Broker Landstar System told analysts on a conference call Thursday that freight volumes are likely to stay sub-seasonal through the fourth quarter. The company reported an in-line third-quarter result Wednesday after the market closed but its fourth-quarter outlook was light of expectations.

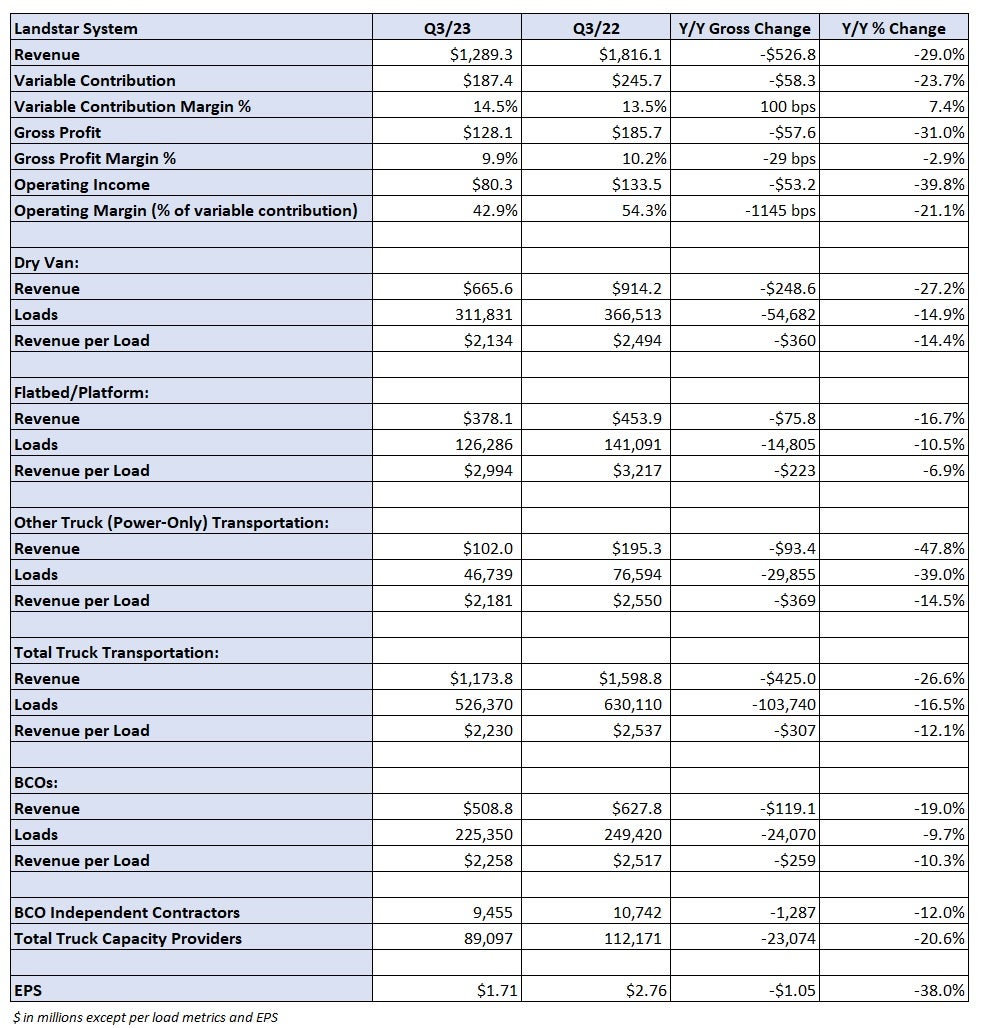

Landstar (NASDAQ: LSTR) reported third-quarter earnings per share of $1.71, in line with the consensus estimate but $1.05 lower year over year (y/y). The company reported a 29% y/y decline in total revenue to $1.289 billion. Both results were near the middle of management’s guidance ranges.

Total truck transportation revenue was off 27% y/y as loads fell 17% and revenue per load was down 12%. Landstar saw modest degradation in trends when compared to the second quarter. Loads were down 6% sequentially and revenue per load was off just slightly.

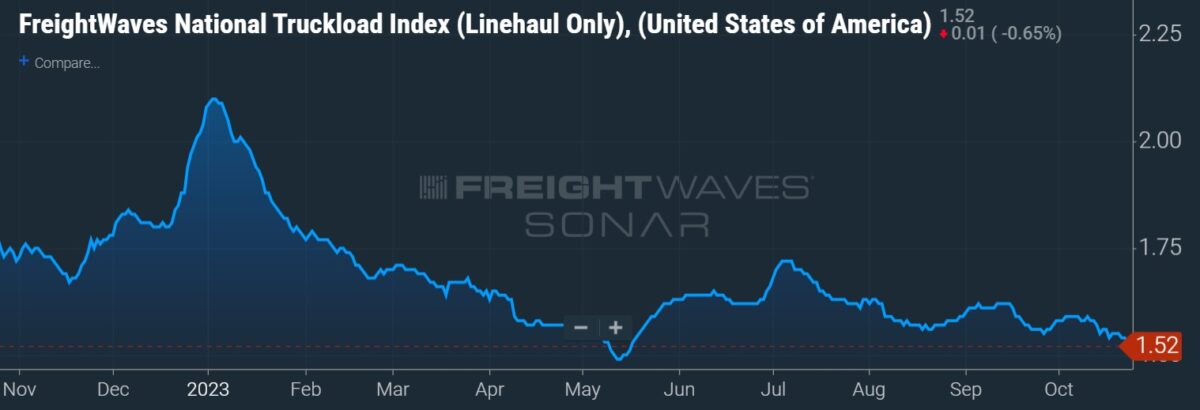

“Lackluster demand, driven by continued weakness in the U.S. manufacturing sector and the ongoing impact of an inflation-challenged consumer goods sector, plus the continuation of a loose truck capacity market drove Landstar’s truck revenue per load and volumes in the 2023 third quarter below prior year levels,” Jim Gattoni, president and CEO, stated in a news release.

The company’s guidance for the fourth quarter was worse than expected. Loads hauled by truck are underperforming seasonality so far in October, with revenue per load “reasonably in-line with these historical, pre-pandemic sequential patterns,” Gattoni continued.

The company is calling for fourth-quarter revenue of $1.225 billion to $1.275 billion, which was lower than the consensus estimate of $1.37 billion at the time of the print. Loads hauled by truck are expected to decline 20% to 22% y/y, and revenue per load is expected to decline 6% to 8%. The guidance assumes a muted peak season and accounts for one fewer operating week in the 2023 fourth quarter than in the same period last year.

Gattoni said it may be next summer, or eight full quarters into a downturn, before revenue per load inflects positively y/y. On the July call, he was leaning closer to a six-quarter downturn. He noted the spread between contract and spot rates continues to hover around 40 cents and hasn’t changed much over the last eight months. He says until it narrows, or freight demand turns meaningfully positive, he doesn’t expect shippers to come back to the spot market.

Landstar’s quarterly revenue peaked in the second quarter of 2022, five quarters ago.

At the midpoint of the ranges, the new guidance implies loads will be 5% lower than in the third quarter but revenue per load will increase 1.5% sequentially. Gattoni said volumes have only been modestly impacted so far by work stoppages across the auto sector.

Fourth-quarter EPS is forecast to a range of $1.60 to $1.70, which was below the $1.84 consensus estimate.

Total truck capacity on Landstar’s platform fell 9% from the second quarter to fewer than 90,000 providers. Trucks provided by the company’s business capacity owners were 3% lower sequentially.

The truck count among BCOs has fallen back to lows last seen in the early days of the pandemic and may not snap back until the economy turns. The group normally weathers downturns better than other operators but management said the extended length of the current freight recession has possibly purged some from the industry. During the quarter, BCOs saw a 10% decline in revenue per mile, which only slightly outperformed the broader metric on Landstar’s platform.

Variable contribution, or revenue less purchased transportation and commissions, fell 24% y/y to $187 million. The contribution margin improved 100 basis points to 14.5% as purchased transportation expenses as a percentage of revenue declined 150 bps. Also, management called out a favorable mix shift toward BCOs as a contributor.

The company has generated $304 million in cash flow from operations year to date, which is 30% lower than the same period last year. It reduced its debt-to-capital ratio 400 bps y/y to 7% during the quarter.

More FreightWaves articles by Todd Maiden

- Old Dominion says Yellow freight redistribution not settled

- Saia’s 7.5% GRI sooner, larger than prior increase

- LTL survey: Averitt No. 1 overall, Old Dominion top national carrier

Lonnie hunt

Truth is they have been cut more from double brokering, that had to play a role in some of their slowdown.