Management from Landstar System said Tuesday that truckload rates appear to have stabilized and may be recovering. It reported weaker-than-normal volumes for July but said increases in revenue per load are outpacing typical seasonal patterns.

The Jacksonville, Florida-based freight broker said it normally sees a 4% decline in loads per workday from June to July but that this year’s change rate has been 300 basis points worse than normal. However, revenue per load typically improves just 2% sequentially in the month but has outperformed seasonality by 300 bps this year.

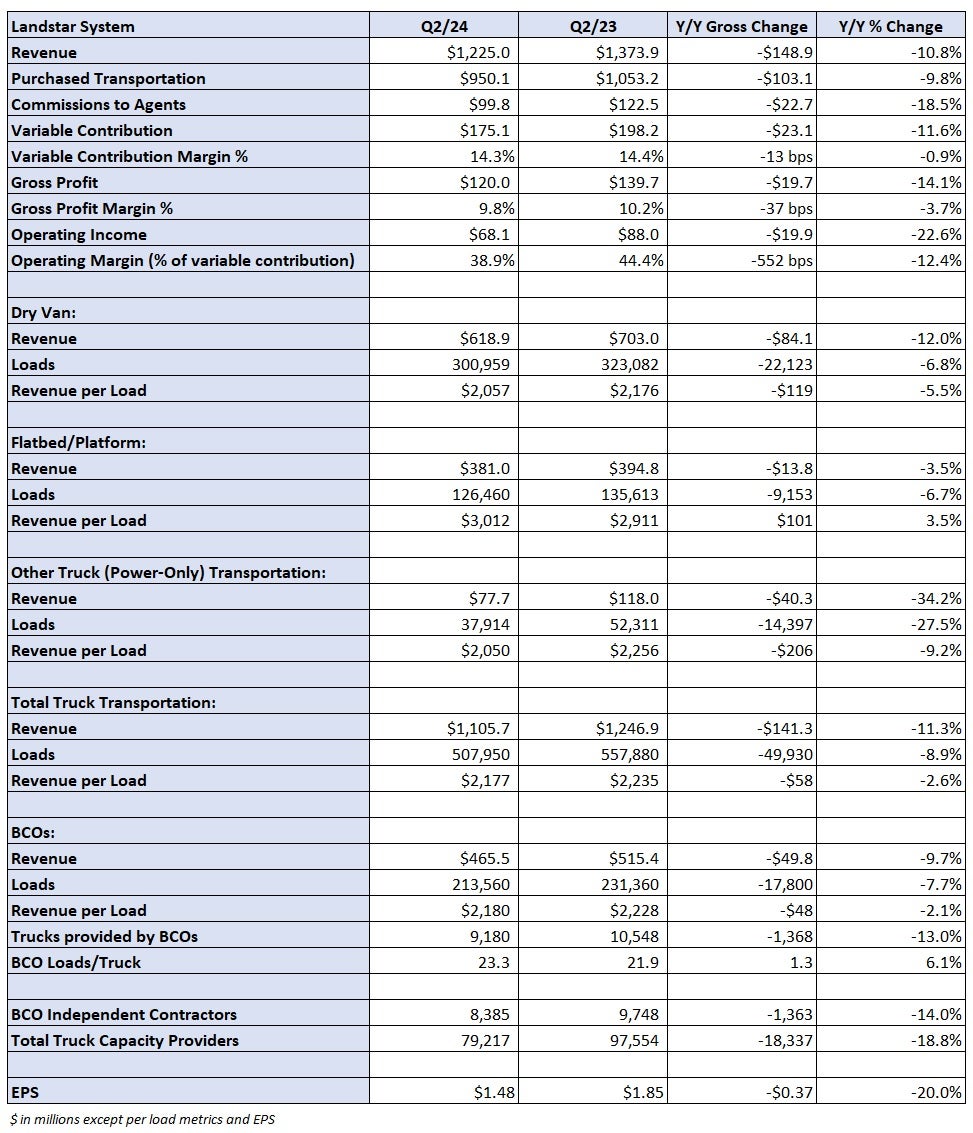

Landstar (NASDAQ: LSTR) reported second-quarter earnings per share of $1.48 Tuesday after the market closed, which was 3 cents better than the consensus estimate and in line with guidance from the company calling for EPS of $1.35 to $1.55.

Revenue fell 11% year over year to $1.225 billion compared to management’s forecast ($1.2 billion to $1.3 billion). Total loads hauled by truck fell 9% y/y (versus guidance of down 9% to down 5%) with revenue per load off 3% (guidance of down 4% to flat).

During the second quarter, Landstar saw volumes fall from April to May by 0.5% when it normally sees a 3.3% increase. A sequential volume decline during May has only happened one other time in the past 20 years. The company pointed to demand weakness among its automotive-related accounts as well as a falloff from the other transportation companies it serves. However, it said both loads and yields improved notably toward the end of June.

Total revenue increased 5% sequentially in the second quarter, which was the first time since the 2022 second quarter that the company reported a quarter-over-quarter revenue increase.

Management said that while rates appear to be at an inflection point and customers are starting to come back to the network, it’s still too soon to say the market has turned. Additionally, Landstar is “not looking for an overly vibrant peak season this year,” said Matt Dannegger, the company’s chief field sales officer, on a Tuesday evening call with analysts.

Total truck capacity in the network was down 19% y/y and 2% lower than in the first quarter. Trucks provided by business capacity owners (BCOs), owner-operators who haul almost exclusively for Landstar, were down 13% y/y and 2% sequentially. The company said it’s seeing both small carriers leave the market and large carriers reduce fleet counts. While it expects to see BCO counts continue to move modestly lower, it said truck count was positive in the last week of July, which it called a “good sign” and indicative of a stabilizing market.

Revenue per mile on BCO loads, which excludes fuel surcharges, declined 4% y/y on dry van loads. Compared to the pre-pandemic 2019 second quarter, revenue per mile was 15% higher in the period.

Landstar’s third-quarter guidance was light of expectations.

Third-quarter revenue is expected to be in a range of $1.175 billion to $1.275 billion as total loads hauled by truck are expected to decline 10% to 6% y/y with revenue per load forecast to be flat to up 4% y/y. The revenue forecast was 6% light (at the midpoint) of the $1.3 billion consensus estimate at the time of the print. EPS guidance of $1.35 to $1.55 was 9% below a $1.60 consensus estimate.

The guidance assumes loads will be down 7% to down 2% sequentially in the third quarter with revenue per load increasing 3% to 7%.

Landstar generated cash flow from operations of $142 million through the first half of 2024, a 26% y/y decline. However, its net cash position increased 29% y/y to $431 million, which it is using to fund share repurchases and to pay dividends. Landstar repurchased $57 million in stock during the quarter and announced that it has raised its quarterly dividend by 9% to 36 cents per share.