Chinese electric vehicle maker BYD faced criticism Thursday from both sides of the political aisle and from geopolitical experts for undercutting U.S. transportation equipment suppliers. Opponents also called out the manufacturer as a threat to American security.

At a hearing on Capitol Hill, BYD, along with railcar manufacturer China Railway Rolling Stock Corp. (CRRC), were singled out as agents of Beijing’s strategy to dominate transportation manufacturing markets, starting with transit suppliers and moving into the freight markets.

Sen. Mike Crapo, R-Idaho, chairman of the Senate Banking Committee, said both BYD and CRRC include direct subsidies from the Chinese government as part of their annual reports. “There are presently at least seven other transit railcar manufacturers besides CRRC and at least five other transit bus manufacturers besides BYD in the United States. It is impossible for other bus and rail manufacturers to fairly compete when these two companies have the unfair advantage of the financial support of the Chinese government.”

Sen. Sherrod Brown, D-Ohio, ranking member of the committee, warned that BYD’s goals in the U.S. “extend far beyond the public transportation market. BYD supplies electric trucks for freight delivery, it offers electric garbage trucks to cities, and it’s eyeing the passenger car market.”

Scott Paul, president of the Alliance for American Manufacturing, testified at the hearing that China’s “sizable” ambitions are “to establish a substantial foothold into our public transit market as a means of expanding into private sectors such as the freight rail and electric vehicle markets.”

Left unchecked, Paul said, “the toll on U.S. supply chains will be devastating. Because CRRC and BYD’s U.S. assembly operations are a supply line for major rolling stock components produced in China, the jobs of American workers throughout our domestic supply chains are now at risk.”

BYD officials were not immediately available to comment on those assertions. The company is publicly traded, with 60% of its stocks owned by U.S. investors. Warren Buffett’s Berkshire Hathaway is the largest single shareholder at 8%, according to the company. Los Angeles-based BYD North America operates a 450,000-square-foot bus manufacturing facility in Lancaster, California.

The company announced in November a joint venture with Toyota to develop battery electric vehicles to be launched in China this year and to be marketed to Chinese customers. Later that month, the company teamed up with Nikola Motor Co. to make an emissions-free beer delivery to the arena where the NHL Champion St. Louis Blues play.

Brown said that while BYD may not be technically owned by the Chinese government, “it’s certainly controlled by it,” contending that the company may receive more state support than CRRC, with deep ties Beijing.

“BYD likes to point out that Warren Buffett is an investor in their company,” Brown said. “One billionaire investor does not mean that BYD is looking out for the interests of American workers. CRRC and BYD are two in a long line of examples of how China cheats its way into being a global leader in industry after industry.”

For example, because U.S. railcar production relies heavily on imported parts, for every one job that the Chinese-subsidized CRRC creates in the U.S., as many as five U.S. jobs are eliminated, according to a study from Oxford Economics.

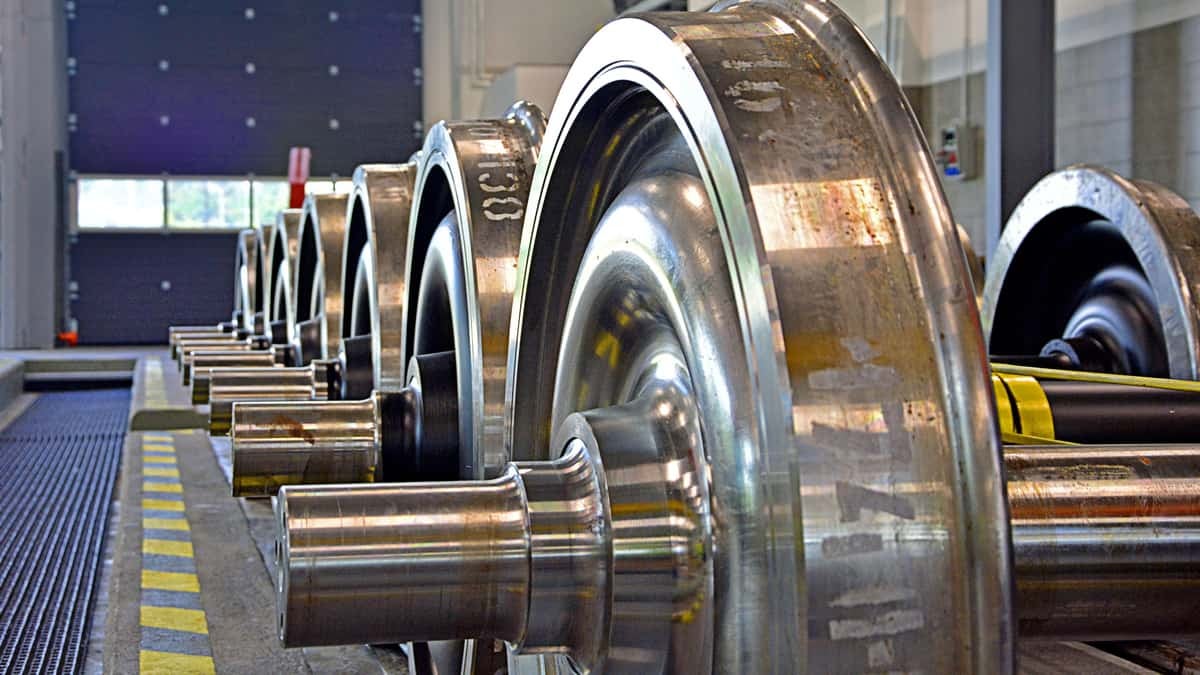

Image: Shutterstock

Michael O’Malley, president of the Railway Supply Institute, said CRRC has secured four major transit rail supply contracts in Boston, Chicago, Philadelphia and Los Angeles — worth roughly $2.6 billion — by undercutting the lowest bid by as much as 20%. “That’s substantial — we don’t think its market based, and it’s done with strong support from the Chinese government,” O’Malley told FreightWaves.

President Donald Trump signed into law a bipartisan bill sponsored by Crapo and Brown, the Transit Infrastructure Vehicle Security Act, as part of the National Defense Authorization Act at the end of last year. The act prohibits transit agencies from using federal funds to purchase railcars manufactured by Chinese-owned or -subsidized companies. Similar legislation is being considered that would apply to freight rail.

Emily de La Bruyere, an expert in Chinese economic strategy at Horizon Advisory, testified at the hearing that BYD’s and CRRC’s ability to thrive in the U.S. represents “an entirely new type of power projection” on the part of Beijing.

“Recent jamming at the port of Shanghai points to potential first-order, operational threats,” she said. “China’s corporate social credit system does the same in the economic domain. But proliferated through ostensibly commercial rather than explicitly military tools, this subversive web is escaping our attention. Worse yet, we are fueling it. We should not be granting federal funding to China’s state-supported champions.”