Logistics managers around the world have faced unprecedented challenges during the COVID-19 pandemic and now another hurdle has been added. American Shipper has learned that since China began implementing its new privacy laws on Nov. 1, many Chinese automatic identification system (AIS) terrestrial providers have stopped transmitting data until they understand the regulations.

If found in violation, these Chinese AIS terrestrial providers could face heavy penalties. This is resulting in an incomplete picture of vessels in the ports.

American Shipper has been in contact with the International Maritime Organization, the legal custodian of AIS. The IMO in general only has requirements that all vessels carry AIS transponders. The IMO is not notified or involved with a national government and its requirements on the use of AIS and how that collected data would be used.

Terrestrial AIS provides real-time vessel tracking since the responders receive signals from a ship’s transponders every 30 to 45 seconds. Satellite responders pass over an area every 90 minutes. While these ground receivers are owned by vessel tracking services like MarineTraffic and WoodMackenzie, it’s the Chinese provider that manages the transmission of that data to them.

The AIS platform by the China Maritime Safety Administration was launched in 2015 and was touted as the world’s largest shore-based AIS network; 402 terrestrial AIS stations were built in China, which covered the entire coastline and inland river high-grade waterways and relevant waters. This met the requirement of international convention and relevant standards.

Charlotte Cook, head trade analyst for VesselsValue, told American Shipper it is currently seeing an industrywide reduction in terrestrial AIS signals in China, with numbers of terrestrial positions dropping significantly toward the end of last month.

“In the past 10 days, terrestrial positions in China have reduced by almost 100% to around 300,000 terrestrial positions being received per day,” Cook said. “The shipping industry as a whole has become increasingly reliant on using AIS data for operational purposes in recent years, with the use of raw and derived AIS data facilitating route planning, logistical operations in port and congestion analysis.

“The increased availability and volume of AIS data provide greater transparency within the industry, allowing shipping lines to predict vessel movements ahead of time, track seasonal trends in delays and improve port and trade flow efficiency. Ultimately, if we see reductions in the coverage of the AIS data that logistics managers have come to rely on, we could see further delays and operations suffer, having a knock-on effect to wider supply chains,” she said.

Among the major companies that provide this type of tracking, IHS Markit is reportedly operating at what’s considered “normal service,” according to those familiar with the service. The company told American Shipper the analysts best to provide comment are based in the Asian Pacific region and were not available for immediate comment.

“AIS data should not be disseminated by a single source because you cannot believe in the reliability of the information,” said one maritime analyst on the condition of anonymity. “If the Chinese government is filtering that data down to one company, it is considered tampered and not objective. The government can narrow the scope of the data as they see fit.”

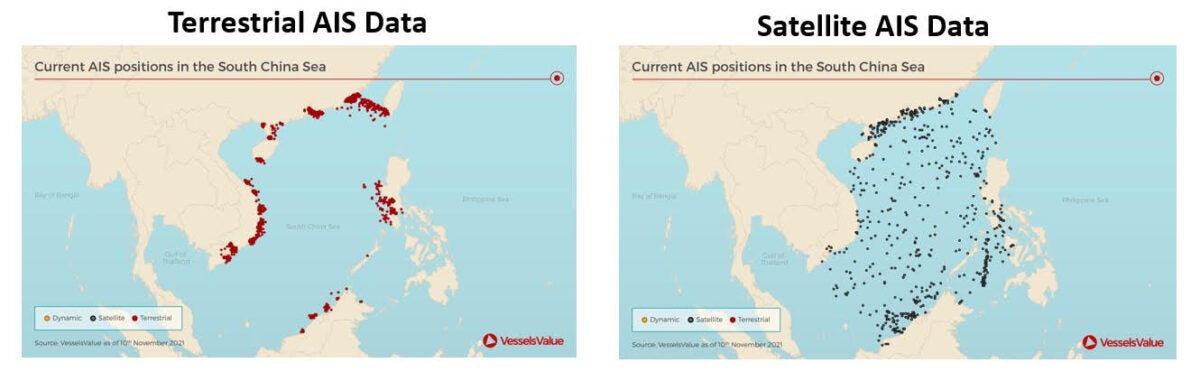

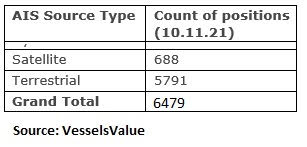

Photos provided by VesselsValue show the impact of the limited data dissemination. Conversely, if you compare satellite AIS to terrestrial, you will see the lack of port data location that shows how valuable terrestrial data is.

When you compare the various AIS sources available, terrestrial AIS outpaces the majority.

AIS features are layered together to provide a complete picture of the waterway superhighway.

“AIS data is indeed a fundamental dataset we are using at most of the ports we are working with,” said Oscar Pernia Fernandez, NextPort founder and technical lead. “For us, it is a fundamental information source when tackling the EDA [exploratory data analysis] phase, where we assess how rich, complete and reliable is the data that ports utilize for decision-making.

“In our experience, and especially for tackling the port logistic chain holistically is not enough, so we look at other data sources such as port community systems and terminal operating systems to complement and to provide context to the more vessel and cargo data.”

This data is also valuable for traders making spot trades, influencing the shipment price of commodities, as well as confirmation letters of credit when things can be picked up and delivered. Terrestrial data enables businesses to be tracked using verifiable data.

“AIS is a key input in monitoring fuel consumption and vessel emissions, ranging from actual vessel speeds and reported drafts to voyage distances and ton-miles,” added Cook. “Owners, operators and investors have a greater requirement to monitor vessel emissions and activity as the importance of green shipping grows, with regulations becoming increasingly tighter. A prolonged reduction in AIS data in any location would cause these data inputs to be incomplete and could result in less accurate reporting, at a time when this data is needed the most.”

Kevin Hemming

So basically another excuse to cover the original excuse with another pre-pandemic hype. Got it. Just the fuel shortage in the west. Yep and the east coast fuel shortage because a Russian hacker hacked a 1950’s colonial pipeline which is ran by cut off valves and not computer ran. Got to squeeze more money out of people to finally collapse the economy. Sounds like the DNC billionaires are not rich enough.

Strange

New city Chinese Buffet in Greensburg Pennsylvania had a line of dirty looking Mexicans walk along the wall into the back twice in the restaurant where everyone was eating. They’re clothes looked like they sleep in a garage Greece pit . About 25 following each other each time. Is that Human Trafficking? Or are they trying to hustle up somebody to arrest for a commission check from the prison system. Using Mexicans that look like they live in a rail container as bait.