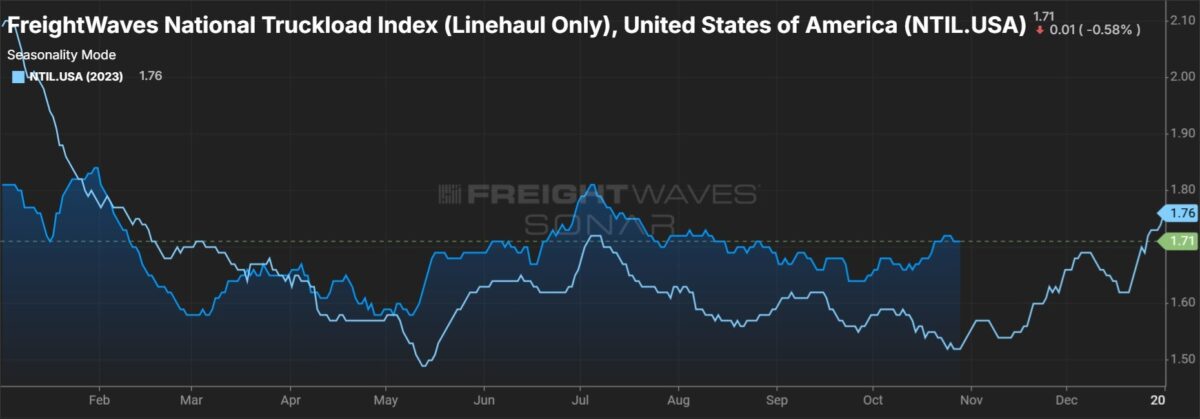

The company said the y/y comps ease as the fourth quarter progresses but noted the sequential trends so far in the quarter have been mixed. It saw normal seasonal volume trends from September to October but revenue per load underperformed historical change rates.

Revenue per load is normally up 0.5% from September to October. However, it’s currently flat to slightly down. Management said that puts the fourth quarter in a bit of a hole as yield is about $40 lower than it was at the start of the third quarter.

Landstar normally sees approximately a 1% increase in truck loads and revenue per load from the third to the fourth quarter. That isn’t the call this year as November and December are expected to see muted trends.

It forecast truck loads to be down 4% to up 1% y/y in the fourth quarter (down 3% to up 3% sequentially) with revenue per load flat to up 4% y/y (down 2% to up 1% sequentially).