Management from freight broker Landstar System says the truckload market remains stuck between cycles.

“I’d like to think that we’re in the beginning of the next cycle. I could also argue that we’re at the end of the prior cycle,” said Landstar President and CEO Frank Lonegro on a quarterly call with analysts Wednesday. He noted sentiment among agents and customers “is clearly more positive.”

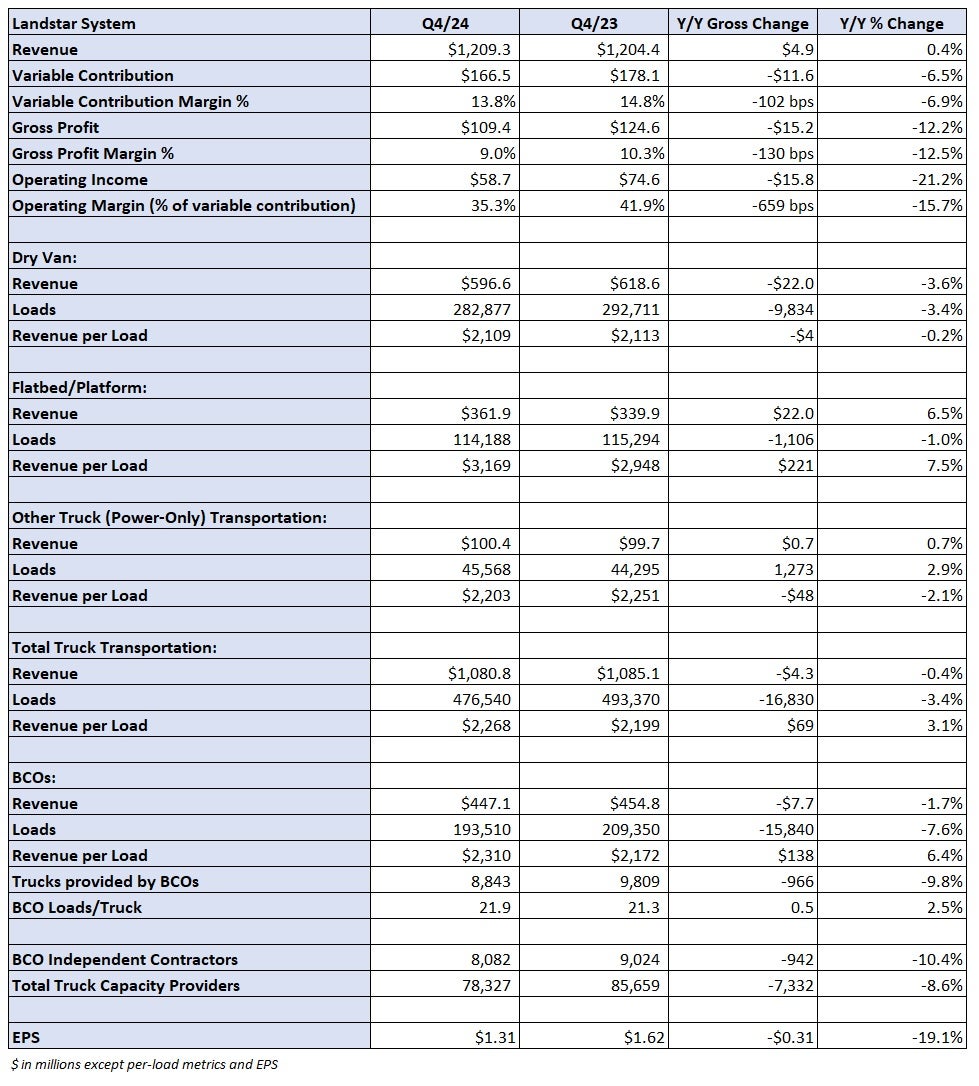

The Jacksonville, Florida-based company missed fourth-quarter expectations, posting earnings per share of $1.31, 3 cents shy of the consensus estimate and 31 cents lower year over year. A lower tax rate was a 5-cent tailwind compared to the year-ago quarter. (The company previously guided the quarter to an EPS range of $1.25 to $1.45.)

However, the first-quarter guide was off more notably.

Landstar (NASDAQ: LSTR) issued first-quarter EPS guidance of $1.05 to $1.25, well below the $1.36 consensus estimate at the time of the print.

A first-quarter revenue outlook of $1.075 billion to $1.175 billion was below consensus of $1.19 billion. The broker expects loads hauled by truck to be 7% to 2% lower y/y, with revenue per load 2% lower to 3% higher y/y.

Q4 still representative of a transitioning market

Fourth-quarter consolidated revenue of $1.21 billion was up 0.4% y/y and the first y/y increase since the third quarter of 2022.

Total truck revenue was off 0.4% y/y as a 3.4% decline in loads was partially offset by a 3.1% increase in revenue per load. Softness in dry van demand was countered by strength in the company’s flatbed offering. Flatbed loads on Landstar’s platform were off 1% y/y, but revenue per load was up 7.5%.

The company noted strength in its heavy-haul business, where revenue increased 24% y/y as loads were up 8% and revenue per load was up 15%.

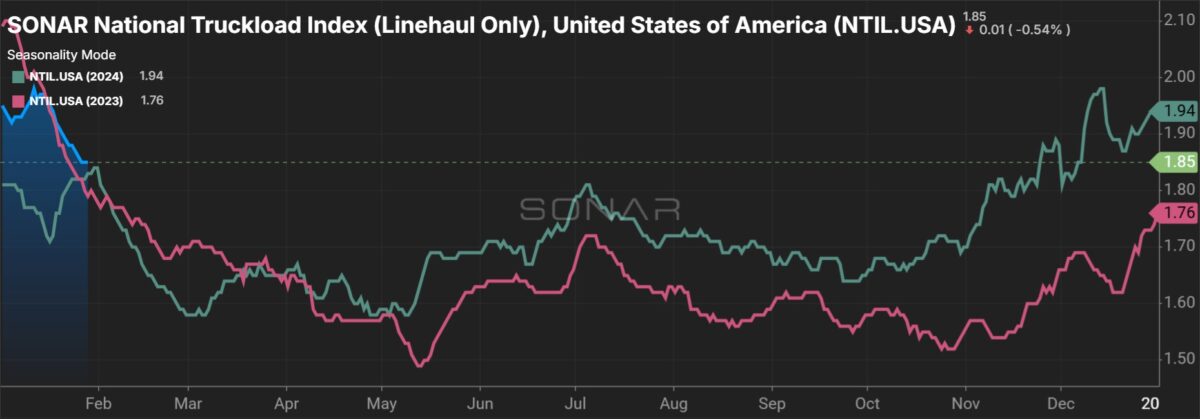

“The rate environment is ever so slowly starting to turn,” Lonegro said.

Revenue per mile on flatbed loads hauled by business capacity owners (BCOs) – owner-operators who haul almost exclusively for Landstar – increased 17% y/y while dry van revenue per mile was up just 3%. (The company views revenue per mile on BCO loads as a cleaner pricing metric as it excludes fuel surcharges.)

However, the number of BCOs in Landstar’s network fell 10% y/y and was down 2% from the third quarter. Truck count for BCOs of 8,843 marked the low point of the cycle.

Margins were negatively impacted by a 70-basis-point y/y increase in insurance and claims expense (as a percentage of BCO revenue). An increase in fraud- and theft-related cargo claims, and higher auto liability claims were the reasons for the increase to the cost line.

The company normally sees a 5% sequential decline in loads hauled by truck and a 4% decline in revenue per load from the fourth to the first quarter. Landstar said rates in January have been in line with normal seasonality with volumes slightly ahead of normal patterns. However, it cautioned that BCO loads during the final week of January were softer than normal due to inclement weather and the fires in Southern California.

The sequential guidance calls for truck loads to be down 5% to up 1% in the first quarter with revenue per load falling between 6% and 1%.

The BCO count is expected to decline again in the first quarter.

Shares of LSTR were down 3.4% in after-hours trading on Wednesday.